A new report, titled MEV and the Limits of Scaling, explores the vast volume of MEV spam offsetting improvements in blockchain throughput.

Effects of the extra traffic include higher fees for users of popular Ethereum “layer-two” (L2) scaling networks.

Similar trends on Solana and other L2s led Flashbots to do their own deep dive into rollups built via the OP Stack (Optimism, Base, Unichain, and World). The findings show how spam transactions take up a significant portion of available blockspace whilst paying disproportionately lower fees for doing so.

Read more: DeFi trader hit by MEV attack swapped 440K USDC for just 10K USDT

Maximal extractable value (MEV) is a practice that traditionally involves scanning the “mempool” of pending transactions to insert a profitable trade according to the actions of other users.

Frontrunning, backrunning, and sandwich attacks are all common MEV tactics. The process tends to be highly specialised, leading to a dog-eat-dog world of bots battling for peak efficiency and the corresponding rewards.

However, on rollups such as those studied, there is no public mempool. The high-throughput, low-fee environment instead allows bots to take a dragnet approach, submitting transactions that read prices across multiple on-chain exchanges.

If a profitable price discrepancy is found, they take the arbitrage. If not, the transaction is aborted.

The highly competitive winner-takes-all landscape of MEV means that the activity is heavily concentrated, with just two searchers being responsible for over 80% of the spam on Base, for example.

Miller highlights one successful example on Base from a bot with a hit rate of roughly one in 350 attempts, in which $0.02 are spent in gas fees to profit just $0.12.

“The true cost of this one successful arbitrage is shocking”, he writes, revealing that approximately 132 million gas was spent per single successful arbitrage — equivalent to nearly four full Ethereum blocks.

“Keep in mind,” he adds, “this was one among several that were competing for this opportunity, so the true cost to the chain is even higher still.”

The effects of all this spam are multiple. The report finds that, in addition to consuming up to 60% of available blockspace, MEV bots pay less than 10% of total fees. The extra traffic clogging up the network also results in a “persistent, artificially high baseline for transaction fees” for regular users.

As well as consuming up to 60% of available blockspace, MEV bots pay less than 10% of total fees.

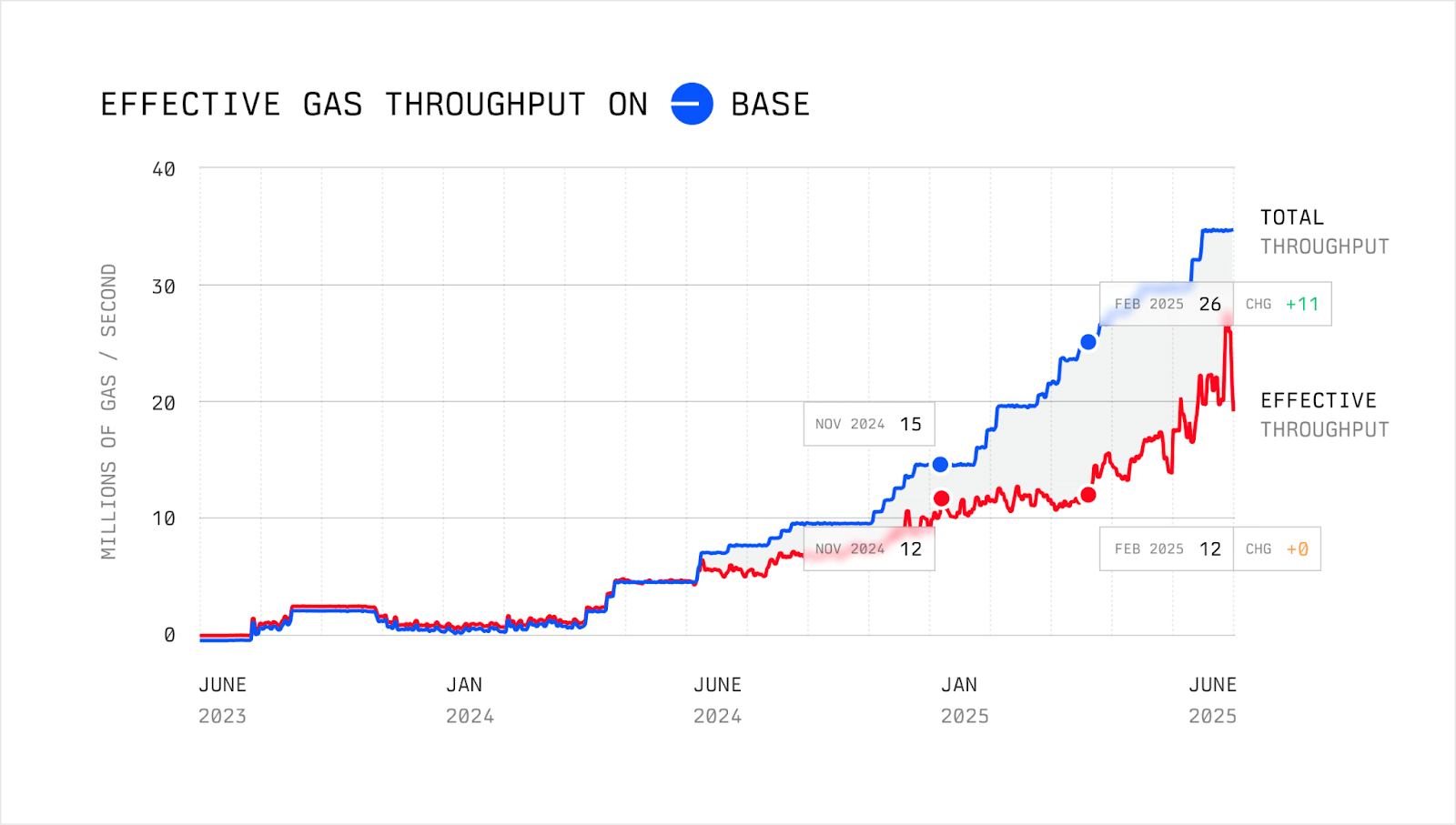

Such inefficient use of the available blockspace leads to a significant lag in “effective gas throughput,” a metric that Flashbots have calculated as “the gas per second a rollup processes after deducting the gas used by spam bots.”

The lag between effective throughput and improvements to total throughput is clear, with MEV searchers’ spam transactions capturing the difference.

The report’s proposed solutions centre around allowing searchers to access the (currently private) pool of pending transactions, and a more efficient auctioning process for having their MEV transactions included in a block.

This would allow for targeted, and likely more profitable, operation, rather than a spam-based approach.

However, it stresses that there should be “restrictions on how [the bots] can use that information” to avoid predatory MEV activity.

Miller signs off with “the conversation on scaling has been too narrow. We increasingly know how to build raw technical throughput; the new frontier is economic.” The full report is available on the Flashbots blog.

MEV searchers’ spam transactions capture the difference between effective and total throughput.

It’s not all spam, though

While MEV bots are often seen in a bad light, it’s not all spam and sandwiches.

Multiple attempted hacks of decentralized finance (DeFi) platforms have been picked up as profitable transactions by bots and frontrun, with the resulting profits ending up with the bot rather than the original hacker.

In many cases, the proceeds are returned by the bot’s owner, who may or may not take a bounty.

Just this morning, a $120,000 hack of Ethereum-based Meta Pool was frontrun by an MEV bot, according to blockchain security firm QuillAudits.

Read more: Whitehat hacker rescues $1.5M from first DeFi hack of 2025

Also today, a “sniper” specializing in being first to newly launched tokens managed to dump a single Spark token for nearly $20,000 of USDT just 11 seconds after the platform’s airdrop went live.

SPK is currently trading at around $0.06, according to CoinMarketCap, which comes out as a cool 3,333% profit for the sniper.

Read the full article here