Singapore’s latest order for unlicensed crypto firms to stop serving overseas customers marks the beginning of the end for regulatory loopholes in the blockchain industry.

The May 30 directive from the Monetary Authority of Singapore (MAS) tells crypto firms and individuals offering services abroad to get licensed or get out.

To some in the industry, it may look like Singapore is suddenly turning away from its crypto-friendly stance. But in reality, the city-state has remained consistent in its push for compliance. The move aligns with a global crackdown aimed at money laundering and terrorism financing.

“For exchanges still playing regulatory pinball — constantly seeking loopholes to avoid licensing requirements — the reality is clear: They will soon find themselves having to relocate to their favorite destination, the moon,” Joshua Chu, a Hong Kong-based lawyer and co-chair of the city’s Web3 association, told Cointelegraph.

“With jurisdictions like Singapore, Thailand, Dubai, Hong Kong and others tightening oversight and closing gaps, there’s simply no escaping the global push for compliance.”

Exiled in Singapore, crypto nomads run out of road

Singapore has been a favorable hub for regulatory arbitrage in crypto, thanks to its Payment Services Act (PSA), which requires licensing for firms serving local clients.

With a relatively small domestic population of around 6 million, many crypto companies opted to sidestep licensing by simply avoiding Singaporean customers and focusing on overseas markets instead, noted YK Pek, CEO and co-founder of the legal tech firm GVRN, on X.

While some interpret the recent MAS move to oust unlicensed crypto firms under the 2022 Financial Services and Markets Act (FSMA) on a tight deadline as a sharp policy reversal, the regulator said it has maintained a steady stance.

“MAS’ position on this has been consistently communicated for a few years since the first response to public consultation issued on 14 February 2022 and in subsequent publications on 4 October 2024 and 30 May 2025,” the central bank said in a June 6 statement.

The FSMA states that any business in Singapore offering digital token services to clients overseas must be licensed. The law has not been changed. Rather, the MAS has completed public consultations and is notifying service providers that their unlicensed tenure is over.

Related: South Korea’s new president will bolster crypto, but scandals prevail

“I think we need to recognize that Singapore is first and foremost a global financial center, not necessarily a crypto one,” Patrick Tan, general counsel at ChainArgos, which was among the respondents to the MAS consultation, told Cointelegraph.

“Given stricter crypto-asset licensing conditions globally, organizations will need to reflect on what they are seeking to obtain from a license,” he added.

Hong Kong offers no guarantees for Singapore’s crypto outcasts

As firms weigh their next move, speculation is growing over what jurisdictions might become more attractive. Recent developments suggest Singapore is not an outlier but part of a global regulatory shift.

The Philippines, for instance, now requires all licensed crypto firms to maintain a physical office in the country. Thailand has recently expelled at least five exchanges over licensing and money laundering concerns, giving investors until June 28 to move their assets.

One destination that has emerged as an option is Hong Kong, Singapore’s regional rival. The two jurisdictions are frequently compared in the so-called crypto hub race.

Related: Who’s got the charm, cash and code to be a crypto hub?

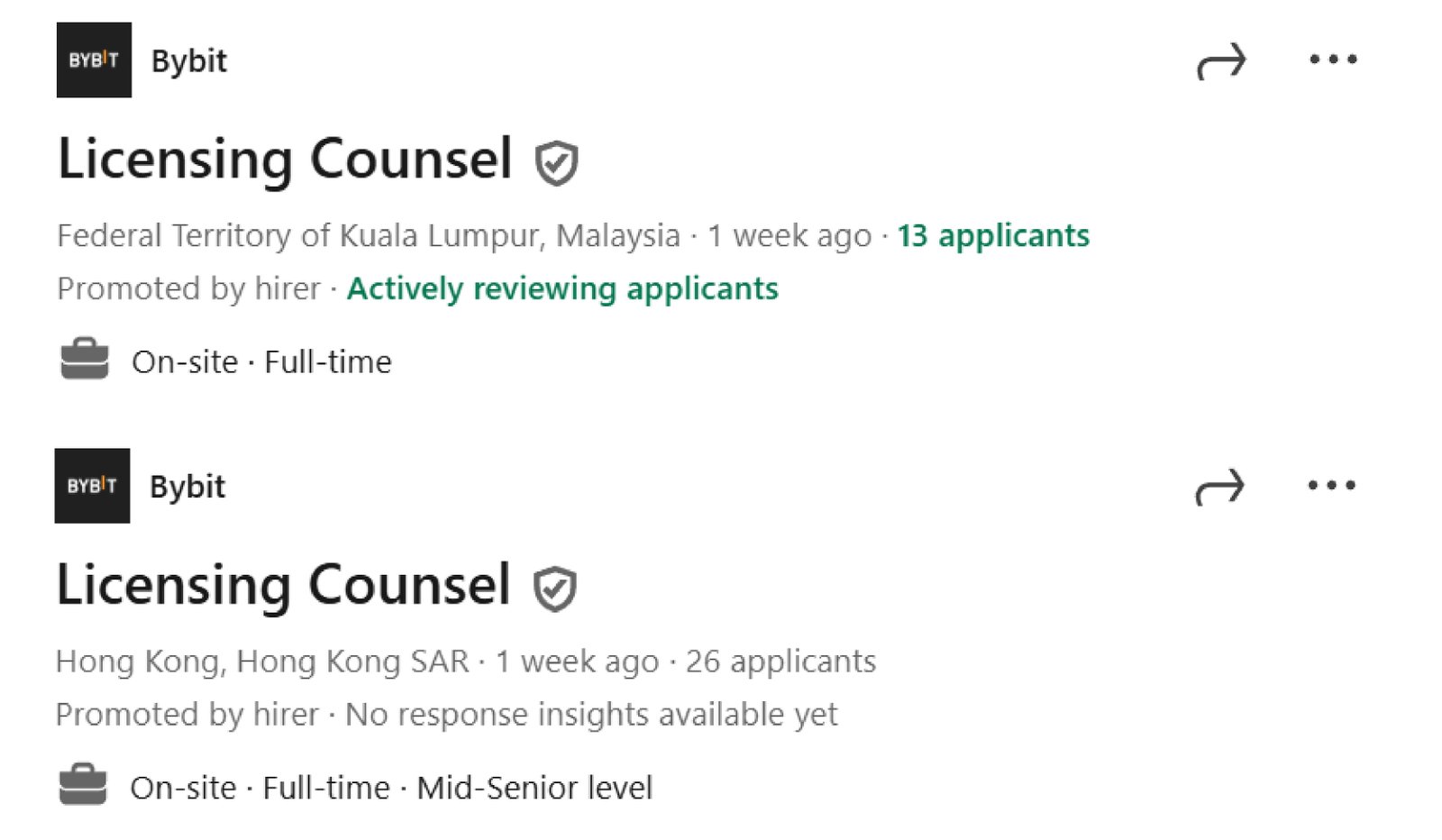

Hong Kong is also being considered by Bybit, one of the exchanges recently expelled from Thailand. A job posting by Bybit seeking a licensing counsel in Hong Kong appeared just days after Thailand’s Securities and Exchange Commission announced the company will be blocked.

A Bybit spokesperson confirmed to Cointelegraph that Hong Kong is one of the jurisdictions under consideration for future licenses, adding that the company is “working with regulators in different countries.” The exchange is also hiring for a similar role in Malaysia.

The industry is learning that being a “crypto hub” often means facing tighter yet clearer regulatory frameworks. Neither Hong Kong nor Singapore has taken a laissez-faire approach. In fact, Hong Kong moved earlier, ordering all unlicensed exchanges to exit the market in mid-2024.

Firms looking to pivot to Hong Kong may find that fewer companies have succeeded in securing licenses there. As of June 6, the city had issued only 10 crypto licenses, compared to 33 digital payment token licenses approved by MAS under the PSA.

“Looking ahead, we anticipate regulatory actions imminently from other major crypto centers including Hong Kong, the European Union with its MiCA [Markets in Crypto-Assets] framework, the United Kingdom’s evolving crypto laws, South Korea, and Japan — all committed [Financial Action Task Force] members with mature or maturing regulatory regimes,” said Chu.

Singapore is among 40 FATF members

Singapore’s FSMA expanded regulatory oversight of crypto service providers, particularly those serving overseas clients. The act complements the PSA and was introduced in part to align with the Financial Action Task Force’s (FATF) mandates on the Travel Rule and Anti-Money Laundering (AML) standards.

The pace of regulatory alignment accelerated after the FATF’s February plenary session, which launched public consultations on improving payment transparency and addressing the complex trails used for money laundering and sanctions evasion.

“Dubai’s [Virtual Assets Regulatory Authority] released its Rulebook 2.0 shortly after the plenary, imposing stricter AML protocols with a June [19] compliance deadline, reflecting its cautious approach following gray list removal,” Chu pointed out.

For FATF members like Singapore and Hong Kong, tightening AML standards is expected. But for non-members that fall short of compliance, inclusion on the FATF gray list can be economically devastating. For example, a report by think tank Tabadlab estimated that Pakistan’s placement on the FATF gray list between 2008 and 2019 led to cumulative real gross domestic product losses of around $38 billion.

FATF President Elisa de Anda Madrazo of Mexico has made strengthening standards for virtual assets one of the priorities of her two-year term. Source: FATF/YouTube

Aside from recently tightening their crypto regulations, another common denominator among Thailand, the Philippines and the United Arab Emirates is their removal from the FATF gray list. Thailand was delisted in 2013, the UAE in 2024 and the Philippines in 2025. According to Chu, jurisdictions that exit the gray list often work “extra hard” to stay off it.

Dubai, the UAE’s emerging financial center, has been a magnet for crypto businesses due to its friendly rules and dedicated regulator, but legal experts warn against misunderstanding the ecosystem.

“Dubai just got off [the gray list] not too long ago and is on the probation list,” Chu said. “So, characters who think they are safe in Dubai might be in a bit of a false sense of security.”

This means that the era of hopping jurisdictions to dodge regulation is coming to a close. As crypto firms search for their next base, the list of friendly but lenient destinations is shrinking, and even the most welcoming hubs are demanding compliance.

Magazine: Baby boomers worth $79T are finally getting on board with Bitcoin

Read the full article here