The day after President Trump publicly confirmed U.S. airstrikes on Iranian military installations, bitcoin showed signs of investor hesitancy despite holding above key support at $102,000. As of June 22, 2025, bitcoin is trading at $102,700 to $102,810, giving it a market capitalization of $2.04 trillion and 24-hour trade volume totaling $31.32 billion. Price action remained volatile within the $100,945 to $103,939 intraday range, highlighting a market balancing between geopolitical risk and technical boundaries.

Bitcoin

On the 1-hour chart, bitcoin is attempting to stabilize following a drop to $100,945, with a visible consolidation pattern hinting at a double bottom formation. The neckline near $103,000 is critical—any breakout above this level, particularly on growing volume, could target the $104,000 to $104,500 range. However, if the support at $100,945 fails to hold, downside targets between $98,500 and $99,000 become likely. Volume has picked up on green candles, suggesting short-term buying interest, but it lacks the conviction typical of a bullish reversal.

BTC/USD 1-hour chart on Sunday, June 22, 2025, via Bitstamp.

The 4-hour BTC/USD chart reinforces the prevailing short-term downtrend, with support again emphasized at $100,945 and resistance forming near $104,000 to $105,000. The most recent sell-off featured a sharp volume spike, hinting at either retail panic or institutional exit. While some buying has emerged, follow-through has been weak. A retest of $100,945 with diminished volume could offer a swing long opportunity, but failure to hold that zone likely triggers a renewed bearish leg.

BTC/USD 4-hour chart on Sunday, June 22, 2025, via Bitstamp.

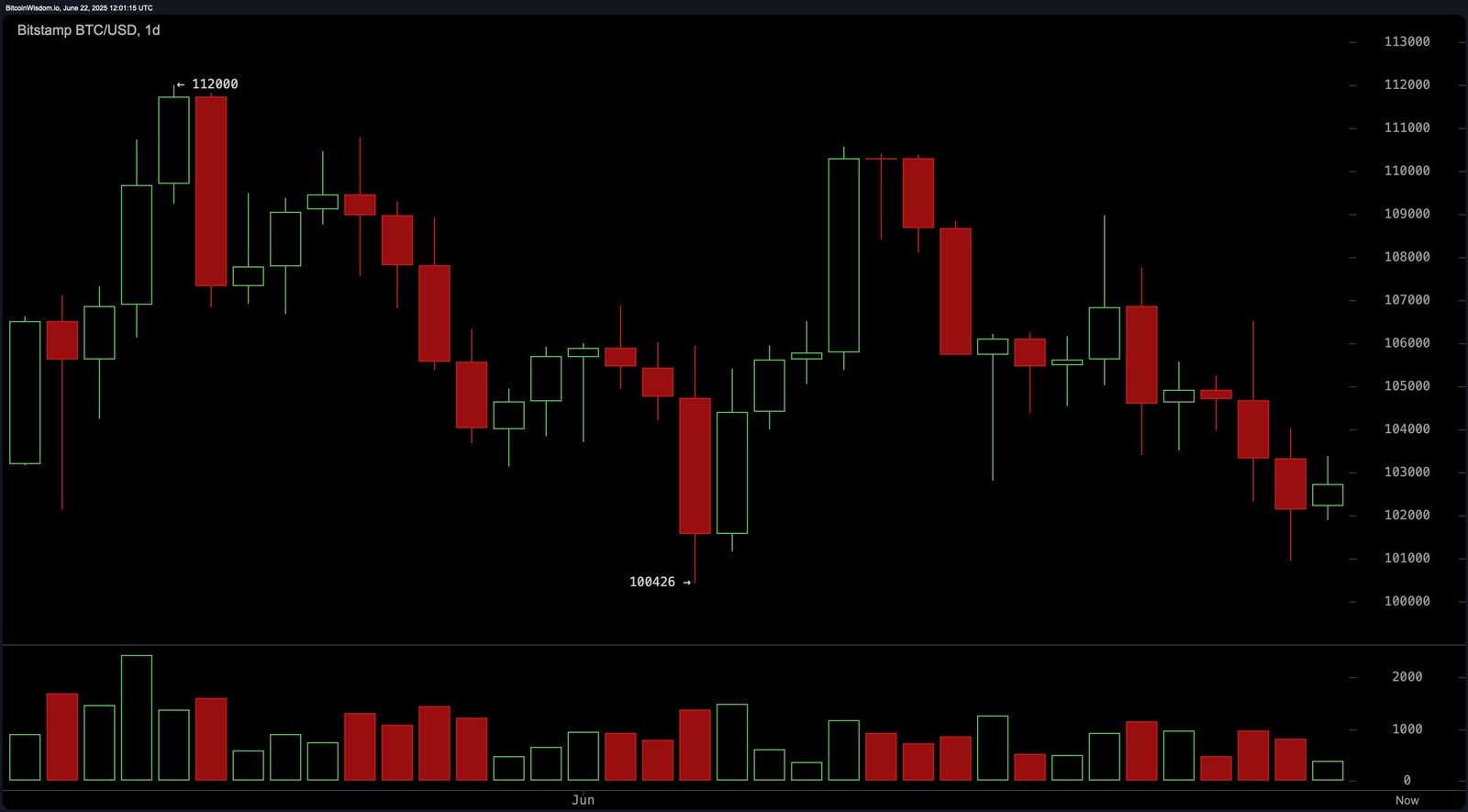

On the daily timeframe, bitcoin remains in a bearish posture with a clear descending trend channel and recent red candles dominating after a short-lived rally. Resistance around $112,000 remains distant, while near-term support holds just above $100,400. The structure suggests a lower high–lower low configuration, typically associated with a continuation of the downtrend. A bullish reversal near $100,000 to $101,000 could be valid if supported by a reversal pattern such as a hammer or bullish engulfing, confirmed by increasing volume. Without such confirmation, a break below $100,000 opens the door to a move toward $96,000 to $98,000.

BTC/USD 1-day chart on Sunday, June 22, 2025, via Bitstamp.

Oscillator indicators present a mixed picture, adding to the overall uncertainty. The relative strength index (RSI) sits at 43, signaling neutral momentum. The Stochastic indicator is at 14, also neutral, while the commodity channel index (CCI) at −125 suggests a potential buying opportunity. Momentum at −2,980 similarly leans toward buy, while the moving average convergence divergence (MACD) at −368 indicates a bearish signal. The Awesome oscillator remains negative at −2,492 with a neutral stance, reflecting indecision among market participants.

Moving averages (MAs) are overwhelmingly bearish on the short to mid-term scales. The exponential moving average (EMA) and simple moving average (SMA) values for the 10-, 20-, 30-, and 50-periods are all aligned in sell territory, suggesting continued downside pressure. However, longer-term averages such as the EMA (100) at $99,223 and SMA (100) at $95,675 are currently in buy territory, providing some structural support beneath current price levels. Similarly, the EMA (200) and SMA (200) at $93,586 and $95,956 respectively suggest a broader uptrend remains intact. Until short-term sentiment shifts, traders should exercise caution and wait for clearer signals before positioning for larger moves.

Bull Verdict:

If the $100,945 support continues to hold and a sustained breakout above $103,000 materializes with strong volume, bitcoin may mount a short-term recovery. The confirmation of a double bottom and potential exhaustion of selling pressure on multiple timeframes could catalyze a relief rally, especially if investors seek alternatives amid rising geopolitical tensions.

Bear Verdict:

Despite the technical setups for a bounce, bitcoin remains vulnerable to further losses given the prevailing bearish momentum and lack of volume confirmation. The dominance of sell signals across short- and mid-term moving averages and oscillators underlines persistent weakness. The geopolitical shock of U.S. airstrikes on Iran introduces elevated systemic risk; if this spirals into wider conflict or market panic, bitcoin may break below $100,000, triggering a slide toward $96,000 or lower in the near term.

Read the full article here