What is the Lightning Network, and how does it work?

The Lightning Network is Bitcoin’s most successful second-layer solution, a protocol built to handle rapid, ultra-low-cost transactions without clogging the main blockchain.

By linking users through a mesh of bidirectional payment channels — essentially offchain smart contracts secured by the Bitcoin blockchain — it allows participants to send and receive funds instantly. The network settles only when a channel is closed, minimizing onchain load and maximizing speed.

At the heart of each channel lies a 2-of-2 multisig Bitcoin address with a fixed capacity. As payments are routed through, each party’s balance is updated offchain in real time. And when two users don’t share a direct channel, the Lightning Network finds a path across multiple hops, secured via hashed timelock contracts (HTLCs) and protected by onion-style encryption for privacy.

This routing process is surprisingly complex. Every Lightning node maintains its own view of the network graph and must compute routes without knowing real-time liquidity balances.

Pathfinding is computationally intensive, often described as NP-complete in its worst case. That led to new routing algorithms in 2025, some of which now power leading Lightning clients like LND, Core Lightning (CLN) and Eclair. A University of North Carolina at Charlotte study found that each takes a different approach to optimizing fees, timelocks and reliability.

Public Lightning capacity topped 5,000 Bitcoin (BTC) in early 2025 — roughly $500 million — marking a 400% increase since 2020. That growth reflects both grassroots adoption and growing institutional confidence in Bitcoin’s layer-2 capabilities.

Whether for tipping on platforms like Tippin.me or monetizing video content with instant micropayments, the Lightning Network is becoming essential infrastructure for earning and spending Bitcoin at scale.

Did you know? Over 650 million users now have indirect access to the Lightning Network thanks to integrations with major apps, custodial wallets and payment platforms.

How to run a Lightning node: Requirements and setup

If you’re wondering how to run a Lightning node in 2025, the good news is the barrier to entry is lower than ever.

Running your own node lets you earn Bitcoin with Lightning node routing fees, support the network and explore hands-on crypto passive income methods.

The hardware requirements are modest. At minimum, you’ll need:

- An SSD (1TB for full Bitcoin Core; 80-160GB for pruned or Neutrino setups)

- 4-8GB of RAM

- A stable internet connection — preferably 100 Mbps or more, with high upload capacity.

For many hobbyists, a Raspberry Pi 5 with an NVMe SSD is the go-to, offering a quiet, energy-efficient way to run a cold storage Lightning node at home.

The three most common implementations today are:

- LND: Popular for beginners and compatible with the myNode Lightning wallet, it has great tooling but slightly higher CPU demands.

- Core Lightning (CLN): Lightweight and modular — perfect for low-power setups and advanced users.

- Eclair: A Java-based option more common in development environments than personal nodes.

The typical Lightning node setup guide involves:

- Installing Bitcoin Core or connecting to a remote instance

- Setting up your Lightning implementation (e.g., LND or CLN via Docker or binaries)

- Funding your Lightning wallet

- Opening payment channels with peers

- Keeping your node online and in sync.

Popular walkthroughs like RaspiBlitz, Umbrel node installation guides and Blockstream’s “Build a Pretty Good Node” offer detailed instructions for each step. These guides also address common issues, such as Lightning wallet sync issues or risks like fraudulent channel closure, making them essential for new node runners.

Did you know? Lightning enables sub-satoshi payments, making it possible to send fractions of a cent, ideal for monetizing streaming, tipping and content micropayments.

Lightning Network node profitability in 2025: What the data shows

If you’re hoping to generate Lightning Network income in 2025, the numbers tell a sobering story — at least for small node operators.

Most community reports agree: Unless you commit serious capital and fine-tune performance, profits will be limited.

One Reddit user summed it up clearly:

“Don’t. With £1,000 you won’t make any profit… the network is centralized over big nodes (20 BTC).”

Another operator running a 2-BTC node reported earning just $5/month (in 2022) — barely enough to justify the capital held in a hot wallet.

That said, scale changes the equation. A mid-size operator with 10 BTC routed roughly 2 BTC/day and earned around 30,000 sats daily — equivalent to about $300/month. After factoring in server hosting, onchain fees for channel management and cold storage precautions, the operation was near break-even. However, the same operator estimated a 3-5x growth in earnings with further scaling and dynamic fee tuning.

In practice, most profitable Lightning node strategies require:

- Larger channel sizes (to handle meaningful volume)

- Near-perfect uptime

- Competitive fee settings and proactive rebalancing

- A strong grasp of overall network topology.

Recent data shows that while public capacity has reached 5,000 BTC, the top 10 nodes control roughly 85% of it, highlighting how much BTC routing fees income is concentrated among route-rich hubs.

In short, Lightning node passive income is possible — but only with the right setup and commitment.

Costs and risks involved with running a Lightning node

Even with high uptime and active channels, profitability is offset by several core costs:

- Onchain transaction fees (especially for opening or closing channels)

- Capital lock-up, where your BTC remains illiquid

- Ongoing server and maintenance expenses

- Technical risks like software bugs or Lightning wallet sync issues

- Liquidity drain or stale routing data due to ephemeral channel behavior

- Fraudulent channel closure risks, especially if security practices are poor.

Running a Lightning node isn’t “set and forget.” It requires ongoing care and an understanding of how traffic moves through the BTC second-layer solution.

Did you know? To fight fraud, Lightning nodes can use watchtowers, external services that detect cheating attempts and automatically punish attackers by claiming their funds.

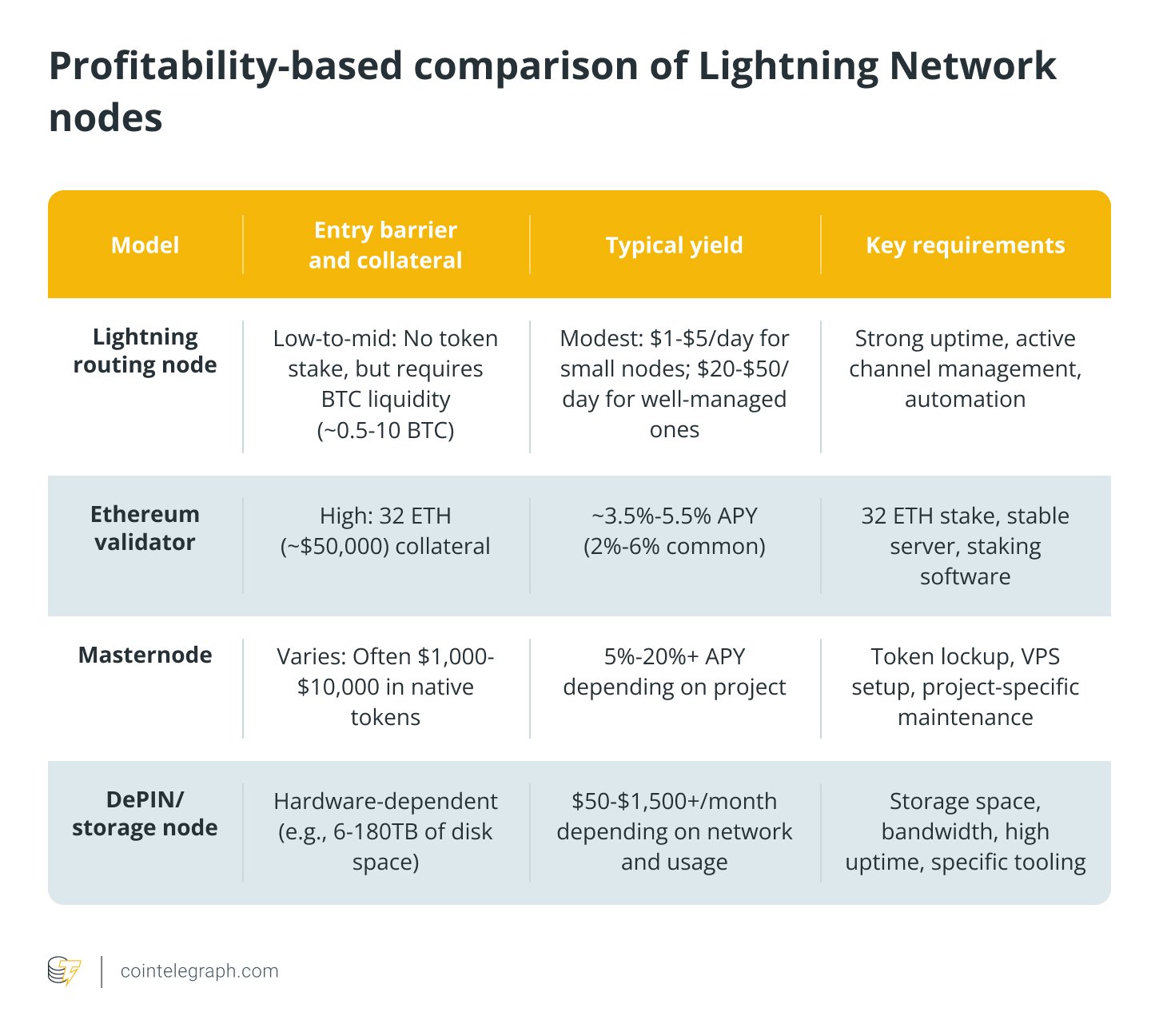

Lightning Network node profitability: A comparison

Here’s how running a Lightning node stacks up against other popular crypto passive income methods in 2025:

Best practices for maximizing yield when running a Lightning node

To boost earnings and avoid common mistakes, here are some actionable Lightning Network tips based on real-world feedback and research:

1. Connect to active, reliable peers

Instead of just linking to giant nodes, connect to a mix of active but moderately sized peers. Aim for 10-15 to start. Channels with balanced flows offer more frequent forwarding opportunities.

2. Use dynamic fee automation

Tools like “charge-lnd” for LND or plugin equivalents in Core Lightning help adjust fees automatically. These ensure your outbound capacity remains profitable as liquidity shifts.

3. Diversify your channel base

Managing 30-50 channels across different regions and node types helps distribute your routing opportunities. It also protects against downtime or centralization.

4. Monitor and rebalance liquidity

Tools like rebalance-lnd, PeerSwap or something similar can help with circular rebalancing, keeping your channels balanced and forwarding-ready without needing costly onchain swaps.

5. Tune pathfinding for your node

Routing success depends heavily on client heuristics. According to 2025 pathfinding research:

- LND balances fees and success rates

- CLN minimizes timelocks (ideal for lower latency routes)

- Eclair focuses on fee optimization — useful for microtransactions like Tippin.me Bitcoin tips or streaming monetization.

By taking a research-driven approach and leveraging modern automation tools, running a Lightning node can become one of the more technical but viable crypto passive income methods available today.

Read the full article here