Last week, Bitcoin spot ETFs recorded over $1 billion inflow, signaling a strong resurgence after two consecutive weeks of outflows. This rebound came despite BTC’s muted price action for most of the week, initially slowing inflows.

As market sentiment improved toward the end of the week, strong capital flow returned to BTC ETFs, resulting in a notable weekly rise in net inflows into the funds.

BTC Funds See First Weekly Inflows in Three Weeks

Between June 9 and 13, Bitcoin-backed funds recorded $1.37 billion in net inflows, marking the first positive weekly inflow after two straight weeks of outflows. The capital influx was recorded despite BTC’s lackluster price action for most of the week, initially prompting institutional investors to reduce their exposure.

Bitcoin ETF Flow. Source: Farside

However, the coin’s price rebounded strongly by June 13, closing above the $106,000 price mark and reviving investor interest and momentum.

This trend further highlights how sensitive ETF flows remain to BTC’s price trajectory. While early-week caution led to subdued activity, the late-week recovery reignited confidence among fund participants.

BTC Edges Higher, Yet Derivatives Market Signals Unease

Today, BTC is up 1% and attempting to stabilize above the $106,000 level. As of this writing, the leading coin trades at $106,590, noting a 16% rise in trading volume over the past day.

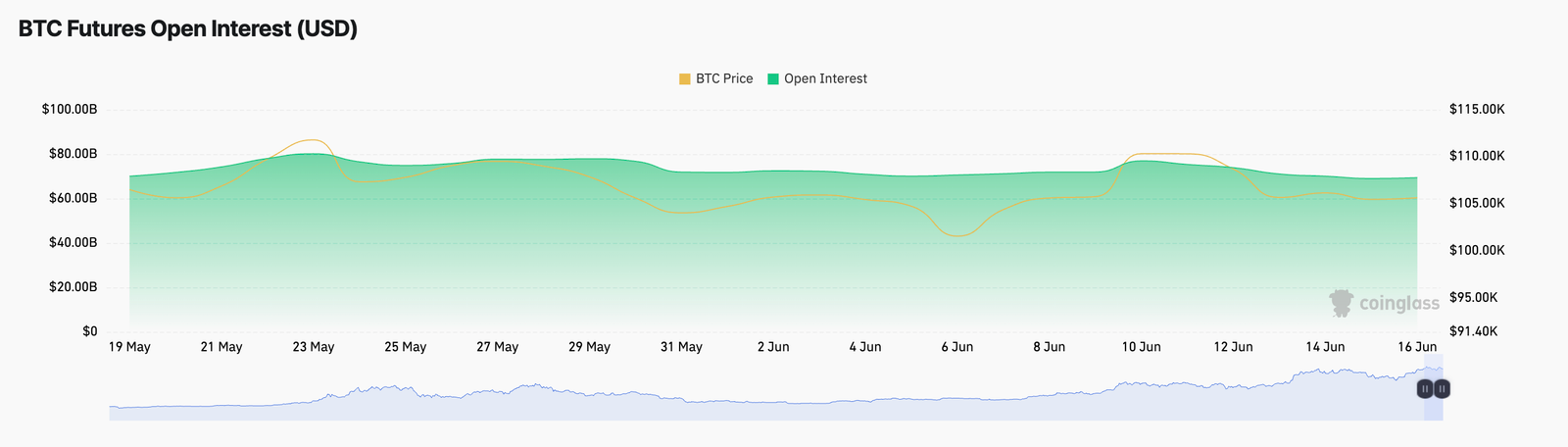

However, the coin’s steadily declining futures open interest suggests traders remain cautious, seeking safer ground. Per Coinglass, this stands at $69.39 billion, plunging almost 10% since June 10.

BTC Futures Open Interest. Source: Coinglass

Open interest refers to the total number of active derivative contracts, such as futures or options, that have not been settled or closed. When an asset’s open interest consistently drops, especially during periods of muted price performance, it signals that traders are unwinding their positions.

This trend reflects the declining market participation and growing uncertainty about BTC’s near-term outlook.

Moreover, on-chain data shows a tilt toward protective positioning on the options front. Demand for put options—contracts that profit when prices fall—has outpaced calls.

Bitcoin Options Open Interest. Source: Deribit

This signals a rise in bearish sentiment and caution among traders looking to hedge against potential downside risk.

Read the full article here