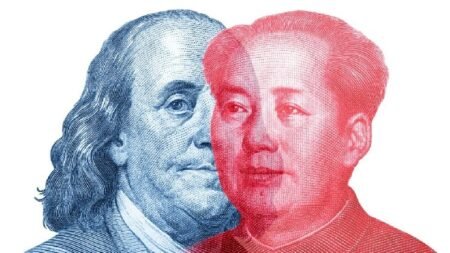

The Chinese State Administration of Foreign Exchange (SAFE) has cracked down on an underground bank that used crypto to offer illegal exchange services. The operation, which had over 1,000 bank accounts and a presence in 17 provinces, moved over 15.8 billion yuan ($2.2 billion) to purchase crypto on exchanges overseas and provide yuan exchanging services.

Chinese State Administration of Foreign Exchange Discovers Ring Using Crypto to Circumvent Exchange Controls

The Chinese government has cracked down on an underground bank that used crypto to provide yuan exchange services to Chinese nationals. According to a post published in Wechat by the State Administration of Foreign Exchange (SAFE), the Qingdao police managed to identify more than 1,000 accounts belonging to a Chinese national identified as Jin, that served as funneling accounts for the exchange business of 15.8 billion yuan ($2.2 billion).

The exchange business had a presence in 17 provinces of the country, with more than 20 million transactions related to this ring. The accounts were connected to Li, a textile worker who acted as a broker for the purchase and sale of virtual currencies. The report reinforced that managing and exchanging cryptocurrency is illegal in China.

Xu Xiao, an inspector at the Qingdao Branch of the State Administration of Foreign Exchange, described how this process was carried out. He stated:

Underground banks purchase virtual currencies and then sell the virtual currencies through overseas trading platforms to obtain the foreign currency they need. This process completes the conversion of yuan and foreign currencies, which constitutes the illegal act of buying and selling foreign exchange.

Also, this kind of exchange must be carried out at state-designated places. SAFE authorities warned against being involved in this kind of illegal trade, even when the exchange rates and “convenience” incentivize this route over conducting legal exchanges.

Huang Hui, Deputy Director of SAFE’s Management and Inspection Department, remarked that it will continue to work with other state institutions to crack down on illegal exchange businesses such as underground banks, and facilitate the usage of legal channels for these operations.

What do you think about SAFE’s recent crackdown? Tell us in the comments section below.

Read the full article here