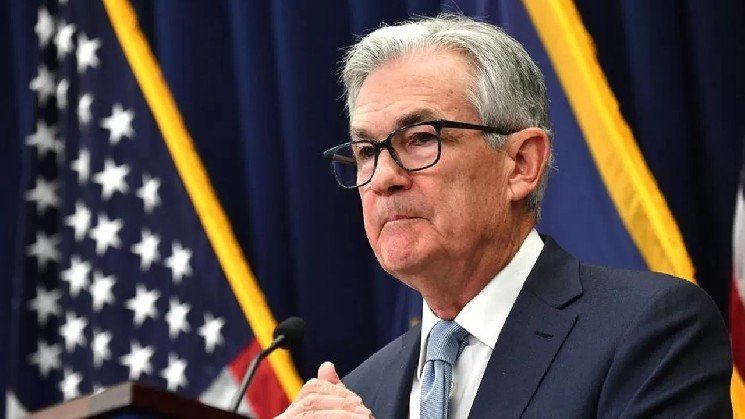

After the FED left interest rates unchanged, FED Chairman Jerome Powell made critical statements at a live press conference.

Here are the most important excerpts from what Powell said:

- The economy is in solid shape.

- Inflation continued to run slightly above targets.

- The current policy stance places us in a favorable position.

- Unusual fluctuations in net exports make the calculation of GDP more complicated.

- Inflation has declined but is still above targets.

- It is not yet clear how market sentiment will affect spending.

- Concerns over trade policy have dampened market sentiment.

- The unemployment rate remains within a narrow range and at low levels.

- Labor market conditions remain strong.

- Many indicators show the economy is near maximum employment.

- The overall personal consumer expenditures index is expected to increase by 2.3% and the core index by 2.6% in May.

- Inflation expectations have risen recently, and this is mainly due to customs duties.

- Most long-term inflation indicators are in line with the target.

- There is still uncertainty about changes in trade policy and fiscal policy.

- The labor market appears balanced and not a source of inflationary pressure.

- The impact of customs duties will depend on their level. Raising customs duties this year could weigh on economic activity and push up inflation.

- Avoiding persistent inflation ultimately depends on keeping long-term inflation expectations stable.

- The impact of customs duties on inflation may be longer lasting.

- There may be some tension between dual mission objectives.

- The current conditions are favorable and we can make the necessary adjustments once we have more information.

- The Fed will work hard to prevent one-time inflation from turning into a deep-rooted situation.

- There is uncertainty in the FOMC policymakers’ forecasts, and that uncertainty is extraordinarily high.

- Commodity prices have increased slightly recently and this trend is expected to continue during the summer months.

- It will take some time for the customs duty measures to be reflected to consumers.

- We have started to see some impacts of the tariffs and expect more impacts in the future.

- We cannot assume that inflation will rise and then fall as predicted.

- As we learn more, we believe it would be appropriate to maintain current interest rates.

- When focusing on forecasts for the Fed’s policy path, we should focus on the short term; long-term forecasts are more difficult.

- The Fed’s forecast has shifted to expect slower economic growth and higher inflation levels.

- Uncertainty peaked in April and has now subsided.

- The economy appears to be growing at 1.5% to 2%.

- No one has great confidence in the interest rate trend forecast and cannot provide a plausible justification for any interest rate trend in the forecast.

- We may reach a point where it would be appropriate to lower interest rates.

You can also access Powell’s new statements by refreshing this page.

The Federal Open Market Committee (FOMC) did not make any changes to interest rates at its June meeting, but attention was focused on the economic projections released rather than the interest rate decision.

The FOMC’s economic forecasts still call for two rate cuts in 2024, but that expectation has weakened. Under the new projections, nine committee members, up from eight at the previous meeting, think either none or just one rate cut would be appropriate this year.

FED officials predict that inflation and unemployment will rise in the coming period, while economic growth will slow. The decision to keep interest rates constant was made unanimously.

Another noteworthy statement in the committee’s statement was the assessment that “uncertainty regarding the economic outlook has decreased, but remains high.” However, this view was found controversial by some circles, as uncertainties in trade policies, the effects of the budget law on public finances, and ongoing geopolitical tensions continue to keep risks alive.

While two interest rate cuts were previously anticipated for 2026, this number has been reduced to one. The expectation for 2027 remains unchanged, with a single interest rate cut, while the projected interest rate for that year has been increased from 3.1% to 3.4%. It is noteworthy that there is a wide divergence of opinion on long-term interest rate projections.

Read the full article here