Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

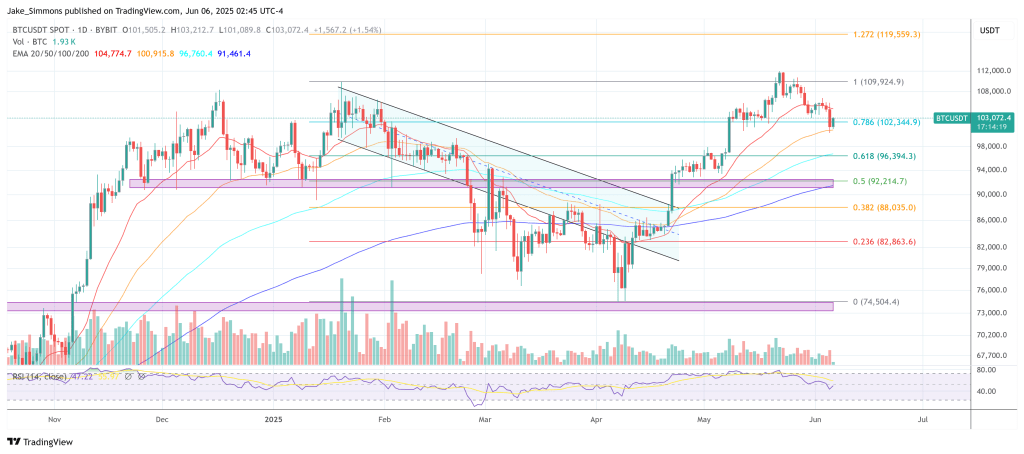

Bitcoin’s majestic 2024-25 ascent may have stalled at the very moment many traders expected an early-summer melt-up, according to crypto analyst Dr Cat (@DoctorCatX). In an extended thread published today, the Ichimoku-focused technician argues that the market printed a “valid cycle high” on the weekly chart and has now slipped into neutral territory—potentially postponing the next decisive breakout until mid-July or, failing that, as late as the first quarter of 2026.

Bitcoin Bottom Not In?

“I warned multiple times that we can’t be bullish on the weekly before the 9th of June,” Dr Cat reminded followers. The Chiko Span (CS) “entered the candles” last week, he noted, stripping the weekly timeframe of its bullish bias even though the long-term monthly structure remains intact. “Because the monthly chart is bullish, things are still long-term bullish,” he conceded, yet the immediate path higher has narrowed to two clear windows.

Related Reading

The first window opens in the week beginning 16 June. If Bitcoin starts that week above $99,881 and closes with CS breaking cleanly above the candle range, Dr Cat believes “the moonshot, potentially to $270,000,” could ignite. Should price open below that threshold, a textbook CS tracing pattern would already be underway, pushing the next breakout target to the week commencing 14 July (or the one immediately after). “Simply because these are the places where CS can make a clear breakout above the candles terminating a CS tracing,” he explained.

Below $93,200—the current position of the weekly Kijun Sen—the bullish countdown is voided. “If the Kijun Sen at 93.2K is lost, we consider much later breakout,” Dr Cat warned, pointing traders to a broad monthly window between November 2025 and April 2026 when the Kijun Sen itself is expected to slope upward again. Until then, he is “not confident that the bottom is in,” flagging $97–98 K as a short-term confluence zone in which the daily Kumo cloud, the weekly Tenkan Sen and the two-day Kijun Sen intersect.

The analysis comes at a delicate moment for sentiment. Bitcoin’s April all-time high above $111,999 has so far resisted several retests, and funding rates on major derivatives venues have eased from euphoric to merely positive. For Dr Cat, such moderation is consistent with Ichimoku’s Kihon Suchi 17-period rhythm: “Time cycles … give a valid cycle high on the weekly. I think at this point it obviously printed,” he wrote, implying that a fresh consolidation phase is statistically favored.

Altcoin Season Even Further Delayed

Altcoins face an even steeper uphill battle. In a companion post dissecting the TOTAL3 index (the market capitalization of all crypto assets excluding Bitcoin and Ethereum), Dr Cat argued that “altcoins are not ready to pump on the weekly and need minimum 1-2 months for that in the most bullish scenario.”

Related Reading

He cited four overlapping bearish ingredients: price below the weekly Kijun Sen, a negative Tenkan–Kijun cross, a Chiko Span trapped beneath the candle “forest,” and a Kijun Sen poised to turn down next week. “The chance for a bullish altcoins explosion in June is around 5 %,” he concluded, assigning a roughly equal probability that Bitcoin alone could rally while “dominance destroys alts.”

That dour appraisal extends to Ethereum and other large caps. In Dr Cat’s view, “blindness … applies to anyone expecting a parabolic bull run above ATH in June for TOTAL3.” The first legitimate “window of opportunity for altcoin bulls,” he adds, does not open until August, when the weekly CS will encounter a thinner overhang of historic candles.

Market implications hinge on whether Bitcoin can defend its higher-timeframe pivots long enough to align with those temporal windows. So far, the $93.200 Kijun Sen serves as the demarcation line between an orderly pause and a deeper retracement. A weekly close beneath it would “activate” the November-to-April contingency track—effectively pushing any move toward Dr Cat’s headline $270,000 projection into the next halving cycle.

At press time, BTC traded at $103,072.

Featured image created with DALL.E, chart from TradingView.com

Read the full article here