Despite another week of downside for the cryptocurrency market, the staked Ether supply reached a new all-time high, meaning over 28% of the token’s supply is now locked in exchange for passive income.

A growing staked Ether (ETH) supply indicates that more investors are preparing to hold their tokens, instead of selling at current prices.

Meanwhile, publicly-traded companies continue establishing corporate cryptocurrency reserves, signaling increased institutional adoption of digital assets beyond Bitcoin (BTC).

On Thursday, Nasdaq-listed Lion Group Holding (LGHL) announced plans to establish a $600 million crypto treasury reserve, with the Hyperliquid (HYPE) token as its main asset.

The Singapore-based trading platform will deploy its first $10.6 million investment by Friday, after the company secured a $600 million facility from ATW Partners, Cointelegraph reported.

Staked Ethereum hits 35 million ETH high as liquid supply declines

The supply of staked Ether reached an all-time high this week, signaling growing investor confidence and a squeeze on the liquid supply of the world’s second-largest cryptocurrency.

Over 35 million Ether (ETH) coins are now staked under the Ethereum blockchain’s proof-of-stake consensus model, according to data from Dune Analytics.

Over 28.3% of the total Ether supply is now locked into smart contracts and is unsellable for a pre-determined time in exchange for generating passive income for investors.

A growing staked supply also indicates that a large percentage of investors are preparing to hold their ETH instead of selling at current prices.

Over 500,000 ETH was staked in the first half of June, signaling “rising confidence and a continued drop in liquid supply,” said pseudonymous CryptoQuant author Onchainschool in a Tuesday post.

Ether accumulation addresses, or holders with no history of selling, have also reached an all-time high of 22.8 million in ETH holdings, signaling that Ethereum is among the “strongest crypto assets in terms of long-term fundamentals and investor conviction,” the analyst said.

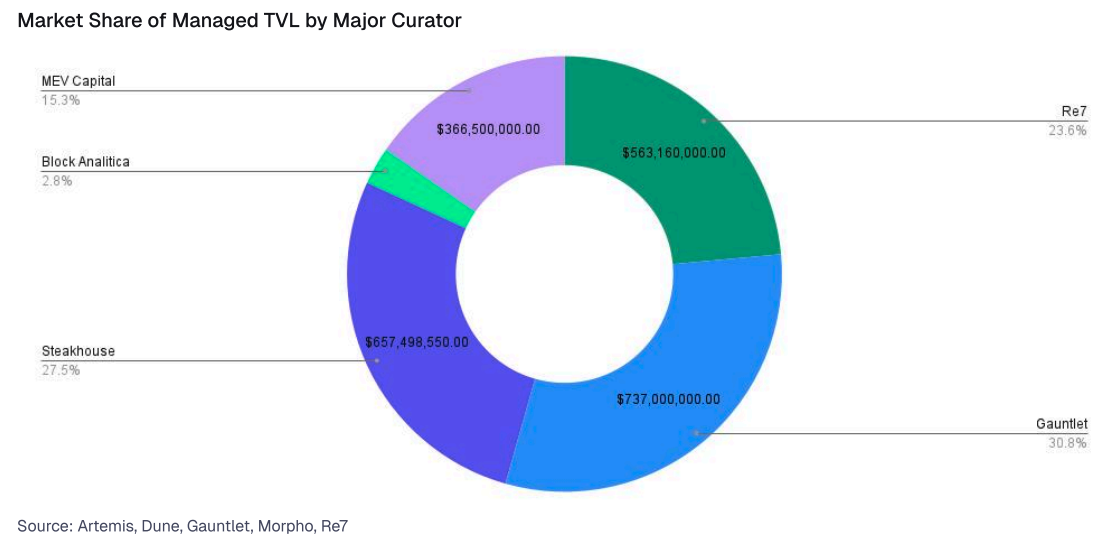

“Crypto-native” asset managers quadruple onchain holdings since January

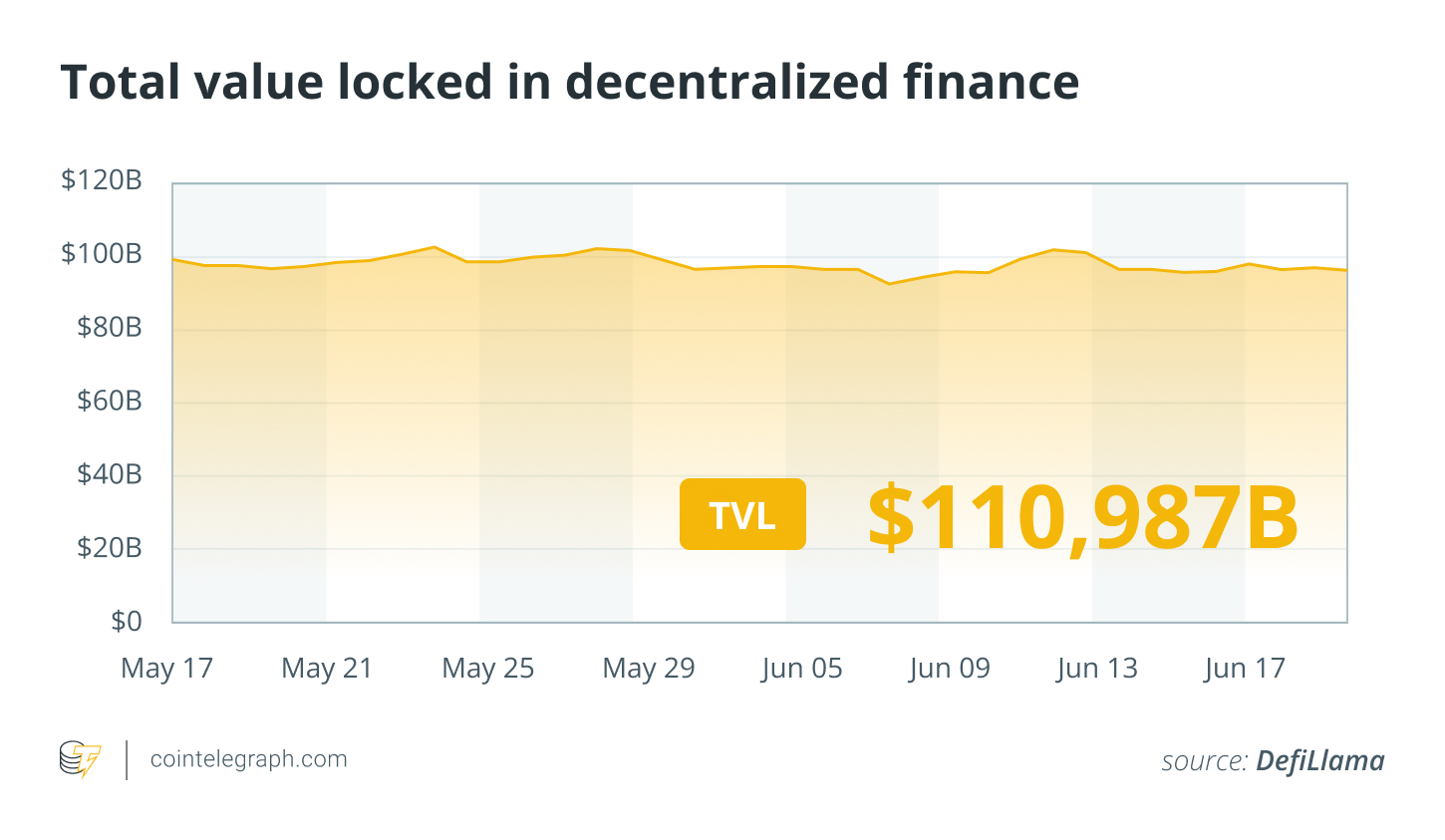

Crypto asset managers have significantly expanded their holdings on blockchains since the start of the year, while institutions increasingly use decentralized finance as a back-end to their services, according to a new report.

“A new class of ‘crypto-native’ asset managers is emerging,” the analytics platform Artemis and DeFi yield platform Vaults said in a report on Wednesday.

“Since January 2025, this sector has grown its onchain capital base from roughly $1 billion to over $4 billion.”

The report said asset managers are “quietly deploying capital across a diverse range of opportunities,” giving the example of major firms having locked in nearly $2 billion in the decentralized lending and borrowing platform Morpho Protocol.

Crypto has boomed this year as the US’s Trump administration has moved to support the sector, giving institutions confidence they can use crypto and DeFi protocols without facing regulatory litigation.

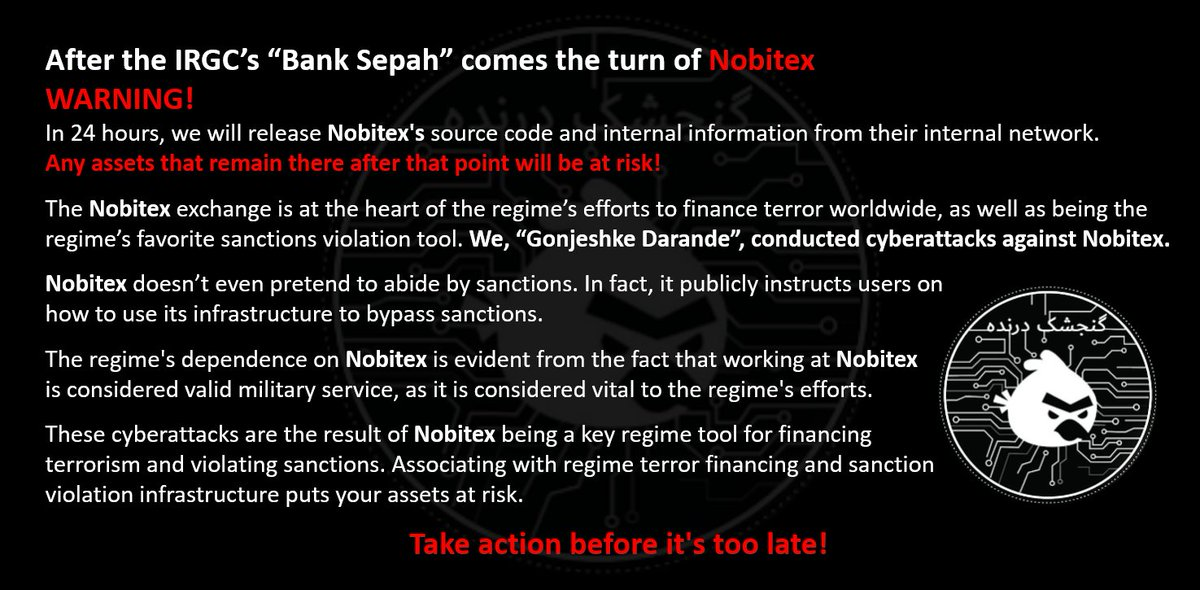

Nobitex source code leaked after $100 million hack by pro-Israel group

Hackers behind a $100 million exploit of Iranian cryptocurrency exchange Nobitex released the platform’s complete source code, placing remaining user assets at risk.

Nobitex exchange was hacked for at least $100 million of cryptocurrencies on Wednesday by a pro-Israel group calling itself “Gonjeshke Darande,” which claimed responsibility for the attack.

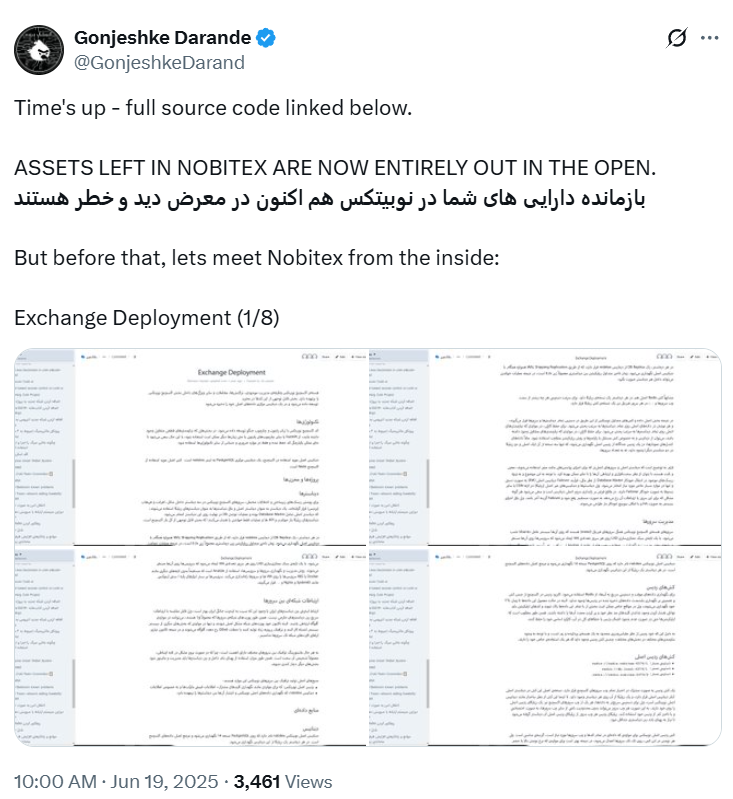

In the latest turn of events, the group said it had made good on its earlier threat to leak the code and internal files of the exchange.

“Time’s up – full source code linked below. ASSETS LEFT IN NOBITEX ARE NOW ENTIRELY OUT IN THE OPEN,” Gonjeshke Darande wrote in an X post on Thursday.

The X thread detailed key security measures of the exchange, including its privacy settings, blockchain cold scripts, list of servers and a zip file containing the full source code to the Nobitex exchange.

The source code was leaked a day after the group took responsibility for the exploit, promising to release the exchange’s source code and internal files within 24 hours.

The hackers said they targeted the exchange because it has ties to Iran’s government and participates in funding activities that violate international sanctions.

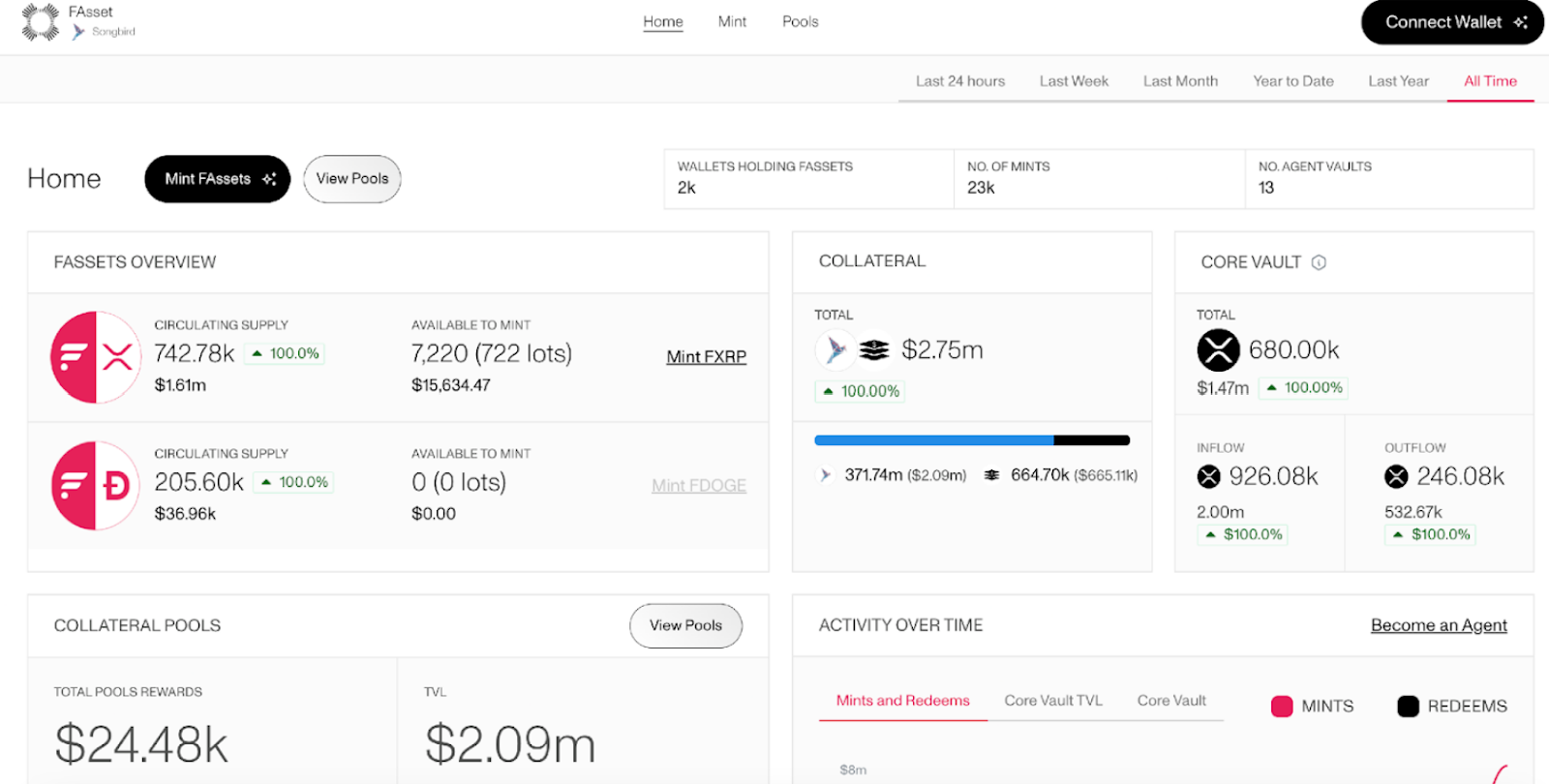

Flare Network bridges XRP to DeFi to unlock dormant liquidity

Despite its massive popularity, XRP has remained largely absent from decentralized finance (DeFi) because of the technical limitations of the XRP Ledger (XRPL).

XRPFi, a DeFi ecosystem centered on XRP (XRP), aims to narrow that gap. It leverages Flare Network’s bridging and smart contract technology to bring XRP into the realm of programmable finance.

Flare Network, a full-stack layer-1 blockchain designed for data-intensive applications, serves as a crucial bridge connecting non-smart-contract assets like XRP to the DeFi ecosystem.

At the heart of Flare’s infrastructure is FAssets, a system that creates fully collateralized representations of these assets. One notable example is FXRP, a wrapped version of XRP that enables holders to deploy their XRP in DeFi protocols within Flare’s network.

By staking FXRP, holders receive stXRP, a liquid staking token that represents a claim on the staked FXRP.

“This setup allows XRP holders to unlock native-like staking yields on an asset that otherwise doesn’t support staking, enabling passive income without sacrificing liquidity,” Max Luck, head of growth at Flare, told Cointelegraph.

Deribit, Crypto.com integrate BlackRock’s BUIDL as trading collateral

Crypto derivatives exchange Deribit and spot exchange Crypto.com are accepting BlackRock’s tokenized US Treasury fund as trading collateral for institutional and experienced clients.

The move will allow institutional traders to use a low-volatility, yield-bearing digital instrument as collateral for their accounts, lowering the margin requirements for leveraged trading, according to Forbes.

Coinbase, one of the world’s biggest exchanges by trading volume, announced a $2.9 billion deal to acquire Deribit in May 2025.

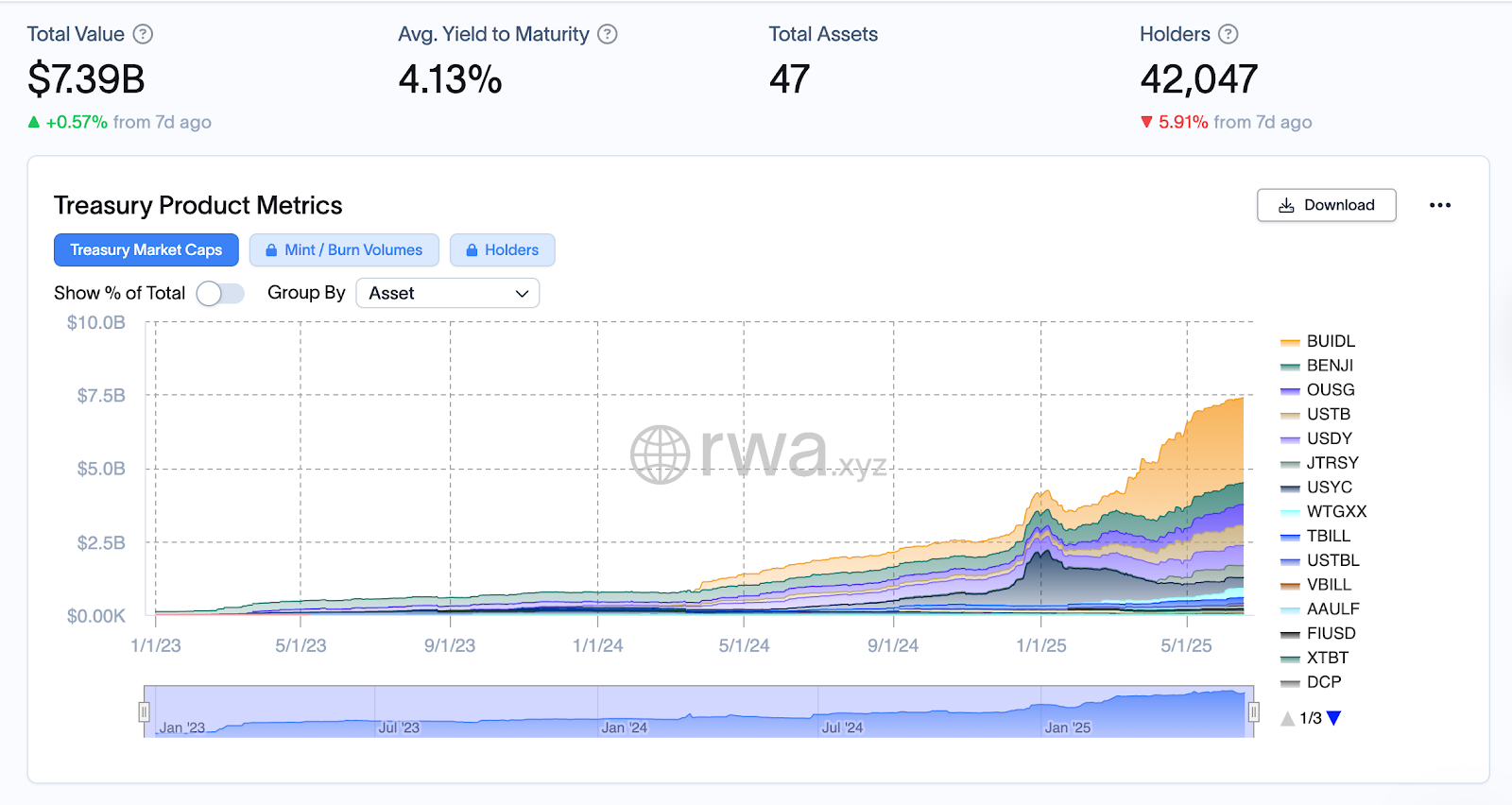

The deal can expand the utility of BlackRock’s Institutional Digital Liquidity Fund (BUIDL). The fund holds nearly 40% of the tokenized Treasury market share, or roughly $2.9 billion in value locked, according to data from RWA.XYZ.

Tokenized US Treasury products are slowly emerging as an alternative to traditional stablecoins, thanks to their yield-bearing properties. The growth of these products reflects the broader merger of cryptocurrencies with the legacy financial system.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the red.

The Story (IP) token fell over 18% as the week’s biggest loser in the top 100, followed by the Four (FORM) token, down over 12% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Read the full article here