Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is trading just above the critical $104K level after enduring multiple days of selling pressure triggered by escalating tensions in the Middle East. The recent attacks between Israel and Iran have injected fresh volatility across financial markets, but BTC has shown notable resilience. Currently down about 5% from its all-time high of $112K, Bitcoin continues to trade within a broader consolidation range as macroeconomic uncertainty persists.

Related Reading

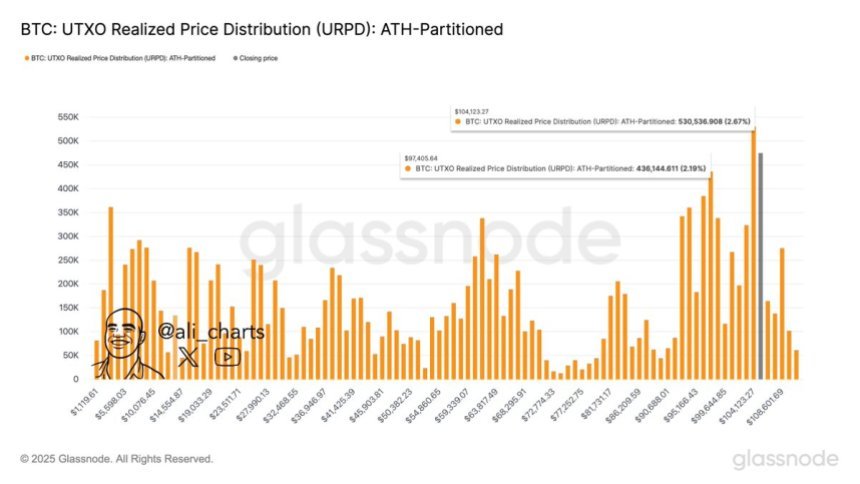

Despite the geopolitical instability and rising bond yields, Bitcoin’s structure remains bullish, with bulls defending key support zones. According to top analyst Ali Martinez, the $104,124 level is a crucial threshold to watch. He highlights that this level aligns with a strong cluster of Unspent Transaction Outputs (UTXOs) based on the Realized Price Distribution metric. This suggests a heavy concentration of buyers who acquired BTC at or near this range, potentially reinforcing it as a solid support base.

Holding above this level could mark a turning point, paving the way for another push toward price discovery. However, a breakdown below this zone could trigger a deeper correction toward lower demand levels. For now, all eyes remain on Bitcoin’s reaction to this key level as global risks continue to evolve.

Bitcoin Holds The Line Above $100K Amid Geopolitical Risks

Bitcoin is showing notable resilience amid global turmoil, holding above the $100K mark despite rising uncertainty linked to escalating Middle East tensions. As the market heads into Monday, investors are bracing for potentially volatile sessions, depending on further developments between Israel and Iran. A sharp rise in oil prices could add additional macro pressure, making the start of the week a decisive moment for risk assets.

BTC continues to trade within a consolidation range after falling 5% from its all-time high of $112K. Analysts widely agree that Bitcoin is in a transitional phase—either preparing for an explosive breakout into price discovery or setting the stage for a deeper retracement. Many believe that a confirmed breakout above $112K could trigger the next major leg higher, marking the beginning of a new expansion cycle for the entire crypto market.

However, caution remains critical at current levels. Martinez pointed to key on-chain data from the UTXO Realized Price Distribution, identifying $104,124 as a pivotal support zone. This price level is where a large volume of BTC last moved, suggesting strong buyer interest. If BTC holds this level, it could form a solid base for continuation. But if it breaks down, the next area of interest lies around $97,405—potentially sparking broader fear across the market.

In the coming days, Bitcoin’s response to geopolitical news and macroeconomic signals, particularly oil price movements and bond yield reactions, will be crucial. For now, the bulls remain in control, but the path forward demands close attention and calculated positioning.

Related Reading

BTC Price Analysis: Bulls Defend Key Support

Bitcoin is currently trading at $105,502, showing signs of strength after defending the crucial $103,600 support level. This price zone has acted as a consistent floor over the past week and continues to be a key pivot for short-term market structure. After a steep drop from the $112K high, BTC bounced off this support with a strong wick on high volume, signaling buyer interest and a potential short-term bottom.

The chart shows that Bitcoin is consolidating between $103,600 and $109,300, with the 50, 100, and 200-period SMAs converging just above the current price, indicating a decision point is near. A clear break above $106,800 could trigger momentum to test $109,300 again, while a failure to hold above $104,500 would expose BTC to downside risk.

Related Reading

Volume remains relatively muted compared to the spike during the June 13 drop, suggesting that most of the panic selling has cooled for now. However, price remains below the 200 SMA, reinforcing that bulls must reclaim this zone to confirm continuation.

Featured image from Dall-E, chart from TradingView

Read the full article here