MicroStrategy (MSTR) stock just recorded a 25-year high of around $255 after US markets opened on Monday, according to data from Yahoo Finance. The surge came amid Bitcoin’s price rally to $69,000, sparking optimism about a continued bullish trend throughout October.

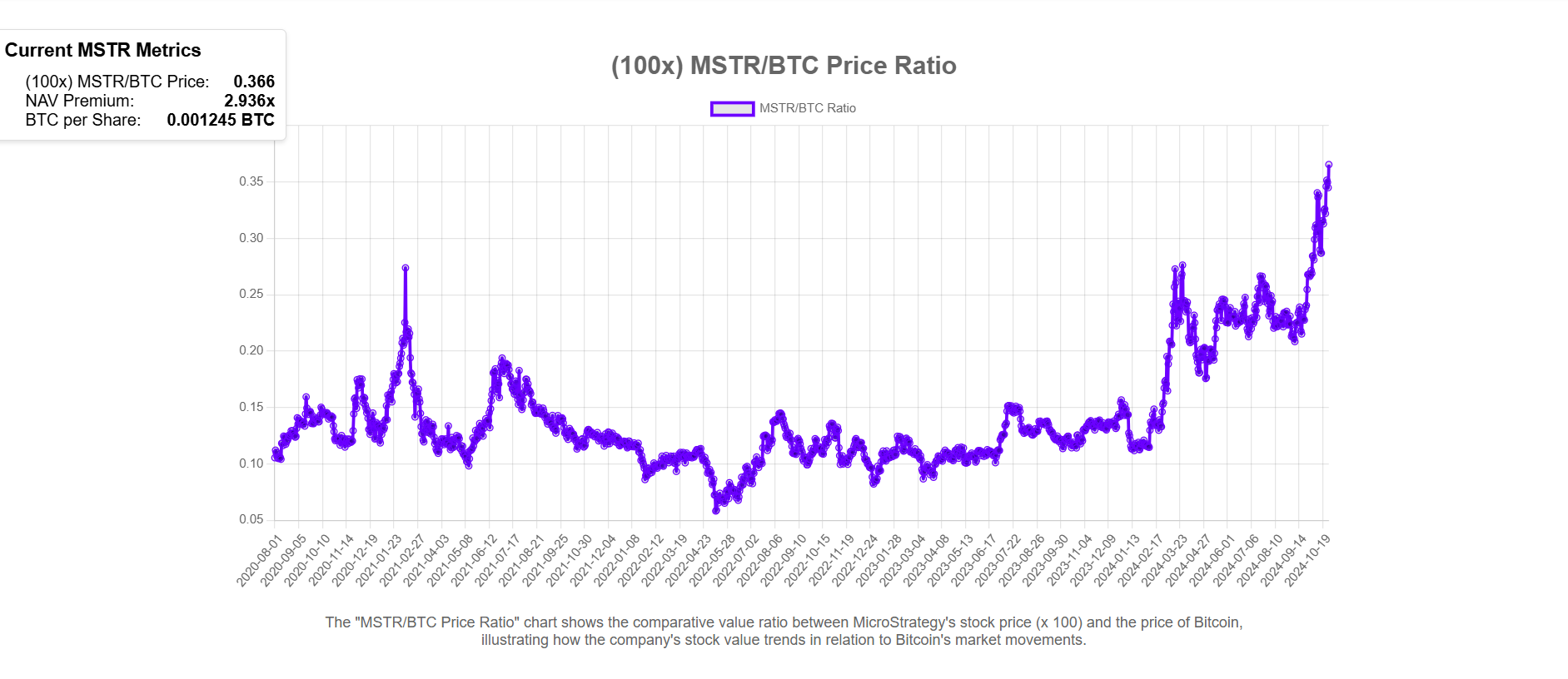

The MSTR/BTC ratio, which tracks MicroStrategy’s stock performance against Bitcoin, also hit a new high of 0.366, according to the MSTR tracker.

The rise indicates that MicroStrategy’s stock has been performing favorably relative to Bitcoin. Last Friday, the ratio hit a high of 0.354, when MSTR surged to $245, as Crypto Briefing reported.

The company’s net asset value (NAV) has grown, with its NAV premium approaching the 3 mark, its highest level since early 2021.

Since MicroStrategy ties closely to Bitcoin, its stock performance tends to track the Bitcoin market. The stock has increased by 295% year-to-date, dwarfing the S&P 500’s 22% increase. Bitcoin itself has doubled in value in the same timeframe.

If MicroStrategy’s Bitcoin playbook proves fruitful, it could propel its stock price to new peaks in the future.

MicroStrategy is currently the largest corporate Bitcoin holder with over 252,000 BTC, valued at roughly $17 billion. Michael Saylor, the head behind the company’s Bitcoin strategy, aims to transform MicroStrategy into a leading Bitcoin bank that could reach a trillion-dollar valuation.

Other crypto stocks also rally

Several other crypto stocks also experienced a surge after the markets opened.

IREN (formerly Iris Energy) shares rose by almost 18%, while TeraWulf and MARA Holdings rose by 11% and 9%, respectively.

Leading Bitcoin miner CleanSpark reported a 10% gain in its stock price. Meanwhile, Coinbase, a major cryptocurrency exchange, also enjoyed a 5% gain.

The market’s optimism was largely driven by a recent 24-hour uptick in Bitcoin’s price, which has rekindled discussions about the potential for an “Uptober.”

Historically, October has been a strong month for Bitcoin, with many traders and investors hoping for a repeat performance. The current upward momentum appears to match the historical trend, suggesting that an “Uptober” could still be on the cards.

Read the full article here