- Sui has hit a $14.8 billion monthly DEX volume despite price stagnation.

- The $223 million Cetus exploit has shaken Sui’s market confidence.

- The price of SUI is currently struggling to break past the $3.87–$4.13 resistance range.

Despite a weekly drop of 45.21%, Sui has reached a historic milestone, recording its highest-ever monthly decentralised exchange (DEX) volume at $13.596 billion, even as the Cetus security exploit cast a shadow over Sui’s surging DeFi momentum.

The unprecedented spike in trading activity in May, which marked nearly a fourfold increase from Sui’s historical monthly average of $3.93 billion, signals intensifying interest in its growing ecosystem and the strength of its DeFi protocols.

SUI price analysis amid the Cetus hack aftermath

Despite this remarkable metric, SUI’s price failed to follow suit, struggling to break past a key resistance zone and remaining in consolidation just below the $3.87 level.

Price performance has lagged even amid favourable on-chain signals, suggesting that traders remain cautious following the recent Cetus Protocol exploit that shook confidence in the ecosystem.

The exploit, which targeted Cetus Protocol—a leading DEX on the Sui network—saw attackers manipulate price oracles to extract approximately $223 million worth of assets from liquidity pools.

Following the breach, emergency measures were swiftly enacted, including halting affected smart contracts and freezing roughly $162 million in stolen funds across the blockchain.

Although a significant portion of the funds was successfully frozen, attackers laundered the remainder through various bridge pathways, complicating recovery efforts.

In response, the Sui Foundation extended a secured financial loan to Cetus, allowing the protocol to begin compensating affected users while preparing a broader restitution framework.

This compensation initiative, while timely, hinges on a community governance vote that will decide whether the frozen funds can be repurposed toward full user recovery.

As the community awaits the outcome of the vote, the exploit has cast a shadow over Sui’s broader DeFi sector, sparking renewed scrutiny of oracle mechanisms and audit standards across protocols.

Meanwhile, the native CETUS token plunged nearly 40% in the aftermath of the exploit, as panicked investors exited positions amid shaken confidence and broader market anxiety.

Even so, Sui’s Total Value Locked (TVL) surged to $2.406 billion, rising 2.51% in just 24 hours, which suggests that longer-term participants are continuing to inject capital into Sui-based protocols.

Spot flow data also revealed mild accumulation behaviour, with net inflows of $1.31 million hinting that some investors are positioning for a longer-term rebound despite near-term volatility.

However, open interest has dropped by 1.58% to $1.77 billion, signalling that speculative traders are stepping back, likely reducing leverage or taking profits amid uncertain short-term conditions.

SUI price forecast

Technically, SUI has struggled to maintain bullish momentum, with the MACD indicator reflecting a weakening trend as histogram bars fade and signal lines converge near neutral territory.

The price hovered around $3.69 at press time, yet it remained boxed within the $3.87 to $4.13 Fibonacci resistance zone—a range it has failed to break for several weeks.

On shorter timeframes, the token has re-entered a descending wedge pattern, while exponential moving averages between $3.59 and $3.62 are now acting as short-term resistance points.

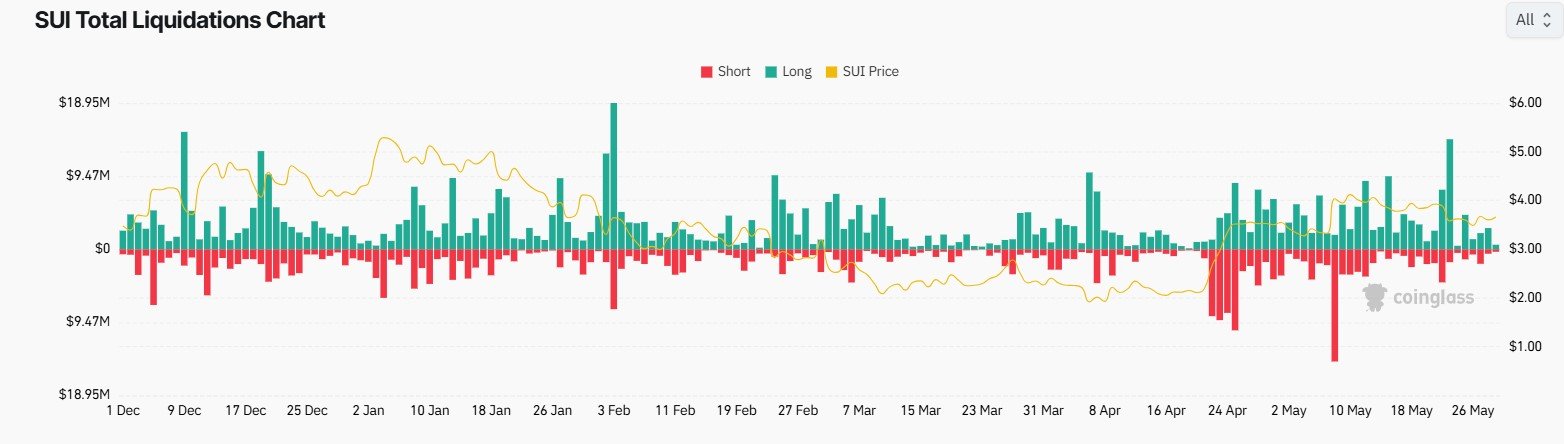

Should the price drop below $3.50, downside targets near $3.30 or $3.20 could become increasingly likely, particularly if selling pressure intensifies from liquidation clusters.

CoinGlass data highlighted dense liquidation zones between $3.60 and $3.87, creating friction points that often result in resistance as traders defend against forced liquidations.

Nonetheless, if bulls manage to break through this zone, the possibility of a short squeeze could propel the price rapidly toward higher Fibonacci levels, possibly near $4.97.

Ultimately, despite the Cetus setback, the fundamentals underpinning Sui’s growth remain intact, as evidenced by its soaring DEX volume, rising TVL, and ecosystem resilience.

However, unless SUI convincingly clears the $3.87–$4.13 resistance range with strong volume, the price may remain range-bound despite the record-breaking metrics.

As governance discussions continue and the market processes the aftermath of the exploit, all eyes will be on whether sentiment can recover fast enough to sustain the chain’s DeFi momentum.

Read the full article here