Ethereum, valued at $468 billion, traded within an intraday range of $3,851 to $3,957.89 on Dec. 14, 2024, reflecting a 20.2% drop from its peak of $4,878.2 on Nov. 10, 2021.

Ethereum

The daily chart reflects ethereum’s ongoing consolidation, with a peak at $4,096.6 marking the recent high of an uptrend that began at $3,014.5. Key support sits at $3,600 to $3,700, while the $4,000 psychological level remains a significant resistance. The market is showing reduced bearish volume, with smaller bullish candles forming near $3,800, suggesting resilience despite slowing momentum.

ETH/USD Daily chart on Dec. 14.

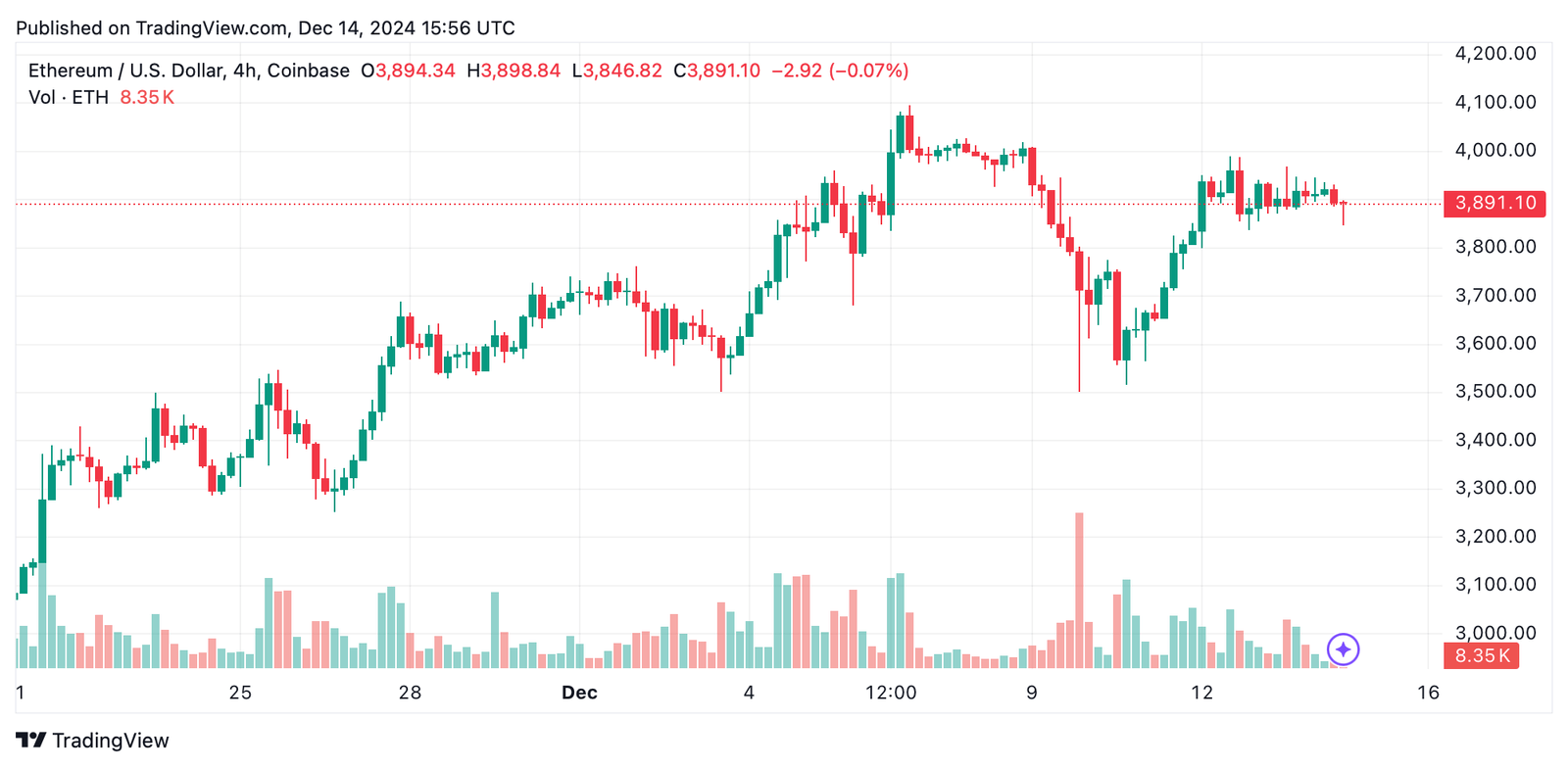

On the 4-hour chart, ethereum consolidates between $3,880 and $3,950. The chart reveals a bounce from a low of $3,467.5, with buyers actively defending the $3,800 range. However, volume is declining during upward moves, hinting at weakening buying pressure. Resistance near $4,000 has been repeatedly tested without success, leaving the market in a state of short-term indecision.

ETH/USD 4H chart on Dec. 14.

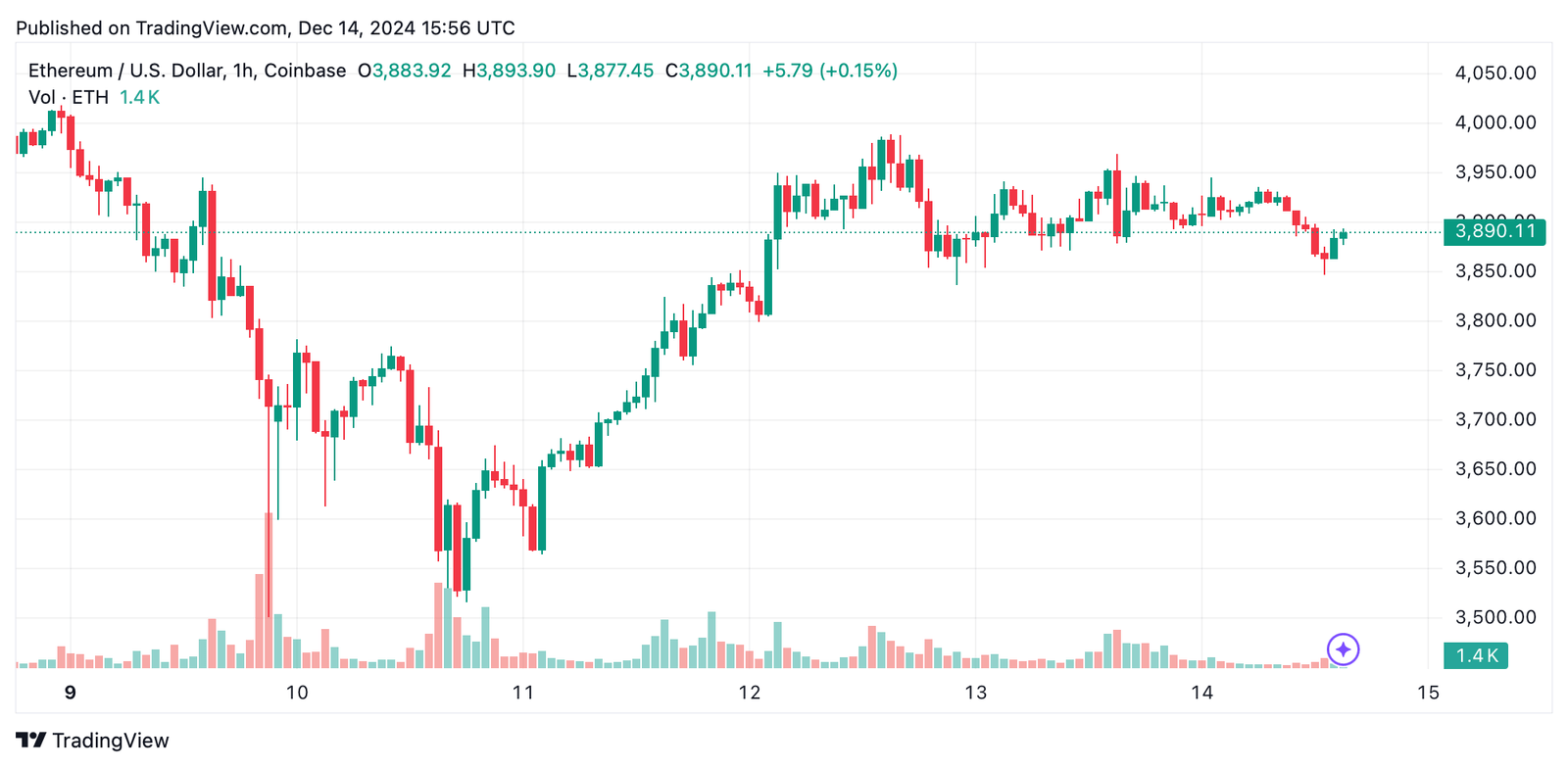

The 1-hour chart shows ethereum attempting to break out from $3,880 to $3,900 consolidation, with intermittent bearish pressure. A potential higher low near $3,846.8 signals a possible upward bounce toward $3,950. Notably, frequent volume spikes during bearish candles highlight aggressive selling near resistance, which has yet to overwhelm support levels.

ETH/USD 1H chart on Dec. 14.

Oscillators display neutral to mixed sentiments, with the relative strength index (RSI) at 61.2 (neutral), Stochastic at 66.3 (neutral), and the moving average convergence divergence (MACD) showing a sell signal at 178.1. The awesome oscillator signals a buy at 301.9, while momentum at 42.7 remains bearish.

Moving averages (MAs), including the exponential moving average (EMA) and simple moving average (SMA), predominantly favor a bullish outlook for ether. The 10-period EMA ($3,828) and SMA ($3,867) suggest short-term buy signals, supported by longer-term averages such as the 200-period EMA ($2,994) and SMA ($3,002).

Bull Verdict:

Ethereum’s consolidation near $3,886 suggests a bullish case, supported by strong buy signals from multiple moving averages and a defended $3,800 support zone. A breakout above the $4,000 psychological resistance could attract momentum buyers, potentially propelling the price toward $4,200 or higher.

Bear Verdict:

Despite ethereum’s resilience, declining volume on upward moves and persistent selling pressure near $4,000 suggest caution. A failure to hold the $3,800 support level could trigger a bearish pullback, with the next support around $3,600 to $3,700. Bears could seize control if broader market sentiment weakens.

Read the full article here