Australians are increasingly adding cryptocurrency to their “self-managed super funds” as a means to secure their retirement life, according to newly released data.

Australians are increasingly looking to cryptocurrency to secure a peachy retirement, with allocation to the asset class from self-managed retirement funds increasing 400% in just four years — with the growth rate surpassing stocks and bonds.

As of the quarter ending in September, the nearly 612,000 self-managed super funds (SMSFs) are holding a total of $658.6 million (992 million Australian dollars) worth of cryptocurrencies, statistics released on Nov.

The latest figure is a 400% increase from the same quarter in 2019 — which closed out at just under $131.5 million (198 million Australian dollars).

In Australia, self-managed super funds — also known as private superannuation funds — allow individuals to control how their retirement funds are invested.

Crypto tax provider Koinly’s head of tax Danny Talwar told Cointelegraph this makes crypto the “largest growing asset class in SMSFs.”

In comparison, listed shares — representing the largest allocation category for SMSFs at the end of the last quarter — grew 28% over the same time.

However, total SMSF allocations to crypto saw a slight 0.8% drop from the quarter ending June 2023 and a 2.4% drop compared to the previous year.

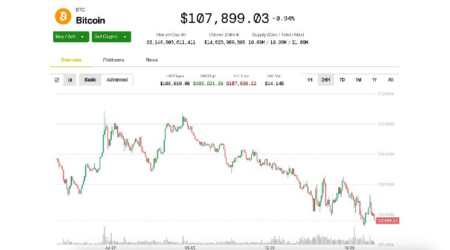

Crypto allocation amounts within all SMSFs per quarter since September 2019.

Despite the rise in more recent years, the amount of crypto held in self-managed funds is currently still down 38% compared to the all-time high of nearly $1.06 billion (1.6 billion AU) in the quarter ending June 2021 during the last crypto bull cycle.

Related: Australia’s tax agency won’t clarify its confusing, ‘aggressive’ crypto rules

Talwar also highlighted that crypto only made up 0.1% of the total net assets held in Australian SMSFs at the end of the last quarter. He also noted that small-sized SMSFs tended to have a larger allocation to cryptocurrencies in their portfolios.

Holding crypto within a super fund is something Talwar said he’s seeing “more and more” of, and local crypto exchanges offering crypto superannuation products are “on the rise.”

“People want to want to hold crypto. You can hold crypto in super, but there are some stricter rules around it,” he warned.

“Your SMSF strategy must allow you to hold crypto. It must be for the sole purpose of providing you with a retirement benefit. You need to get everything audited. You need to segregate SMSF holdings from personal holdings. You can’t have a blurred line between the two.”

Specific cryptocurrencies SMSFs hold and what gain or loss has been made is unknown, as the ATO doesn’t provide information on portfolio holdings or performance.

Read the full article here