Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum’s price action has demonstrated a pullback in recent days, reacting to broader market cues, including geopolitical developments. As of the time of writing, the asset is trading at $2,621, marking a 3.2% decline over the last 24 hours.

The drop follows recent reports of a federal court reinstating US President Donald Trump’s tariffs, which appear to have triggered a brief wave of risk-off sentiment across the crypto asset space. Despite this short-term weakness, ETH remains up approximately 45% over the past month, supported by momentum built earlier in the quarter.

Related Reading

Large Ethereum Inflows to Binance Spark Caution

This latest pullback coincides with a notable increase in on-chain activity, particularly surrounding Ethereum transfers to exchanges. On May 27, an unusually large transfer of ETH was observed moving to Binance, a trend that has caught the attention of a CryptoQuant analyst monitoring potential profit-taking behavior.

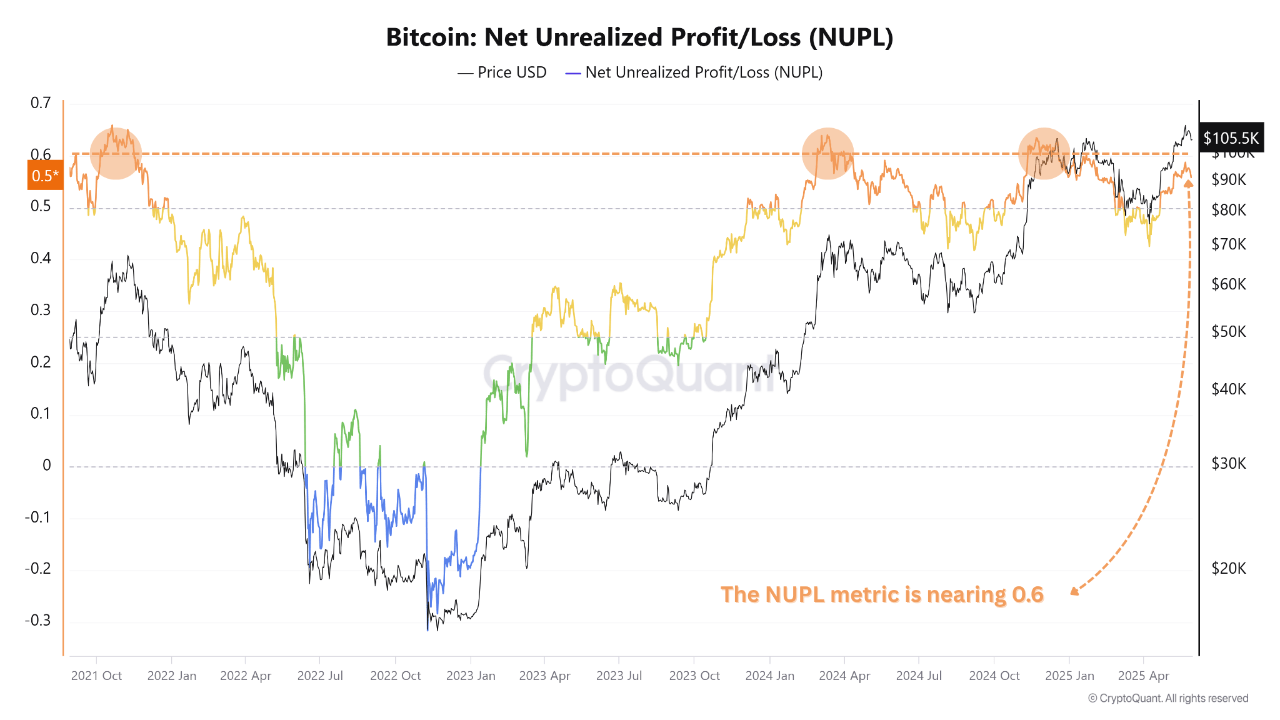

Parallel to this, Bitcoin’s Net Unrealized Profit/Loss (NUPL) metric has reached a key level historically associated with market cooling phases, hinting that broader sentiment may be at a transitional point.

According to CryptoQuant contributor Amr Taha, Ethereum experienced a substantial net inflow of approximately 385,000 ETH to Binance beginning on May 27. This marks one of the largest daily exchange inflows for the asset in recent months.

Exchange inflows of this magnitude are often interpreted as signals of increased selling intent, particularly when driven by larger holders or institutional entities. The movement of such a high volume of ETH to a centralized exchange may reflect preparations for liquidity provision or anticipated market volatility.

At the same time, Bitcoin’s NUPL, a metric that calculates the difference between unrealized profits and losses relative to market cap, has approached the 0.6 threshold.

Historically, this level has acted as a pivot point where investors begin realizing gains, typically leading to price consolidation or downward pressure. Previous occurrences in early March and late 2024 saw NUPL at similar levels, followed by pullbacks in Bitcoin’s price, which also influenced broader market direction.

Signals Suggest Potential Consolidation Phase

Taken together, these developments present key indicators that market participants are adjusting their positions amid heightened uncertainty. Taha emphasized that while not definitive sell signals, the 385,000 ETH inflow to Binance and the NUPL’s rise to 0.6 are noteworthy.

In prior cycles, similar patterns coincided with phases where investors reduced exposure or rotated assets. As ETH remains near local highs, the potential for short-term correction or sideways movement cannot be dismissed.

Related Reading

Taha concluded that investors may consider monitoring exchange inflows alongside NUPL and other on-chain metrics to better gauge sentiment shifts. Additionally, developments in regulatory or macroeconomic narratives, such as US trade policies or broader equity market behavior, could further influence crypto price dynamics.

While Ethereum continues to demonstrate long-term strength, recent signals point to a phase of caution and strategic reassessment in the near term.

Featured image created with DALL-E, Chart from TradingView

Read the full article here