Ethereum’s on-chain activity has taken a hit over the past week, as rising geopolitical tensions continue to rattle investor confidence.

The decline in usage triggers concerns of further downside risk for ETH as the second quarter nears its end.

Ethereum’s On-Chain Metrics Crumble Under Geopolitical Pressure

According to Artemis, the Ethereum network has witnessed a notable dip in user activity over the past week as tension escalates between Israel, Iran, and the US. The Layer-1’s (L1) daily active address count has plunged by 26% during that period.

Ethereum Daily Active Addresses. Source: Artemis

A decline in Ethereum’s daily active address count signals reduced engagement from users and developers on the network. It also suggests that fewer wallets are initiating transactions, deploying contracts, or interacting with the decentralized applications (dApps) on the L1.

This drop in participation often precedes a broader slowdown in network activity, reflected in Ethereum’s transaction count, which has also fallen. Per Artemis, it has dipped by 14% during the review period.

Ethereum Transactions Count. Source: Artemis

The decline in user engagement is mirrored by Ethereum’s shrinking DeFi TVL. At $57 billion at press time, this has plunged 10% over the past seven days.

Ethereum TVL. Source: Artemis

This pullback suggests that users are withdrawing funds or avoiding new deployments amid growing uncertainty, limiting liquidity across lending platforms, DEXs, and staking protocols.

With fewer transactions taking place, demand for ETH declines, dampening price momentum and contributing to the asset’s recent slump.

Ethereum Eyes $2,569 as Price and Volume Surge

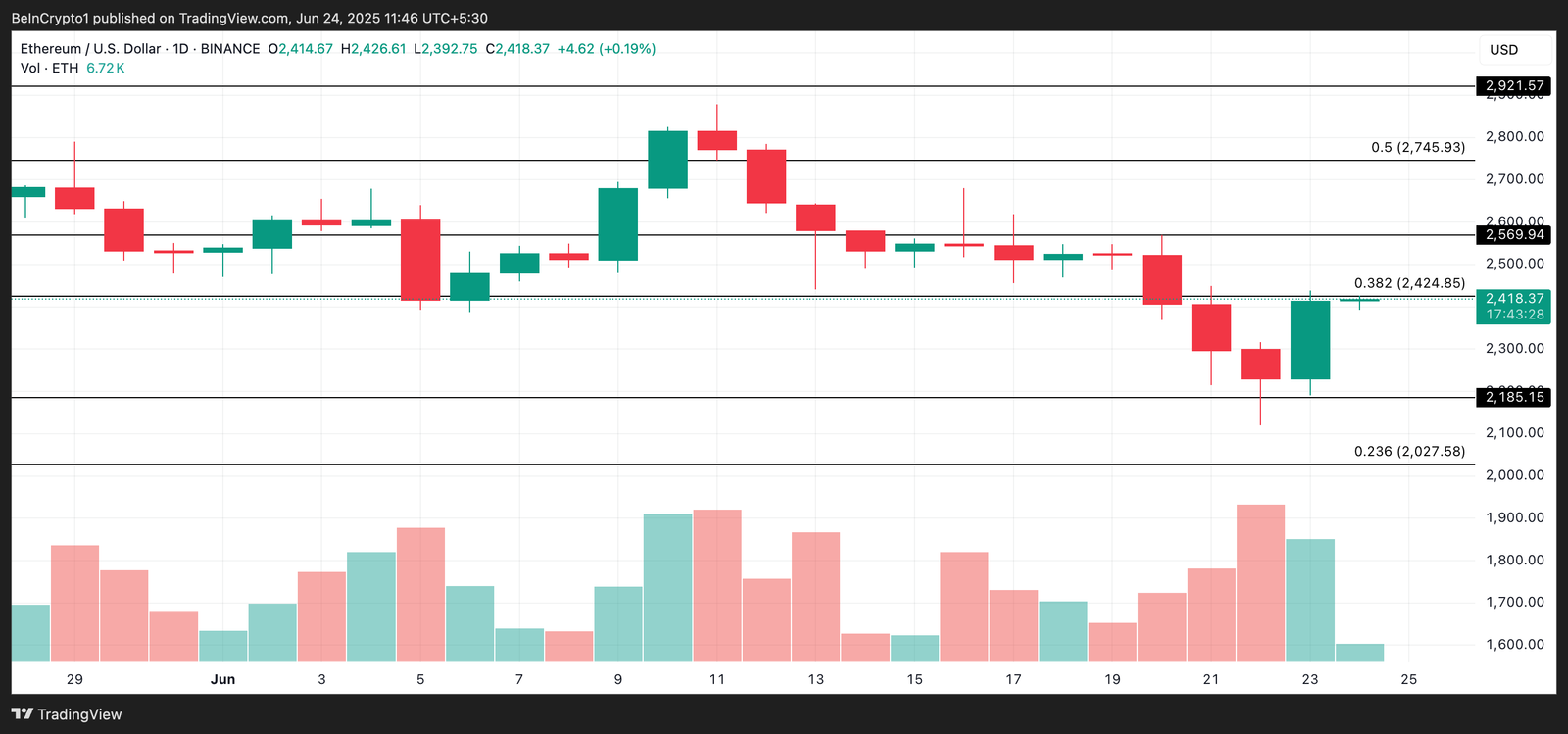

Amid a broader market upswing, ETH has surged 8% over the past 24 hours, trading at $2,418 at the time of writing. Accompanying this price jump is a 7% rise in daily trading volume, now at $26 billion.

When both price and trading volume increase simultaneously, it signals growing investor confidence and stronger market participation. This suggests that real demand rather than speculative spikes drives ETH’s current price rally.

If this continues, ETH could breach $2,424 and climb toward $2,569. A successful break above this price level could send ETH’s price toward $2,745.

Ethereum Price Analysis. Source: TradingView

However, if selloffs continue, the coin will resume its decline, and its price could fall to $2,185.

Read the full article here