The Ukraine-Russia War has shaken up the world in many ways. For the Nordic countries, two of which share borders with Russia (Finland and Norway), a military invasion is no longer unthinkable. For Sweden, it may also be prompting second thoughts about its “cashless society.”

According to a recent report in The Guardian, Sweden is worried about hybrid warfare attacks from Russia, including cyberwarfare. This can take down critical infrastructure like power grids on which digital payment networks depend. The Swedish government has even advised its citizens to put aside some “cash” — just in case.

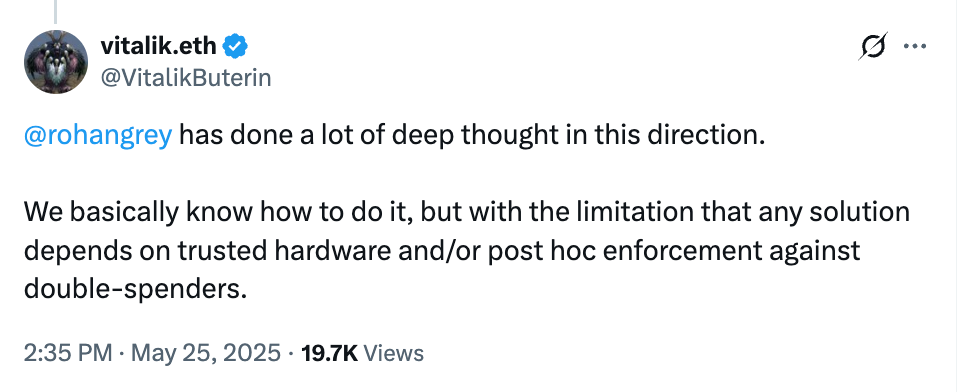

“Nordics are walking back the cashless society initiative because their centralized implementation of the concept is too fragile. Cash turns out necessary as a backup,” Ethereum co-founder Vitalik Buterin posted on May 25, referencing The Guardian story.

The payments market in Sweden is almost entirely digital. Debit and credit cards are the most common forms of payment, and mobile-based payment apps like Swish are also widespread.

But digital payment networks like Sweden’s depend on internet access, which in turn requires electricity, and that infrastructure can be vulnerable to natural disasters as well as terrorist acts and foreign military interventions.

One response to this vulnerability would be to develop an offline version of electronic cash — so economic life can continue even if the internet goes down or the nation’s electric grid is damaged. Such a capability would also make Sweden’s society more inclusive, others note, because not everyone today has a bank card or a smartphone.

Related: Trump’s consumer protection reforms could leave crypto users in a lurch

But this raises other questions. Is offline electronic cash technically feasible? Is the necessary hardware at hand? If so, how long before a solution can be implemented at scale?

Also, is there a potential role to be played by blockchain developers, as Buterin suggested in his May 25 post?

Government advisory: Set aside cash for emergency

Sweden, together with Norway, has the lowest amount of cash in circulation as a share of GDP in the world, according to a recent report from Sweden’s central bank, the Riksbank. But the Swedish government never had an explicit strategy to become cashless, Jonas Hedman, a professor in the Department of Digitalization at the Copenhagen Business School, told Cointelegraph.

It came about as a result of market forces; Banks, merchants and consumers turned away from cash in favor of much more convenient digitized forms of exchange, but now, according to Hedman:

Due to the Russian invasion of Ukraine, people have begun to keep more cash for a potential crisis. In addition, the government and the Riksbank have encouraged people to have cash on hand in case of emergency.

Offline e-payments an “absolute necessity”

The need for an offline digital cash option seems to be gaining traction globally. The Bank of England and the European Central Bank are also exploring offline e-cash options, Rohan Grey, assistant professor at Willamette University College of Law, told Cointelegraph, while Visa and Mastercard have been looking at an offline electronic cash alternative for years. China has developed a SIM card hardware wallet that supports offline digital yuan payments.

China has many rural communities without easy internet access, and it has realized that “if it wants its digital yuan to be widely used, it has to develop an offline capacity at the lowest level,” said Grey.

“The possibility of military and cyberwarfare, natural disasters and authoritarian shutdowns — all could have a significant impact on critical infrastructure, including the internet and the industries that rely on it, such as banking and financial services,” Yash Kalash, research director of digital economy at the Centre for International Governance Innovation (CIGI), told Cointelegraph, adding:

This possibility makes the role of offline transaction capability an absolute necessity and not just a matter of convenience.

Sweden’s policymakers are thinking more today about how their society will function under duress, Kalash continued, and at present, they can’t switch to a totally digital payment system because the offline payments technology simply isn’t available.

How long would it take to find a workable solution? “I’d say we’re three to five years from scalable, privacy-preserving offline digital payment models,” said Kalash.

Until then, “hybrid” models that combine preloaded wallets, secure chips and proximity-based communications — like NFC or Bluetooth — will dominate, he added.

Another “double spend” problem

Keir Finlow-Bates, CEO and founder of Chainfrog — a blockchain research and development firm — has written about some of the challenges in designing an offline transaction capability. “I live in Finland, which is similarly moving rapidly towards being a cashless society — and is even closer to Russia,” he told Cointelegraph. “But the same issues apply when it comes to offline digital cash.”

The technical challenges aren’t dissimilar to those faced years ago by crypto developers, explained Finlow-Bates. “Ultimately, it all comes down to the double-spend problem.”

Related: New Bitcoin treasuries may crack under price pressure

Duplication is easy in the digital world, and Satoshi Nakamoto, Bitcoin’s founder, worried about people simply copying Bitcoin. As Finlow-Bates wrote in a blog last year:

How does one make a digital construct behave like a physical object so that only one person can own it at a time? That is the core problem when designing and implementing offline digital cash.

Nakamoto solved the problem with decentralized cash systems and a proof-of-work validation protocol, but his model still required electricity and internet access.

A role for blockchain?

In his post, Buterin suggested that Ethereum might be able to play a role in making digital payment systems more robust.

CIGI’s Kalash agreed that blockchain could help. During an attack, blackout nodes wouldn’t be able to synchronize or broadcast transactions, but:

Blockchains can be potentially utilized to pre-authorize or pre-mint balances and credentials when a user is online and then allow secure, offline transactions through cryptographic proofs.

These offline transactions would probably be validated locally and then broadcast later to the blockchain when connectivity returned, he explained.

Kalash added the caveat that privacy-enhancing technologies, “such as zero-knowledge proofs and secure enclave hardware, are promising but not yet production-ready for broad civilian use.”

According to Buterin, “We basically know how to do it, but with the limitation that any solution depends on trusted hardware and/or post hoc enforcement against double-spenders.”

The “worst off” suffer more when cash vanishes

Aside from the danger of being attacked by a revanchist Russia, there are other reasons Sweden could be rethinking its cashless society. A significant portion of people in Sweden still depend on cash, and their plight worsens when public transport, stores and services do not accept cash as payment.

“There are no public car parks that accept cash,” for instance, explained Hedman. In practice, “it becomes very difficult to live in Sweden” today without debit/credit cards or Swish accounts, which are held by 80% of the population, reportedly.

Moa Petersén, associate professor at Sweden’s Lund University, told Cointelegraph:

The continued disappearance of cash disproportionately affects socioeconomically vulnerable groups, pushing them further to the margins.

Is a “cashless society” unrealistic?

Maybe a totally “cashless society” was just a pipe dream all along, and Sweden and other digitally advanced countries are just waking up to the fact that they will always need coins and paper bills as a backup — especially in times of geopolitical tensions.

“The answer to whether the cashless society was too utopian is ‘yes,’” answered Petersén, though maybe not in the way some had anticipated. It has led to a less inclusive and less democratic society, in her view, “where large groups feel disenfranchised and unable to participate fully.”

It wasn’t as if Sweden’s citizens had been clamoring for digital payments from the beginning, either. The technology became available, and people just took advantage of it. It’s been sustained since that time “by Sweden’s desire to maintain its image as a global leader in digitalization,” opined Petersén.

That reason, in her view, is not a sound basis “for changes of such profound societal impact.”

Magazine: Older investors are risking everything for a crypto-funded retirement

Read the full article here