Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

An analyst has suggested that Monero (XMR) could repeat its 2021 cycle-high amid its recent price jump. However, a renowned on-chain sleuth has linked the surge to suspicious Bitcoin (BTC) transactions.

Related Reading

Monero Soars After $330 Million BTC Theft

Privacy and security-focused token Monero saw its price soar 52% to a four-year high on Monday. The cryptocurrency surged from its recently reclaimed $220-$230 support toward the $340 resistance, hitting $347 in the early hours of Monday.

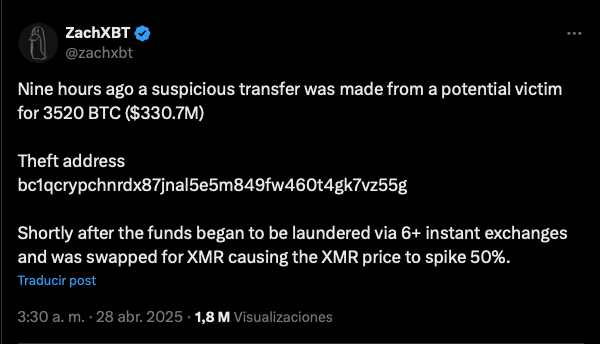

Amid the massive surge, on-chain detective ZachXBT has linked the pump to a “suspicious transfer” from a potential victim of social engineering. The crypto sleuth explained that a suspicious transfer of 3,520 BTC, worth around $330.7 million, was made on Sunday night.

According to the post, the funds were laundered via more than 6 instant exchanges shortly after the initial transfer, being swapped for XMR, seemingly based on timing analysis and the Monero price jump.

An X user suggested the stolen Bitcoin was “likely from the Bitstamp hack that occurred in 2014.” The internet detective denied the idea, stating that the victim was likely an OG Bitcoiner.

Meanwhile, others questioned whether the wallet owner made the transactions or if it was a theft. ZachXBT detailed multiple factors that led him to believe it was likely a theft, including the wallet being a longtime BTC holder and a Gemini, River, and Coinbase user.

Additionally, he noted that the $330 million in Bitcoin was suddenly moved and transferred in small increments to instant exchanges, creating hundreds of orders. This would make the owner lose multiple 7-figures to fees, making it inefficient for a normal person.

The crypto sleuth also considers that the theft isn’t likely related to North Korea’s Lazarus Group, which recently stole $1.5 billion worth of Ethereum (ETH) from crypto exchange Bybit.

Is XMR Near A Breakout?

Since the pump, Monero has retraced around 25% from today’s high to trade between the $250-$260 range. Crypto analyst Rekt Capital noted that XMR has successfully retested its $214 range’s low as support amid the market recovery.

Notably, the cryptocurrency has been moving within the $112-$214 price range since 2022, surging above the range’s resistance line amid the November post-US elections breakout.

After the Q3 2024 rally, Monero entered its key $214-286 range, which has previously worked as a key support and resistance area. After breaking out of the range’s upper boundary, the cryptocurrency rallied to its 2018 all-time high (ATH) of $542 and its 2021 high of $480.

During the Q1 2025 retraces, the XMR dropped below the $214 mark, testing the $200 area as support before bouncing. Similarly, the early April pullback sent the cryptocurrency toward this level, finally reclaiming it two weeks ago.

Since then, the cryptocurrency has rallied toward the $220-$230 range, fueled by the ongoing market recovery, but was ultimately rejected at the key resistance level. Today’s recent pump has seen Monero break above the $230 mark for the first time since February.

Related Reading

Despite the alleged laundering-driven surge, the analyst affirmed that the cryptocurrency has now “repeated early 2021 history,” where the token reclaimed its current range and retested its lower boundary before breaking out to cycle highs.

If history repeats and XMR’s price holds its current range, it could position itself for a surge above the $300 barrier.

Featured Image from Unsplash.com, Chart from TradingView.com

Read the full article here