Since May 8, bitcoin (BTC) has been confined within the $100,000 to $110,000 range, indicating that neither bulls nor bears have been able to take control. This consolidation phase has continued as the leading digital asset enters the third quarter of the year.

According to the latest Bitfinex Alpha report, BTC may perform even more poorly over the next three months, as this quarter has historically been its weakest.

BTC in A Waiting Game

Bitfinex analysts say BTC is in a waiting game, with reduced profit-taking and cooling signs seen in overall on-chain and exchange activity. The cryptocurrency bottomed at $99,830 last week, triggering significant liquidations across the futures market. Both long and short traders were hit with liquidations totaling hundreds of millions each.

Bitcoin-denominated open interest also declined 7.2% from 360,000 BTC to 334,000 BTC. Bitfinex said the liquidations and decline in open interest indicated a forced de-leveraging event that cleared speculative positions on both sides. The flush reflected a highly reactive environment where overextended traders were caught off guard, leading to a short-term reset.

With open interest now rebalanced by the flush, analysts believe the market is better positioned for decisive action. There are expectations of deviations above and below the $100,000-$110,000 range in the near term as Q3 progresses.

Moreover, there have often been seasonality changes in market conditions between Q2 and Q3 in the past. BTC has recorded an average return of 27.12% in Q2 and 6.03% in Q3 since 2013. With market volatility expected to reduce this quarter, experts believe range-bound price action will continue for longer.

Market Structure Still Healthy

On a general note, the ongoing consolidation phase marks the first notable slowdown in bitcoin’s momentum since April 9, when the asset fell to $74,000 due to fear driven by escalating tariffs and geopolitical uncertainty. Since then, BTC has rallied roughly 50% to new all-time highs (ATHs), showing resilience.

Although the momentum from that uptrend has begun to weaken, the broader market structure remains healthy with higher support zones intact. On-chain data suggests BTC is in a transition phase and could either enter correction mode or continue with sideways reaccumulation.

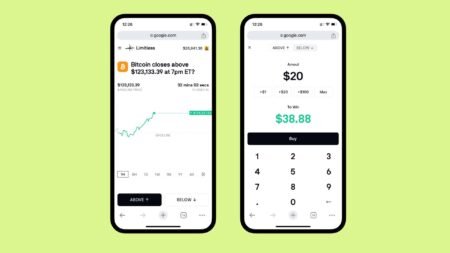

A continued lack of spot volume and intensified profit-taking could trigger a significant decline. However, persistent institutional demand, particularly from United States exchange-traded funds (ETFs), could sustain an upside trend, possibly leading to new ATHs.

Read the full article here