A recent analysis by Deribit, a leading derivatives exchange, suggests a bullish sentiment for Bitcoin as we approach early 2024. This optimism is rooted in the current Bitcoin put-call options ratio, a critical option market metric.

Deribit’s Insight: Bitcoin Calls Outpace Puts Signaling Market Confidence

Notably, options are financial instruments that give traders the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price within a set time frame. The put-call ratio is used in options trading to measure market sentiment.

A put option signifies a bet on the price of an asset falling, while a call option represents a wager on its rise. A lower put-call ratio indicates that more traders are betting on the asset’s price increasing rather than decreasing.

Deribit’s analysis shows an increasing trend in the number of call options outstripping put options in Bitcoin’s options market. Luuk Strijers, Chief Commercial Officer at Deribit, highlighted that the put-call ratio for Bitcoin has consistently hovered “between 0.4 and 0.5” throughout the year.

This trend is particularly noticeable for options expiring in March and June 2024, suggesting that investors are increasingly using call options to position for a potential appreciation in Bitcoin’s value during this period.

The put-call options ratio falling below one is a bullish market indicator, as it shows that call volume, or bets on the price increase, surpasses the put volume, which are bets on the price decrease. According to Deribt, Bitcoin’s put-call ratio currently stands at 0.42, as of today.

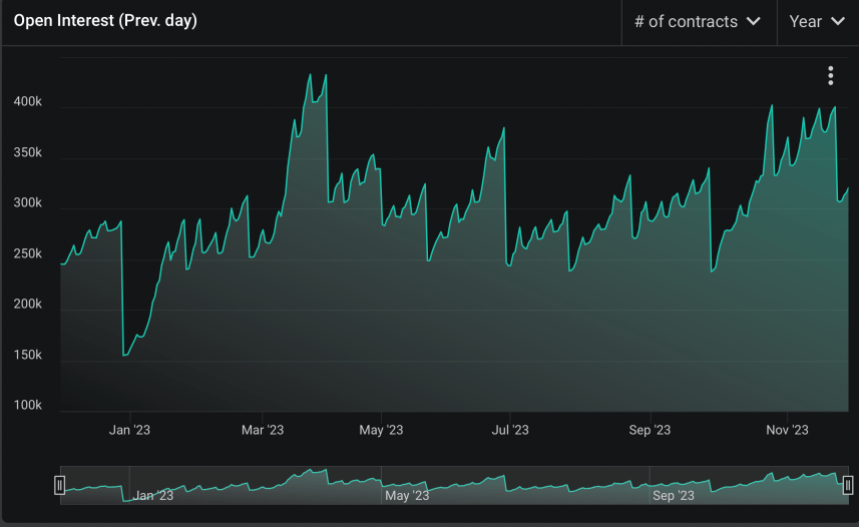

A Surge In Crypto Derivatives Activity

Meanwhile, November has seen significant activity in the crypto derivatives market, as noted by Strijers. The Deribit executive attributes this increased market activity to higher levels of “implied volatility (DVOL),” which have spurred “opportunities and overall market volumes.”

The expiration dates of the upcoming options, especially the significant one on December 29, are expected to maintain the heightened interest and activity in the market. With $5.7 billion in Bitcoin options and $2.7 billion in Ethereum options set to expire at the end of December, the market is poised for notable movements.

Bitcoin maintains its upward momentum, advancing by 1.8% over the past 24 hours. With Bitcoin currently trading at $38,344, the asset has sustained the gains achieved at the close of the previous month.

Bitcoin’s trading volume significantly reflects heightened market activity, suggesting ongoing buying pressure. In just the last day, trading volumes have surged from around $11 billion earlier in the week to over $21 billion, a noteworthy indication of increasing investor engagement.

Featured image from Unsplash, Chart from TradingView

Read the full article here