If Bitcoin reaches $119,000 by the end of August, MicroStrategy’s (now Strategy) third-quarter earnings could set a new record for a publicly traded company’s highest quarterly profit in financial history. This impressive figure would easily top Nvidia’s earnings and approach Apple’s record.

As Bitcoin gains widespread acceptance, it prompts the question of whether major players will adopt Strategy’s plan by the book. According to Brickken analyst Enmanuel Cardozo, it depends. Though Strategy’s current achievements are impressive, the quality of its long-term health comes into question.

Could MicroStrategy’s Bitcoin Gains Top Tech Giants?

Michael Saylor’s aggressive Bitcoin plan for Strategy (formerly MicroStrategy) continues to remain strong through sunshine or rain. For now, it shows no signs of slowing. With 592,100 Bitcoins on its balance sheet, Strategy is the biggest corporate holder worldwide.

As Bitcoin’s price continues to climb, so will Strategy’s overall earnings. This large-scale success has already led several publicly traded companies to follow suit. The question is whether other corporate giants will also take the leap and purchase Bitcoin.

If Bitcoin closes Q3 above $119,000, and Strategy has 592,100 bitcoins acquired at an average cost of $70,666 each, Strategy’s estimated quarterly net earnings would be approximately $28.59 billion.

Strategy’s most recent Bitcoin purchases. Source: Strategy.

This figure would exceed Nvidia’s highest reported quarterly net income of $22.091 billion, making it Strategy’s largest quarterly earnings and a significant outlier among many publicly traded tech companies.

Since Strategy uses fair value accounting for its Bitcoin, it directly reflects these gains in its net income. If Bitcoin’s price continues to rise beyond this level, Strategy’s earnings could potentially challenge Apple’s current record-setting quarterly net income of $36.33 billion.

Could this unprecedented success generate a fear of missing out among other competitors?

To Buy or Not to Buy

Cardozo expressed excitement over how such a scenario could generate further Bitcoin adoption by other corporate trailblazers.

“With [Strategy’s] 592,100 BTC holdings, other companies might feel the need to finally jump in, especially as Strategy’s performance is outpacing traditional metrics. That kind of success won’t go unnoticed and will eventually push their boards to at least explore Bitcoin to keep up,” he told BeInCrypto.

Some of Bitcoin’s advantages over assets may even appeal to companies with massive earnings, like Nvidia or Apple.

“There’s a solid case for tech giants like Apple and Nvidia to diversify into Bitcoin, and I’m loving the possibilities here. On the pro side, Bitcoin is built as a perfect hedge against fiat devaluation because of its limited supply and decentralized nature,” Cardozo added.

However, a playbook like Strategy’s comes with many risks, and it’s not a one-size-fits-all win—even for Strategy itself.

Strategy’s Financial Health: A Deeper Dive

While Strategy has seen significant profits from holding Bitcoin, these gains primarily stem from a tax advantage, not from its core business operations.

“These gains, driven by fair value accounting, aren’t cash in hand like Apple’s billions from iPhone sales, they are paper profits tied to Bitcoin’s price. Investors and analysts should see this as a speculative boost, not a sign of operational strength, and focus on cash flow and debt to gauge real business health,” Cardozo explained.

Effectively comparing Strategy’s net income to other characteristics like cash flow and debt indeed reveals more about the problems that may lie ahead for the company, especially if Bitcoin’s price were to decline steadily.

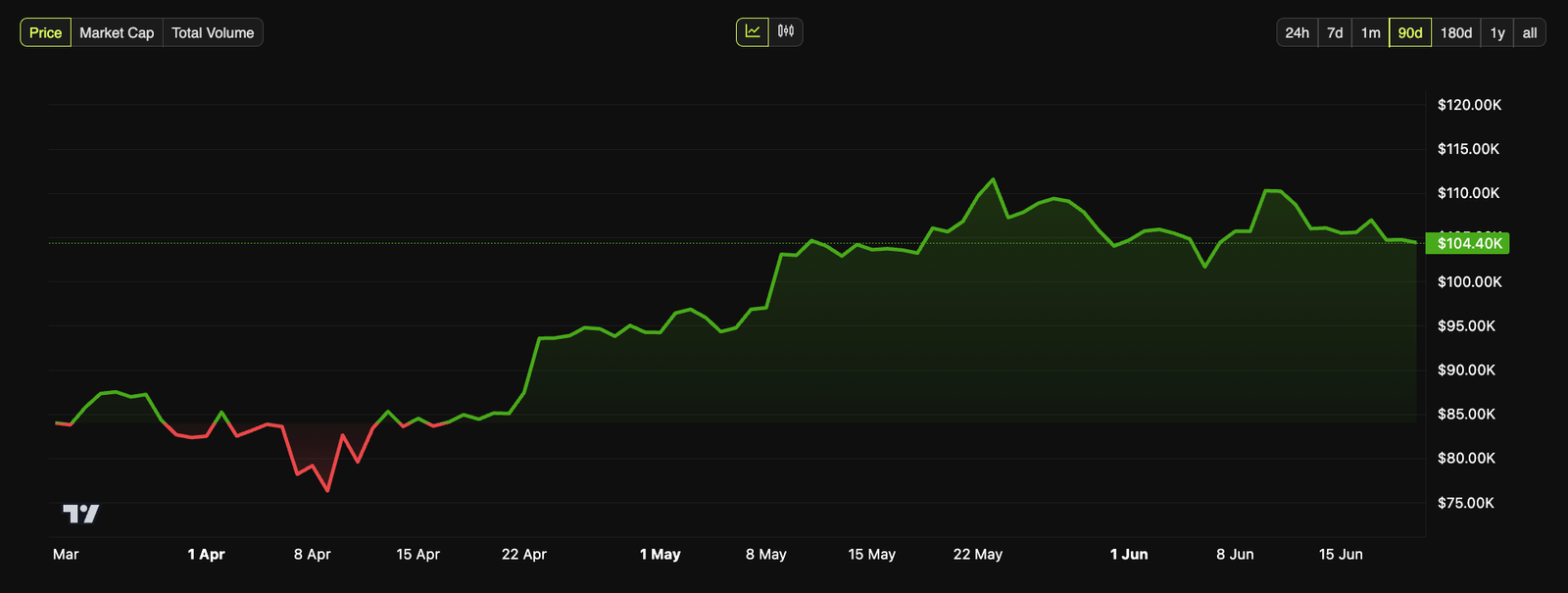

Changes in Bitcoin’s price over the past three months. Source: BeInCrypto.

According to the firm’s most recent SEC filings, Strategy reported its outstanding debt amounted to $8.22 billion as of March 2025. It also had a negative cash flow of -$2 million, representing a significant decline year over year.

Though these numbers make sense considering Strategy’s aggressive Bitcoin buying, they also demonstrate that the company’s core software business is not generating enough cash to cover its expenses. Strategy said so itself in its latest filing.

“A significant decrease in the market value of our Bitcoin holdings could adversely affect our ability to satisfy our financial obligations,” read the statement.

It must issue debt and new equity to raise capital to continue its strategy. The plan is risky, to say the least.

Is Bitcoin Right for Every Company?

Given that Strategy’s main income comes from its Bitcoin purchases, Cardozo argues that other companies should carefully consider their financial position before taking a similar approach.

“Analysts should weigh this against operational metrics; a company living on unrealized gains is riskier by nature. I think it’s an innovative strategy, but for long-term health, especially for traditional businesses, cash-generating operations beat paper profits any day, investors should keep that in mind,” he said.

However, as Bitcoin increasingly symbolizes technological innovation, companies aligning with this principle might feel pressured to embrace it. They wouldn’t need to acquire nearly 600,000 Bitcoins, like Strategy, to make such a statement.

They also have a resilient enough treasury to break a fall.

“I’m pretty confident that Apple and Nvidia will eventually invest into Bitcoin, especially with its current track record over the last 10 years,” Cardozo said, adding, “their treasuries could handle a small 1-5% allocation, and not only be hedged against inflation but also as a branding move since they represent the very image of innovation which will also pressure them to do so eventually.”

Yet, ultimately, companies like Apple and Nvidia cater to different customers. Adding Bitcoin to their balance sheets may cause them to lose clients.

The Sustainability Question for Bitcoin Adopters

It’s no secret that Bitcoin mining is extensively damaging to the environment. Strategy, through its Bitcoin acquisitions, directly contributes to the high energy consumption levels associated with the industry.

“Bitcoin’s annual energy consumption is equivalent to a mid-sized country and of course it’s a conflict right off the bat with Apple’s 2030 carbon neutrality target and Nvidia’s renewable energy push,” Cardozo told BeInCrypto.

These companies could risk damaging their public image by associating with an industry that conflicts with their own Environmental, Social, and Governance (ESG) goals.

“Customers and activists might pressure them, seeing it as greenwashing, especially with sustainability being a big part of their public image… they could align Bitcoin with their ESG goals and keep their image intact as Bitcoin mining becomes more sustainable than traditional banking’s legacy system,” Cardozo added.

Ultimately, while the allure of Bitcoin’s gains might pressure tech giants like Apple and Nvidia to follow Strategy’s lead, such a consideration may cause these companies more problems than profits.

Read the full article here