Circle Internet Financial, the issuer of the second-largest stablecoin USDC, has achieved a market valuation of $66.9 billion, eclipsing the entire $61.3 billion circulating supply of its own dollar-pegged token.

This rise, fueled by growing investor confidence following pivotal U.S. stablecoin legislation, has seen Circle inch closer to crypto exchange giant Coinbase’s $78 billion market cap.

CRCL Outpacing USDC

Data from Yahoo Finance shows Circle (CRCL) went as high as $298.98 during Monday’s session before closing at $263.45. This was still a nearly 10% improvement for the day and an 800% jump since its IPO in early June. The peak pushed the company’s market capitalization to just under $67 billion, overtaking the $61.3 billion supply of USDC currently in circulation.

This milestone follows the U.S. Senate’s decisive 68-30 vote on June 17 to pass the GENIUS Act. Once signed into law, the legislation will mark the United States’ first federal framework for dollar-pegged crypto assets.

It will mandate full backing, regular audits, regulatory approval for issuers, and limits on algorithmic stablecoins while paving the way for banks, fintechs, and potentially major retailers to enter the market.

Investor reaction was immediate, with CRCL shares surging over 80% last week alone. The momentum continued yesterday, amplified by news that fintech giant Fiserv plans to launch its own price-stable digital asset (FIUSD) by year-end using Circle’s infrastructure.

Bubble Fears vs. Broader Stablecoin Boom

While Circle’s valuation now places it within striking distance of Coinbase, the small matter of its trading at 216x net income with a P/E ratio above 3,200 has a few talking heads worried about a possible bubble. They suggest that investors are possibly banking heavily on future profits rather than present fundamentals.

However, the uptick has come at a time when the broader stablecoin market is experiencing growth. A recent Coinbase report revealed that fiat-linked cryptocurrencies processed $27.6 trillion in 2024, beating Visa and Mastercard combined. The study also found strong interest from 81% of crypto-aware SMBs and tripled interest from Fortune 500 firms compared to 2024.

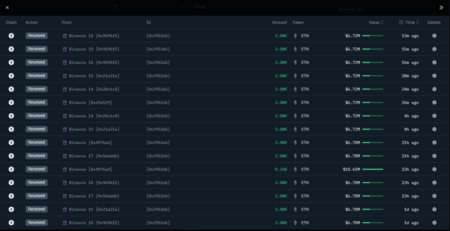

Additionally, the latest data from DeFiLlama shows the sector’s total market cap rose by $5.671 billion in the last 30 days to push past $251 billion. Ethereum was the primary growth engine, contributing more than $3.6 billion of the new supply.

Meanwhile, Tether’s USDT is the most dominant stablecoin, with its $156 billion circulating supply making up 62% of the market. USDC’s $61.3 billion market cap gives it a 24% stake, solidifying its second-place position in the space.

Read the full article here