At the 2023 New York Times DealBook Summit in New York, JPMorgan Chase CEO Jamie Dimon delivered a sobering message to Wall Street and the world and warned investors there’s potential for further inflation, while not ruling out the possibility of a recession.

According to Dimon, numerous factors contribute to a dangerous and inflationary environment, including the need for increased government funding in various sectors as they move to fund the green economy and remilitarize. He said:

A lot of things out there are dangerous and inflationary. Be prepared… Interest rates may go up and that might lead to recession.

The CEO of JPMorgan added that he is “cautious about the economy” as while the labor market in the United States has been resilient inflation is “hurting people.” Reflecting on recent economic policies, Dimon criticized the stimulus money distributed during Covid shutdowns and the quantitative easing by the Federal Reserve, describing these measures as injecting “drugs directly into our system” that led to an economic “sugar high.”

He expressed concern about the potential impact of continued quantitative easing, tightening monetary policies, and geopolitical issues. In previous interviews, Dimon has suggested that the Federal Reserve’s aggressive interest rate hikes might not be over, indicating he believes interest rates may go as high s 7%.

As CryptoGlobe reported at the time, Dimon suggested global financial markets could face unprecedented turbulence if the Federal Reserve pushes its benchmark interest rate to 7% in the face of stagflation.

Despite previously advocating for a rate hike to counter soaring inflation, Dimon underscored that the transition from 5% to 7% would exact a more pronounced toll on the economy compared to the shift from 3% to 5%.

Dimon also commented on the broader geopolitical landscape, describing the current era as potentially the most dangerous in decades, highlighting the conflicts in Ukraine and Gaza and noting their possible extensive impacts on global energy and food supply, trade, and geopolitical relations. He even raised the issue of “nuclear blackmail” as a significant concern.

To JPMorgan’s CEO, the United States has to ensure it has the “best military in the world, bar none” as it works on “keeping the Western world together.”

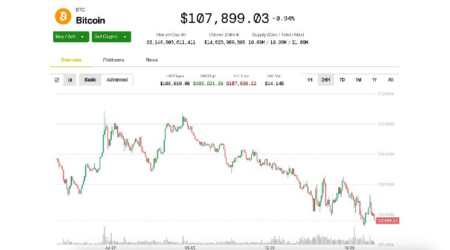

Dimon, it’s worth noting, like blockchain technology but is a well-known harsh critic of Bitcoin and other cryptocurrencies. Earlier this year he questioned Bitcoin’s supply being capped at 21 million.

Featured image via Unsplash.

Read the full article here