The combined market capitalization of the five biggest stablecoins passed $200 billion for the first time after Treasury Secretary Scott Bessent pledged on Friday to use the digital assets to help maintain the greenback as the world’s reserve currency.

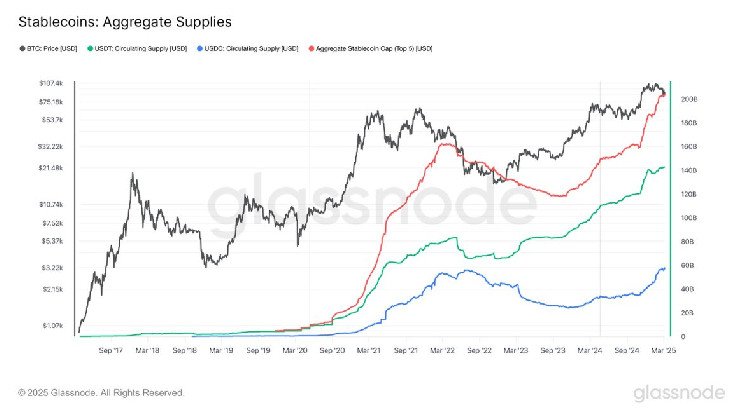

The market cap of the coins, whose value is pegged to a real-world equivalent such as the U.S. dollar, climbed as high as $205 billion, Glassnode data shows. Demand was buoyed by investors seeking relief from sliding cryptocurrencies such as bitcoin (BTC) and ether (ETH).

Since President Donald Trump won the U.S. election, the stablecoin market cap has grown by $40 billion. With both cryptocurrencies and U.S. equities struggling in recent weeks, stablecoins have emerged as the clear winners.

Market leader Tether’s USDT has maintained a market cap of around $140 billion since December, while second-placed USDC, issued by Circle, is nearing $60 billion — an increase of $25 billion since the election.

At the Digital Asset Summit on Friday, Bessent said, “We are going to keep the U.S. the dominant reserve currency, and we will use stablecoins to do it.”

Bessent’s remarks highlight concerns over macroeconomic and geopolitical uncertainty, which could lead to a decline in foreign demand for U.S. debt, pushing treasury yields higher. Over the past year, Japan and China, the two largest holders of U.S. Treasuries, have reduced their holdings.

For the dollar to maintain its status as the world’s reserve currency, there must be consistent demand for U.S. debt. The administration identified stablecoins as an ideal partner in this strategy.

By holding U.S. debt as reserves, stablecoins can help lower Treasury yields while simultaneously expanding the global reach and dominance of the dollar. Stablecoins need to have dollars available to repay investors looking to cash out. Tether is already one of the largest holders of three-month U.S. Treasuries.

Read the full article here