Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is navigating a highly volatile environment, as escalating Middle East conflicts and intensifying macroeconomic risks dominate global headlines. Despite mounting uncertainty, BTC continues to hold firm above the $104K level, signaling strong buyer interest at key support zones. Bulls remain in control for now, but hawkish macro conditions—such as elevated US Treasury yields, persistent inflation concerns, and geopolitical turmoil—pose serious risks that could drive BTC below the critical $100K mark.

Related Reading

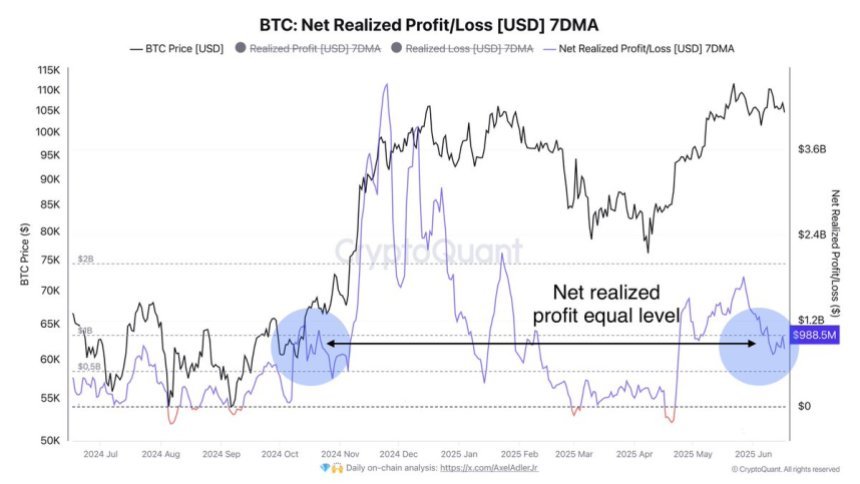

The market is divided on what comes next. Some analysts point to strong fundamentals and institutional adoption as fuel for a massive bull run, while others warn of a deeper correction before any upward continuation. Top analyst Darkfost emphasized the importance of monitoring on-chain behavior during such periods of uncertainty. According to CryptoQuant data, realized profits on Bitcoin (7-day moving average) show no major warning signs. Current profit-taking activity remains below $1 billion—similar to levels seen following the October 2024 correction—indicating that investors are neither panicking nor overly euphoric.

This muted profit realization could be a sign that long-term holders are still confident in the broader trend, setting the stage for an eventual breakout once macro conditions stabilize.

On-Chain Metrics Signal Calm Bitcoin Consolidates

As the conflict between Israel and Iran escalates, fears of a broader war—and the possibility of US intervention—continue to weigh heavily on global markets. Investors remain on edge, with rising oil prices and weakening economic confidence feeding into macro uncertainty. Yet, Bitcoin seems largely unfazed. Despite the heightened geopolitical tension, BTC continues to consolidate just below its all-time high, showing resilience that has both bulls and bears second-guessing their next move.

Fundamentally, Bitcoin remains strong. Institutional adoption is steadily increasing, and exchange supply continues to decline, reflecting a trend toward long-term holding and off-exchange accumulation. In many ways, BTC appears to thrive in this environment of volatility and uncertainty.

According to on-chain data shared by Darkfost, realized profits on Bitcoin—measured by the 7-day moving average (7DMA)—show no major warning signs. Current profit levels remain under $1 billion, a range not seen since the end of the October 2024 correction. Even during the recent ATH surge, realized profits stayed well below the January 2025 peak. This lack of aggressive profit-taking suggests that most investors are still holding strong, neither panicking nor rushing to sell.

That restrained behavior is playing a key role in Bitcoin’s ongoing consolidation. Without a wave of profit realization, there’s little pressure to force the market down—yet no catalyst strong enough to push it decisively higher either. Monitoring these on-chain signals will be critical in the coming days. If realized profits spike or exchange inflows surge, it may mark the beginning of a new phase.

Related Reading

BTC Technical Analysis: Key Support Being Tested

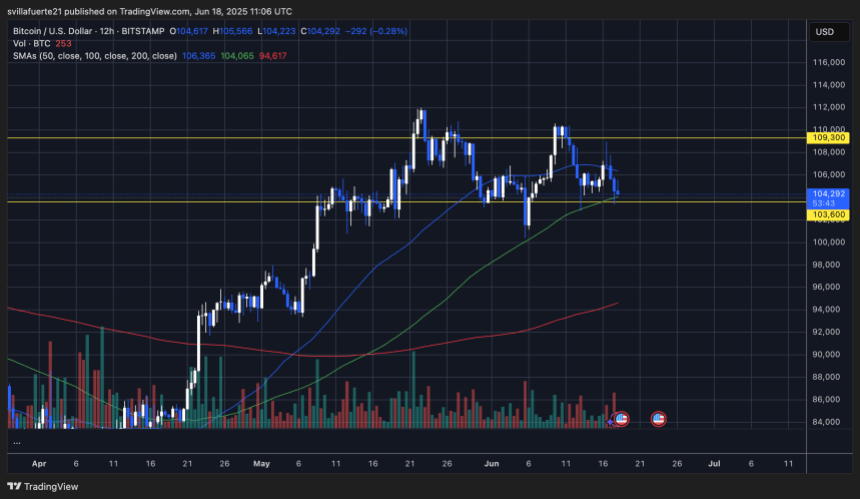

The 12-hour chart of Bitcoin (BTC/USD) shows the asset currently trading at $104,292, just above a crucial support level at $103,600. This area, which corresponds to the previous all-time high set in late 2024, has become a key battleground for bulls and bears. BTC has repeatedly bounced from this level in recent weeks, and its ability to hold could determine the direction of the next major move.

BTC failed to break through the $109,300 resistance, forming a series of lower highs since tapping the $112,000 level. This suggests a weakening bullish momentum and highlights the importance of current price action around the 50-period SMA, which is now acting as short-term dynamic resistance.

Volume has remained relatively stable but showed slight upticks during recent pullbacks, hinting at cautious selling rather than full-blown capitulation. The 100-period and 200-period SMAs, currently sitting at $104,065 and $94,617, respectively, offer additional support beneath the current range, with the 100-SMA now directly aligned with the horizontal $103,600 level.

Related Reading

If BTC breaks and closes below this demand zone with volume confirmation, it could trigger a move toward the $100K psychological support. Conversely, a strong bounce from here would reinforce the ongoing consolidation and keep the path open for another test of $109,300.

Featured image from Dall-E, chart from TradingView

Read the full article here