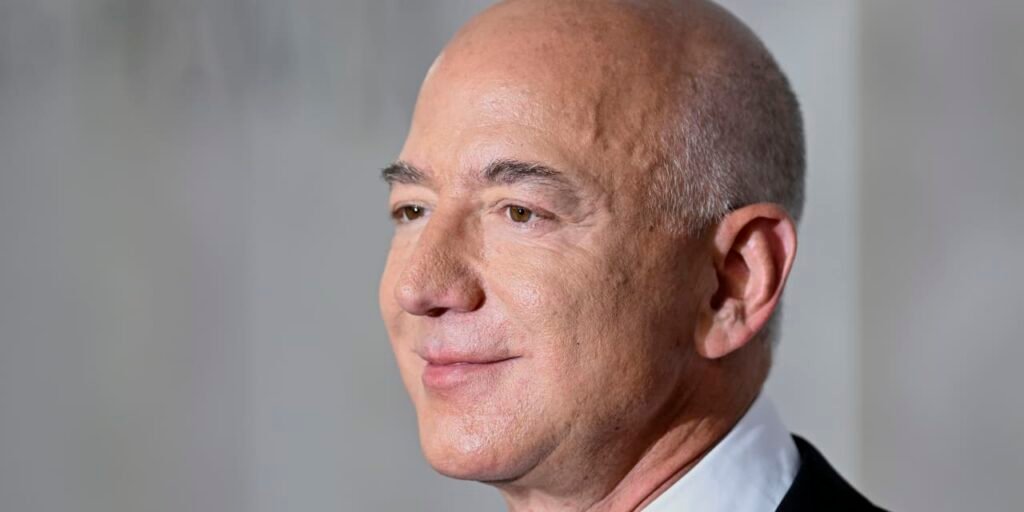

Amazon.com

founder Jeff Bezos is letting go of Amazon stock. That happens sometimes after founders leave their companies. While diversification is always a good idea for most investors, when you are as rich as Bezos, traditional diversification rules just might not apply.

Bezos recently gifted some 1.7 million shares of Amazon (ticker: AMZN) stock worth some $240 million, according to filings with the Securities and Exchange Commission. That leaves him with about 989 million shares worth some $140 billion.

Bezos is still the largest holder of Amazon stock with just under 10% of shares. Outside of Bezos, the largest holders are three institutions: Vanguard, BlackRock (ticker: BLK), and State Street (STT), mostly through client accounts. Those three are the largest holders of many large-cap U.S. stocks. They are the largest providers of certain mutual funds, and exchange-traded funds, such as the State Street

SPDR S&P 500 ETF

(SPY), which has assets under management of more than $400 billion.

Traditional fund managers Fidelity and

T. Rowe Price

(TROW) round out Amazon’s top five institutional holders. Together, the five hold just under 20% of the total stock outstanding.

Bezos is the largest individual holder of Amazon stock. His ex-wife MacKenzie Bezos nee Scott is the second-largest holder with almost 3% of shares outstanding.

Those two are the most significant individual holders. Current CEO Andy Jassy owns only 0.02% of the stock outstanding. Still, that’s worth more than $300 million.

Top Amazon executives, including CEO Jassey, and Adam Selipsky, CEO of Amazon Web Services, have been selling stock this month. Bezos himself hasn’t sold any Amazon stock since November 2021, although he has gifted considerable amounts to charities. Of all the 70 or so Amazon insider transactions in 2023, all but three have been sells, according to Bloomberg; those include transactions related to options, which typically involve some sale to cover taxes.

At his peak ownership, all the way back in 2000, Bezos held about 2.3 billion Amazon shares, adjusted for stock splits, according to Bloomberg. Diversification is generally a good idea, but in this case, Amazon stock has risen about 3,800% since Bezos began reducing his stake. The

S&P 500

has returned up about 310% over the same span.

Bezos has sold stock, gifted stock, and lost some shares in a divorce. If he still held all the shares, they would be worth some $345 billion—and they would’ve outperformed an equivalent investment in the S&P 500.

That has also happened to other founders, who don’t always hold on to their stocks after moving on. Take

Microsoft

(MSFT). In 1999, co-founder Bill Gates held 1.6 billion shares of the software company, according to FactSet. His holding is now down to about 100 million shares.

Gates is worth an estimated $117 billion, according to Forbes. Not bad, but 1.6 billion Microsoft shares would be worth some $600 billion today.

Microsoft has also done much better than the S&P 500 for the past 20-plus years. Shares are up roughly tenfold since Gates owned that much stock. The S&P 500 is up about fourfold over the same span.

Gates remains the largest individual holder of Microsoft stock, but his stake is less than 2%. The largest holders of Microsoft stock are Vanguard, BlackRock, and State Street.

Warren Buffett once said something that seems antithetical to diversification principles. He suggested it’s a good idea to put all your eggs in one basket and then watch that basket.

One of the world’s richest humans, on the level of Gates and Bezos, Buffett added that his watch-the-basket rule only applies to people who “know what they are doing” in the market.

“Diversification is a protection against ignorance,” Buffet has also said. The rest of us should still diversify.

Amazon stock was up 1.4% in afternoon trading, after setting a new 52-week intraday high of $149.26. The S&P 500 was down 0.1%. The

Nasdaq Composite

was flat.

Write to Al Root at allen.root@dowjones.com

Read the full article here