According to Fireblocks’ newly released report, global financial institutions are actively adopting stablecoins as strategic tools for cross-border payments, market expansion, and operational efficiency.

Fireblocks’ report is based on an online survey of 295 respondents. With nearly half of the surveyed organizations already using stablecoins and others in testing phases, the data reveals a clear shift: stablecoins are moving from the periphery to the heart of global finance.

Stablecoins Enter the Financial Core

According to Fireblocks’ “State of Stablecoins 2025” report, 49% of organizations worldwide have utilized stablecoins for payments, while 41% are in the testing phase or planning to implement them.

Current stablecoin adoption. Source: Fireblocks

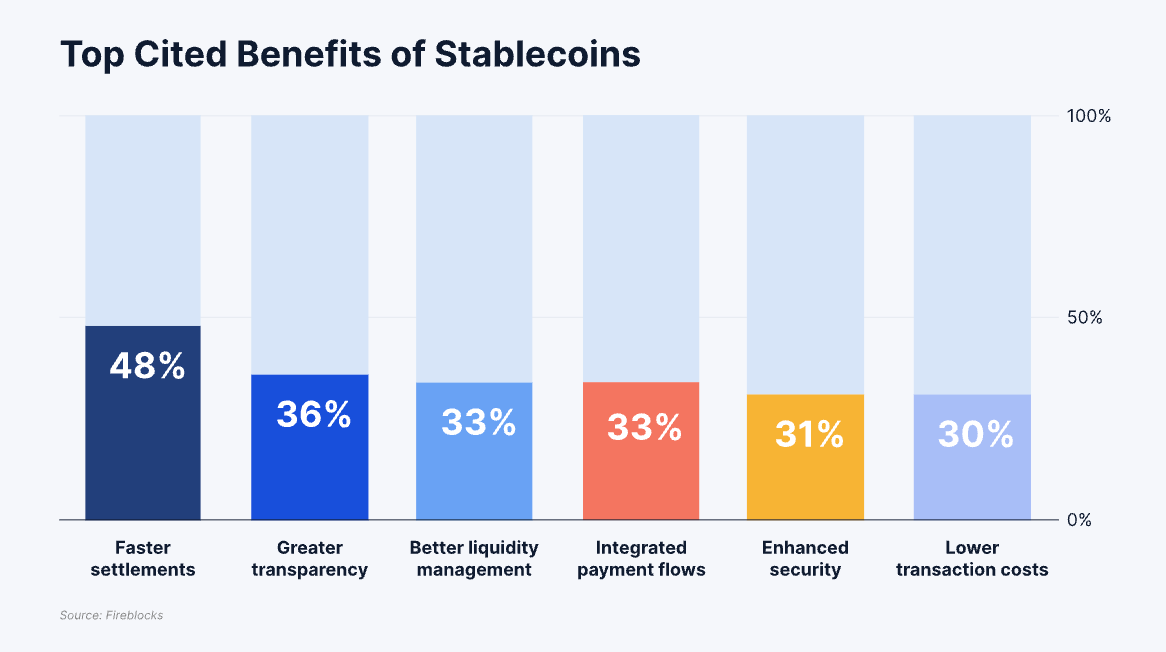

The biggest benefit of stablecoins is the speed of instant settlement, which 48% of executives value, far outweighing cost savings. Cross-border B2B payments are the top use case, especially in Latin America, where 71% of organizations prioritize use.

The top benefit of stablecoin. Source: Fireblocks

“Stablecoins are emerging as strategic growth enablers to expand into new markets and meet growing customer demand. Banks are using them to regain lost cross-border volume while maintaining existing infrastructure, while fintechs and payment gateways aim to reach revenue and margin gains.” the report stated.

Market expansion is the main driver in Asia, while North America sees regulation as an opportunity. With its MiCA regulatory framework, Europe promotes clarity and security, reducing compliance concerns to 18%.

This shows that stablecoins are not just a trend but have become a necessary solution.

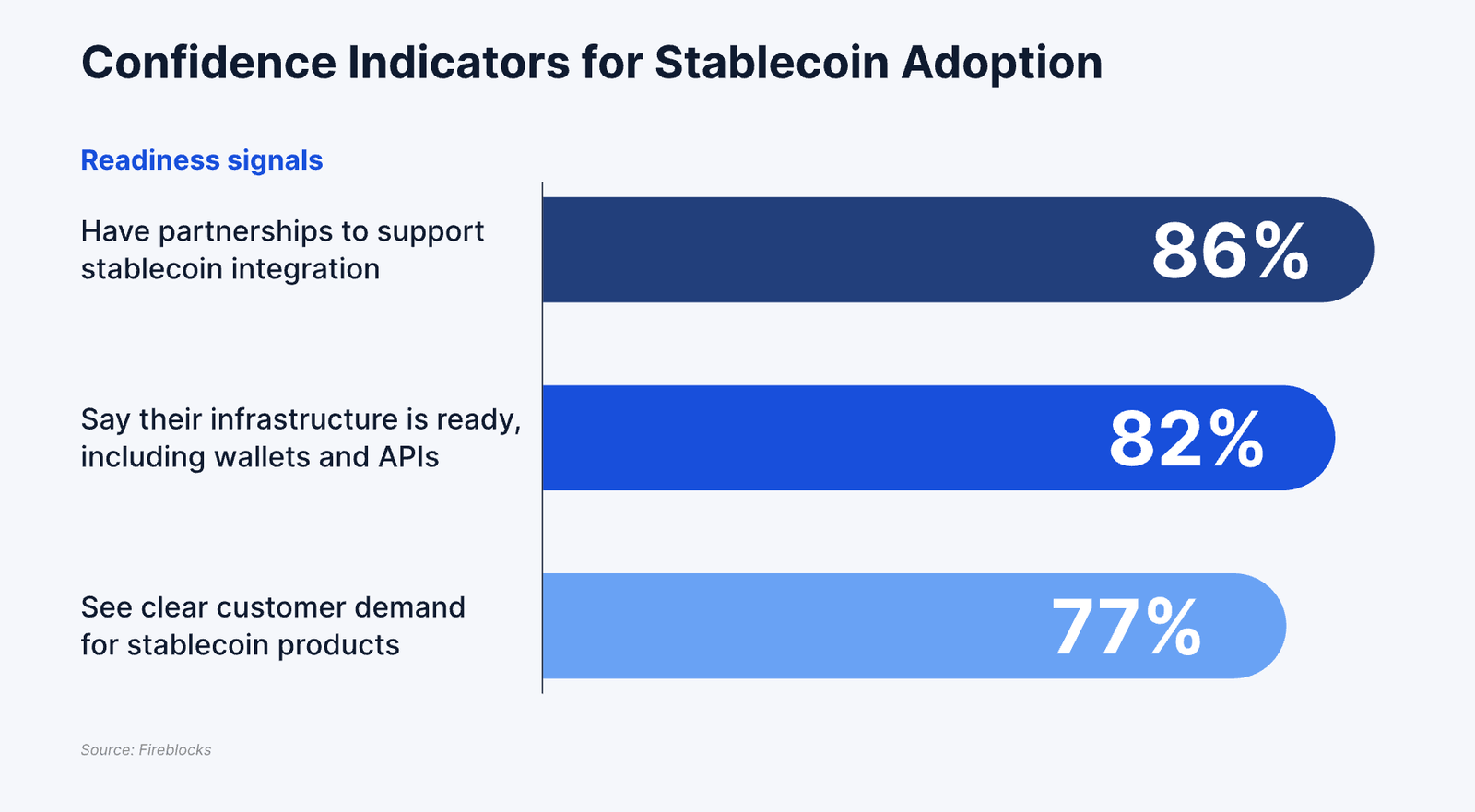

The infrastructure to support stablecoins is also ready, with 86% of organizations believing that wallets, APIs, and compliance tools meet their needs. Security is highlighted, with 36% of executives saying improved security will drive wider adoption.

86% of firms report their infrastructure is ready for stablecoin adoption. Source: Fireblocks

Strategic drivers such as revenue growth and customer satisfaction override cost savings, suggesting that stablecoins are a tool for financial modernization that will help organizations compete in the digital age.

The stablecoin market is expected to exceed $2 trillion in the next three years, with major players such as Visa and Mastercard joining the mix.

Optimistic Long-Term Potential for USDC

Meanwhile, Jon Ma, founder of Artemis, a crypto data platform for institutions, predicts that USDC’s market value could exceed $370 billion by 2029. He argues that with a 30% annual growth rate, the global stablecoin supply could reach $1.2 trillion, with USDC holding a 28.5% market share.

USDC, issued by Circle, is currently the second-largest stablecoin with a market capitalization of approximately $61 billion. Given its recent growth in market cap, long-term projections for USDC are quite optimistic.

This aligns with the recent state of the stablecoin market. As reported by BeInCrypto, the total stablecoin supply surpassed $250 billion by mid-2025, with USDT and USDC dominating market share. This growth reflects demand for payments and opens opportunities for institutions to optimize cross-border transaction costs, previously constrained by traditional banking systems.

Furthermore, the Circle Payment Network (CPN) is expected to process 20% of $570 billion in B2B payments by 2029, generating significant revenue and reinforcing USDC’s position.

Read the full article here