Bitcoin’s next significant price catalyst may arrive Friday as the US debt suspension period comes to an end, potentially injecting fresh liquidity into markets and driving a price rebound.

The US Treasury hit its $36 trillion debt ceiling a day after President Donald Trump’s inauguration on Jan. 20. A “debt issuance suspension period” began then and was set to last until March 14, according to a letter published on Jan. 17.

Bitcoin (BTC) has dropped 22% during the two-month debt suspension plan, from over $106,000 on Jan. 21 to $82,535 at the time of writing on March 12, TradingView data shows.

BTC/USD, 1-day chart since Debt suspension plan. Source: Cointelegraph/TradingView

A resumption of government spending may bring a liquidity boost to catalyze Bitcoin’s next rally, according to Ryan Lee, chief analyst at Bitget Research.

“With in-hand cash, the demand for financial assets such as stocks and crypto can increase, and there may be a relief from ongoing volatility,” the analyst told Cointelegraph. “In such periods, we can expect a boost in the overall momentum, although many other factors are important to note.”

Beyond global tariff uncertainty, “concerns such as inflation, interest rates and geopolitical issues remain unresolved,” Lee added.

Considering that the debt suspension will end just two weeks after the White House Crypto Summit, a portion of the new liquidity may flow into cryptocurrencies, according to Aleksei Ponomarev, co-founder and CEO of crypto index investing firm J’JO.

“Surges in liquidity have typically benefited Bitcoin and risk assets, and the end of the US debt suspension will be no different,” he told Cointelegraph, adding:

“While the liquidity surge will undoubtedly drive market price movement, it is limited to short-term impact. The long-term trajectory of Bitcoin is, and remains, tied to institutional investments, ETF growth and regulatory clarity and implementation.”

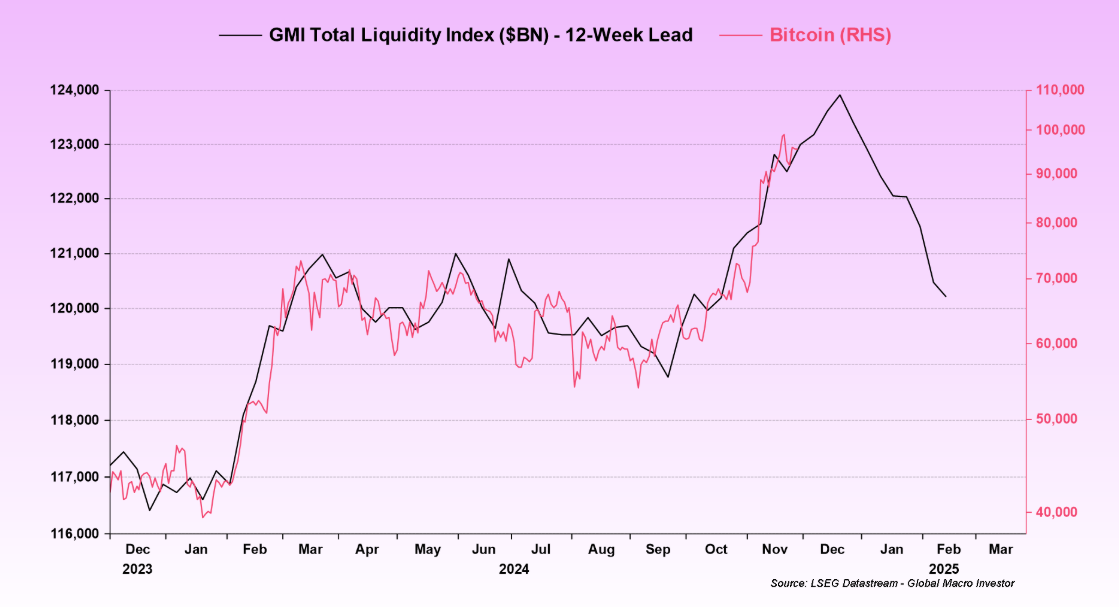

GMI Total Liquidity Index, Bitcoin (RHS). Source: Raoul Pal

Bitcoin’s right-hand side (RHS), which marks the lowest bid price for which someone is willing to sell the currency, may still face a potential correction to near $70,000 until the end of the debt suspension period on Friday, based on its correlation with the global liquidity index.

Still, the growing money supply could push Bitcoin price above $132,000 before the end of 2025, according to estimates from Jamie Coutts, chief crypto analyst at Real Vision.

BTC projection to $132,000 on M2 money supply growth. Source: Jamie Coutts

Related: Bitcoin may benefit from US stablecoin dominance push

Bitcoin price still limited by global trade war concerns

While more global liquidity is an optimistic sign for Bitcoin, the world’s first cryptocurrency remains limited by global trade tariff concerns, according to James Wo, the founder and CEO of venture capital firm DFG:

“While some may argue that retaliatory measures from tariff-imposed countries were already priced in, tariffs have a delayed economic impact beyond their initial announcement.”

“Higher import costs and reduced corporate margins are likely to push inflation higher, forcing central banks to keep interest rates elevated for longer under a restrictive monetary policy,” he added.

This may also tighten liquidity conditions, making risk assets such as Bitcoin “less attractive in the short to medium term,” Wo said.

Related: Bitcoin reserve backlash signals unrealistic industry expectations

The European Union introduced retaliatory tariffs on March 12, threatening a Bitcoin correction below $75,000 in the short term. This may occur temporarily due to Europe accounting for over $1.5 trillion of annual US exports.

Despite the short-term correction concerns, most analysts remained optimistic about Bitcoin’s price trajectory for late 2025, with price predictions ranging from $160,000 to above $180,000.

Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – March 1

Read the full article here