Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Shares in Indonesian fintech firm DigiAsia Corp jumped sharply on May 19 after it revealed plans to put Bitcoin at the center of its future.

Related Reading

The company wants to raise $100 million to start building a BTC reserve, and it says half of its net profits will go toward buying more. The announcement got a lot of attention—maybe too much, too fast.

Stock Soars On Bitcoin Reserve Plan

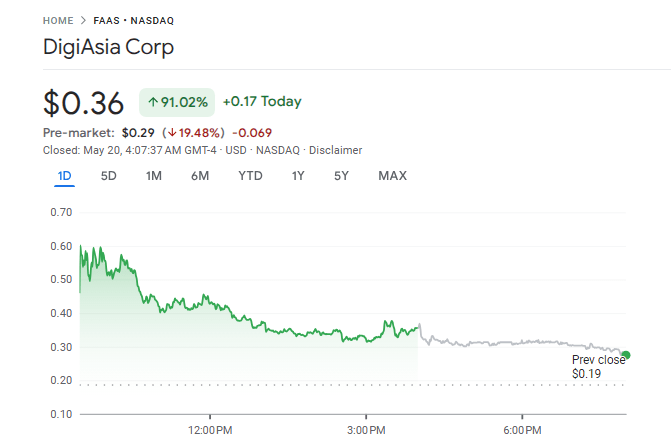

DigiAsia’s stock, which trades under the ticker FAAS on the Nasdaq, closed the day up more than 91% at 36 cents, Google Finance data shows. But the excitement didn’t last long.

After hours, the price dropped 20% to 28 cents. That sudden move shows how quickly investor mood can shift, especially when crypto is involved.

Source: Google Finance

The stock had been down around 50% this year before the announcement. It was trading close to $12 back in March 2024. Now, it’s nowhere near those highs. This latest surge looks like a shot of adrenaline, not a long-term fix.

Bitcoin Reserve Plan And Profit Pledge

DigiAsia isn’t just talking about Bitcoin—it’s making it part of its future profits. The company’s board has already approved a plan to treat Bitcoin as a treasury reserve asset. That means it’s not just holding cash; it wants BTC in its back pocket.

It also said it would put up to 50% of its net profits into acquiring Bitcoin. The company is currently looking to raise up to $100 million to get that plan moving. It might use tools like convertible notes or crypto finance products to do that.

Management is also in talks with regulated partners to figure out how to earn yield on its holdings, possibly through lending or staking.

Revenue Growing But Still Small

Based on an April 1 financial update, DigiAsia brought in $101 million in revenue in 2024, a 36% jump from the year before.

It’s aiming for $125 million in 2025, with projected earnings before interest and taxes of $12 million. That’s solid growth, but the company is still small compared to others getting into Bitcoin.

Related Reading

Some are questioning whether it’s ready to play in the same league as firms like Strategy or even GameStop, which raised $1.5 billion earlier this year. DigiAsia’s numbers show ambition, but also limits.

Bitcoin Adoption Among Public Companies

More and more companies are buying into Bitcoin, currently trading around $105,116, with a market cap close to $2 trillion, as a long-term strategy.

MicroStrategy, now known as Strategy, holds over 576,000 BTC—worth around $60.9 billion. Strive Asset Management also announced it’s shifting into a Bitcoin treasury approach.

Featured image from Unsplash, chart from TradingView

Read the full article here