Fed Governor Christopher Waller recently addressed key economic issues such as inflation trends, the labor market and future monetary policy adjustments.

Waller emphasized the FED’s cautious stance in monitoring inflation data, stating that the recent rise resembled a “roller coaster” and that the central bank was evaluating whether this rise would continue.

Waller also shared his outlook for the labor market, predicting a slowdown in employment growth and a gradual increase in the unemployment rate. However, he reassured that the unemployment rate would remain at historically low levels. He described the current labor market as “very healthy” with supply and demand reaching equilibrium.

Despite inflationary pressures, Waller said consumer demand remains strong. While demand for commodities is currently subdued, he sees a recovery as consumers become “willing” to buy as interest rates fall. He also noted that household consumption resources are “in good shape” and the economic foundation remains strong, potentially leading to faster GDP growth in the second half of 2024.

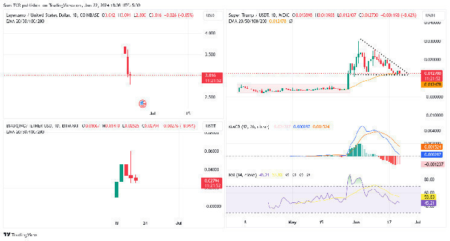

But Waller expressed disappointment with the latest inflation data, suggesting the Fed could preemptively cut interest rates if inflation falls below the Fed’s 2% target or if the labor market deteriorates. Conversely, if inflation unexpectedly rises, the central bank could pause planned rate cuts.

Looking ahead, Waller expects the Fed to adjust policy to a neutral stance “at a steady pace” if the economy develops as forecast. Waller also reiterated that the current policy rate will remain at a restrictive level and that there is a baseline expectation that the policy rate will be gradually reduced over the next year. However, he warned that recent events such as the hurricanes and the Boeing strikes could reduce job growth by 100,000 in October.

Waller concluded his remarks by pointing out that the FED’s approach could be more conservative compared to the September meeting and emphasizing that caution should be exercised in reducing interest rates.

*This is not investment advice.

Read the full article here