Martin Shkreli, also known as Pharma Bro, has criticized Michael Saylor for implementing a bitcoin playbook for Microstrategy, stating that it cannot end well. Shkreli revealed that he was short Microstrategy, explaining that it was both fun and “a little painful.”

‘Pharma Bro’ Martin Shkreli Blasts Michael Saylor, States It Will ‘Not End Well’ for Microstrategy

Martin Shkreli, known as “Pharma Bro” for his conviction linked to the healthcare industry, has called out Microstrategy’s co-founder and executive chairman Michael Saylot for his applied bitcoin playbook.

Saylor pioneered the idea of purchasing bitcoin as a reserve asset for institutions. Microstrategy’s business model now consists of amassing the largest amount of bitcoin possible, even issuing debt to continue with these purchases.

For Shkreli, these actions will ultimately backfire on the company. In Shkreli Planet, Shkreli’s podcast, he blasted Saylor’s ideas heavily.

Shkreli stated:

This got to end poorly right? I think Saylor’s insane, I think he’s just drunk on, you know this is like a big bubble and there’s just no way this could end well.

Furthermore, Shkreli criticized Saylor’s recent Microsoft pitch, which failed to entice shareholders to add bitcoin as a reserve asset for the company. “Saylor is not the best advocate, even though he’s the loudest advocate. I’m starting to turn somewhat bearish on bitcoin,” he declared.

Read more: Microsoft Votes No on Bitcoin Reserves: Michael Saylor’s Pitch Fails to Convince

Shkreli revealed that he had skin in the game, disclosing that he was short Microstrategy without specifying his position’s size. However, he did state that the trade had been “a bit painful but fun nevertheless.”

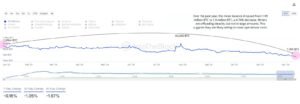

Shkreli’s stance on Microstrategy can be seen as a contrarian bet, given that the company has managed to keep issuing debt instruments to purchase bitcoin. Just a year ago, Microstrategy shares were priced at close to $60, while today, the stock is priced at over $400, reaping a benefit of over 600% in such a short period.

This spectacular performance allowed the company to be included in the Nasdaq-100 index. Microstrategy currently holds a bitcoin reserve of over 423,000 BTC worth over $43 billion.

Read more: Microstrategy Joins Nasdaq-100: Bitcoin’s Dominance Solidified on Wall Street

Read the full article here