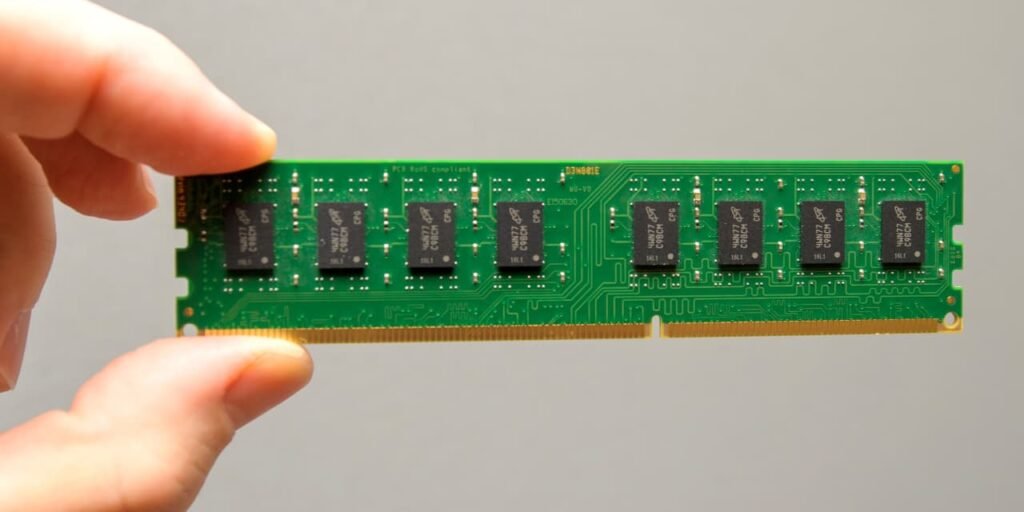

Micron,

the maker of computer memory chips, had analysts raising estimates after reporting better-than-expected results.

Micron shares were up 6% in premarket trading to $83.43. Competitors were also rising, but not as much.

Analog Devices

added 1.1%.

Texas Instruments

climbed 0.8%, while

Applied Materials

rose 1.5%.

Bolstered by chips that can be used with artificial intelligence programs, Micron on Wednesday reported a smaller-than-expected loss on revenue that was higher than what analysts had predicted. It was able to raise prices and increased guidance for the current quarter.

That led John Vinh at KeyBanc to raise estimates and raise the price target on the stock to $100. Coming into Thursday, shares had already gained more than 50% this year.

Analysts at SIG led by Mehdi Hosseini also raised estimates. They have a price target of $112, but see downside risks to that valuation that include weaker demand and a lack of execution by the management team.

The team at

Piper Sandler

led by Harsh V. Kumar are a bit more downbeat with a price target of $70 after the big gains already seen this year.

“Overall, we like the setup for the company as well as the broader industry, however given the recent stock price move reflecting these trends, we reaffirm our Neutral rating,” they wrote in a Wednesday note.

Write to Brian Swint at brian.swint@barrons.com

Read the full article here