Over the past week, inscriptions minted on a number of blockchains have caught the attention of crypto traders and developers alike due to large transaction volumes that generated unusual amounts of gas fees. On Layer 2 (L2) chains like Arbitrum and Layer 1 chains like Avalanche and Solana, there has been a proliferation of inscriptions: on-chain pieces of data that are stored inside transaction calldata.

On the Solana network, transactions reached more than $1 million in cumulative value since November 13, 2023; Solana activity also spiked on December 16, with 287,000 new inscriptions created in a single day. These inscription-based NFTs and tokens follow a similar structure to Bitcoin’s BRC-20 standard based on Bitcoin Ordinals, with Solana adopting the SPL-20 token format.

On Avalanche, inscription-related transactions were recorded to have reached over $5.6 million in a single day for gas costs, as recorded on December 16, 2023. This record is followed by Arbitrum One at $2.1 million for gas costs spent on inscriptions.

On December 15th, Arbitrum experienced a two-hour outage. Arbitrum is still investigating the exact cause, but its initial analysis found a surge in network traffic stalled the sequencer, reversing batch transactions and draining the sequencer’s Ether reserves. While compromised during the outage, Arbitrum’s core functionality was restored shortly after.

A recent analysis by the pseudonymous Twitter account Cygaar, a core contributor at Ethereum L2 network Frame, sheds light on the inner workings of inscriptions and how these began to get spammed into L2 networks and L1 chains in recent weeks.

People are able to spam these txns because they’re extremely cheap compared to smart contract txns.

This has led to Arbitrum being taken down, and leading to degraded experience on other chains like zkSync and Avalanche.

It remains to be seen when this craze will end.

— cygaar (@0xCygaar) December 18, 2023

What are Inscriptions?

Inscriptions are pieces of data recorded or ‘inscribed’ onto a blockchain. This data can include transaction details, smart contract codes, metadata, and more. The addition of inscriptions to a blockchain not only adds complexity and richness to the technology but also increases its potential for securing and managing all types of data.

According to Cygaar, inscriptions store token or NFT metadata in on-chain transaction calldata. This allows low-cost transactions for “xRC-20” tokens – where “x” represents standards like BRC-20, ZRC-20, etc. – since the bulk of the logic and enforcement happens off-chain. By contrast, smart contacts store significant data on-chain and require more computational resources and thus, higher fees. Other inscription token standards include PRC-20, BSC-20, VIMS-20, and OPRC-20.

“Smart contracts need to execute logic and store data on-chain. Inscriptions only involve sending calldata on-chain, which is much cheaper to do,” Cygaar explains.

Inscriptions are being spammed on networks like Avalanche, Arbitrum, and Solana likely to secure an early position for trading speculative, low market capitalization opportunities. However, these repetitive automated mints and transfers offer little utility and have caused congestion and outages. If these inscription transactions continue to dominate activity, changes to these protocols may be required to limit their disruption.

Chain Analytics: Top networks minting inscriptions

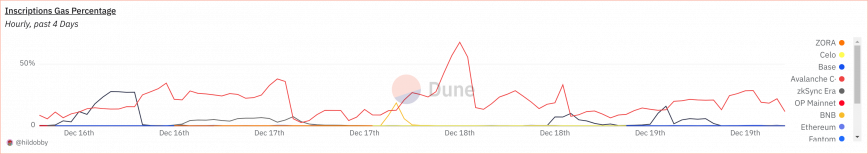

A dashboard on Dune Analytics published by Hildobby, an on-chain analyst at crypto venture capital firm Dragonfly, provides some insights into the impact of inscriptions on EVM chains.

According to the dashboard, inscriptions have exploded across all major EVM-compatible blockchains over the past week.

Between November 15 and December 18, chains like Polygon, Celo, BNB Chain, Arbitrum, and Avalanche are seeing daily inscription transaction volumes in the millions, with the top six chains representing over half of all 13 listed chains.

Polygon PoS has the most number of inscriptions (161 million), while BNB Chain has the most number of inscriptors (217k). Ethereum has the most number of inscription collections, despite only having 2 million inscriptions minted by 84,000 inscriptors.

Most of the gas costs are claimed by the Avalanche C Chain, which topped all other chains, claiming 68% of all transactions on December 18.

Prospects for inscriptions

Though some protocols benefit from the activity spikes because of earnings from gas reimbursements, analysts argue that systemic changes like adjusting gas pricing algorithms, limiting which transactions qualify for reimbursement, or outright blocking known spam accounts will be essential to ensure these do not impair network functionality.

On the other hand, the proliferation of inscription-related activity also incentivizes miners. Miners benefit from increased volume and cumulative fee revenue despite minimal per-transaction charges. Notably, on Avalanche, transaction fees are paid in AVAX, and the transaction fee is automatically deducted from one of the addresses controlled by the user. The fee is burned (destroyed forever) and not given to validators.

The recent spike in low-cost inscription transactions on EVM-compatible blockchains appears to be driven more by short-term profits than real utility. Arguably, policy changes around transaction fees or restrictions may be necessary to prevent the occurrence of network-disrupting transaction volumes from meaningless activity. For inscriptions to mature as a scalability solution rather than just a fad, they must enable valuable applications instead of repetitive token minting.

Read the full article here