Key Insights:

- ETH inflows to Binance hit the highest level in 14 months, Ethereum price can be impacted.

- Profit-taking returns as SOPR enters warning zone.

- Price sits at key decision point near $2,440–$2,520.

Ethereum (ETH) is struggling to stay above $2,500. While there hasn’t been a major correction yet, pressure is building. On-chain data shows several signs that selling could return soon. If ETH fails to reclaim higher levels, the downside may come faster than expected.

Inflows Are High, Sadly

Ethereum exchange reserves on Binance just jumped to 4.9 million ETH. That’s the most since May 2023.

This rise means large wallets are moving coins to exchanges. That often signals they are ready to sell.

Binance inflows- Source: CryptoQuant

The ETH price hasn’t reacted sharply yet, but this same pattern has appeared before past dips. ETH also hasn’t cleared $2,600, a key resistance zone.

If these reserves continue to rise, it could signal a larger correction, in the form of a sell-off.

Exchange reserves measure how much ETH sits on trading platforms. A rising figure often suggests upcoming sell pressure. In most cases, people try and sell their exchange holdings over time.

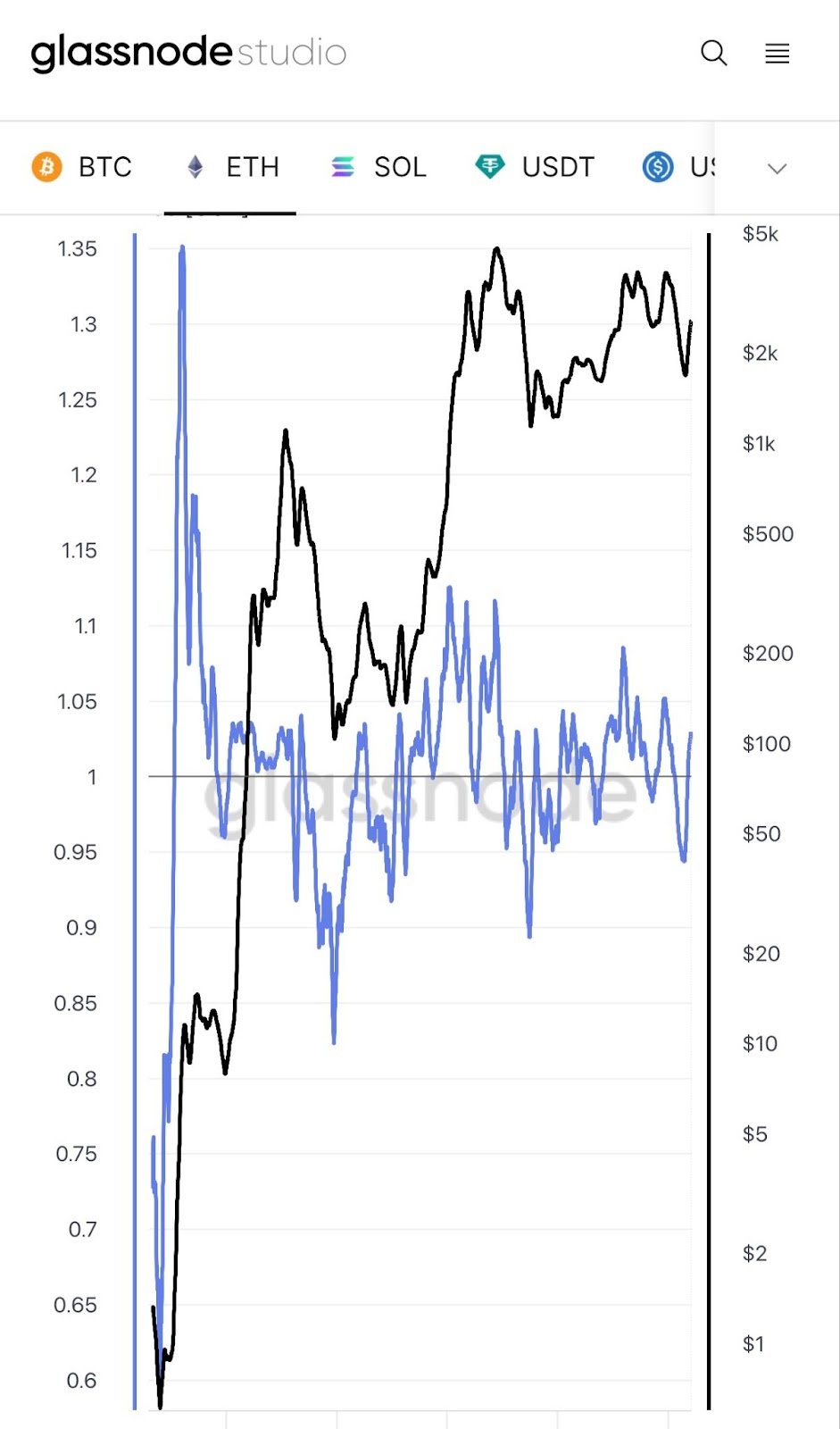

Ethereum Price SOPR Shows Profit-Taking Is Here

ETH’s Spent Output Profit Ratio (SOPR) is hovering near 1.05. This level shows that most ETH being sold was bought earlier at a cheaper price. Sellers are now cashing out in profit.

ETH SOPR-Source: Glassnode

That itself isn’t a bad thing. But in past cycles, when SOPR stayed between 1.05 and 1.15, the price often got rejected. One key example was in March 2024, when ETH price dropped over $300 after a similar SOPR spike.

We are not yet seeing panic. If this ratio climbs further and Ethereum price stalls below $2,600, a correction toward $2,300 becomes likely.

SOPR is an on-chain metric that tracks whether coins moved on-chain are sold at a profit or loss. When the value is above 1, it means coins are being sold at a profit.

A rising SOPR with flat price action often means sellers are getting ahead of demand.

SOPR is useful because it shows real-time investor behavior. It doesn’t rely on exchange data alone. If holders are confident, they usually wait.

But when they start selling into strength, it means they are unsure about future upside. Simply put, ETH, at this juncture, cannot afford a steeper SOPR rise.

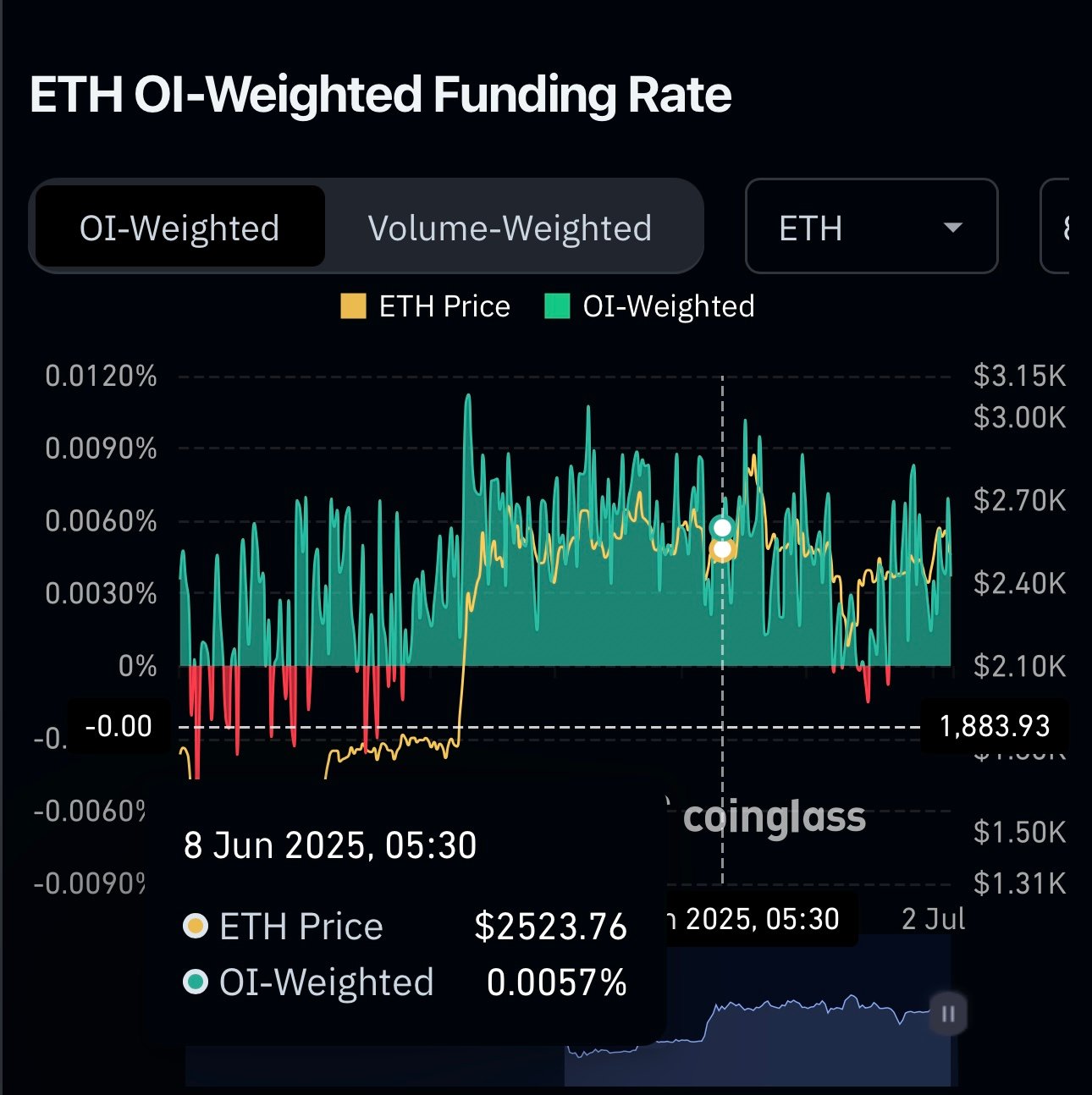

Funding Rate Remains Positive, But Weak

Open Interest-weighted funding rate is still slightly positive. Traders are paying to hold long positions.

This shows that bulls are still active. But the number hasn’t jumped, and that matters.

When funding rates are flat, it means there is no strong belief in a breakout. Right now, the market is leaning bullish, but not by much.

ETH OI-weighted funding

Funding rate is the cost traders pay to hold long or short positions. Positive means more longs. Negative means more shorts. Yet, positives cannot guarantee an ETH price move if the same isn’t backed by exchange outflows and whale buys.

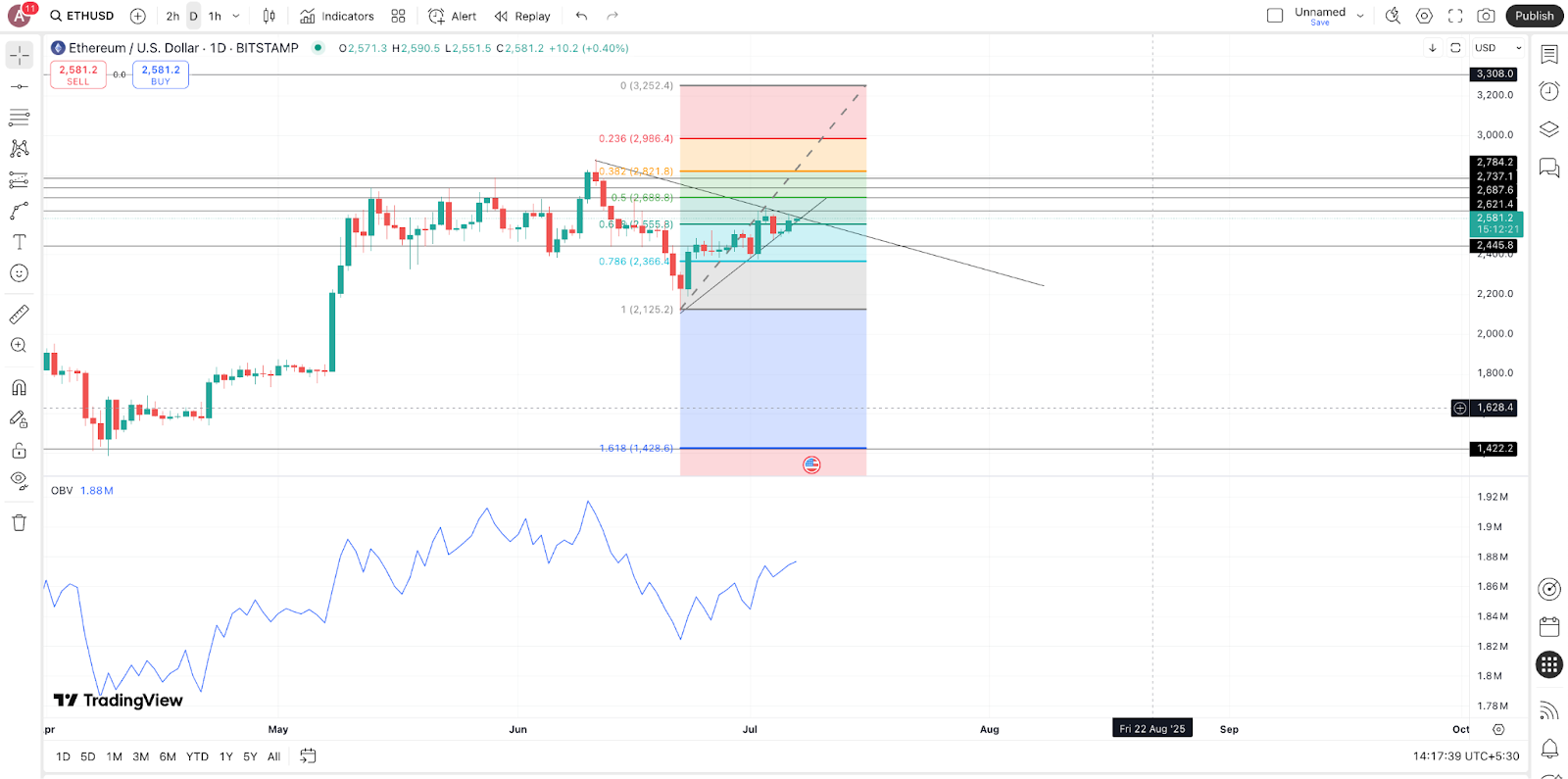

Ethereum Price Action Shows it Can Correct

ETH price is now trading inside a pennant pattern, stuck between two trend lines. The support level sits near $2,440. Resistance is just above $2,520.

This pattern often breaks with high volatility. If ETH drops below support, the first downside target is $2,350. That aligns with the 0.382 Fibonacci level. If that fails, $2,280 (0.5 Fib level) could follow.

On the upside, ETH must reclaim $2,600 and flip resistance to support. Only then does a push toward $2,750 become possible.

Fibonacci retracement is a tool used to spot support and resistance based on previous price moves.

ETH price action- Source- TradingView

OBV Divergence Suggests Weakness

On Balance Volume (OBV) has been flat while the price moved up. This is a bad sign.

If the price rises, volume should rise too. OBV tracks this relationship. If OBV flattens while price goes up, it often signals that buyers are getting tired.

Right now, the OBV is not supporting the breakout. That adds risk to any bullish case.

OBV adds volume on green candles and subtracts on red ones. It shows if volume supports the trend.

Ethereum’s on-chain setup is beginning to resemble past local tops. Inflows are rising. SOPR is in the warning zone. OBV is flat. ETH price still holds inside the pennant, but without stronger demand, the pattern may break to the downside.

Unless the price flips $2,600 and volume kicks in, a drop to $2,300 is still in play.

Read the full article here