Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bearish sentiment on X continues to grow, fueling a rising number of crash forecasts. Among them is Dom (@traderview2), a widely followed crypto market analyst, who issued a stark warning on Wednesday: Bitcoin is approaching a structural tipping point that could trigger a severe breakdown if bulls fail to act swiftly. “If this continues, it snaps,” Dom cautioned, referring to a wave of relentless selling pressure and thinning liquidity across major exchanges.

Time Is Ticking For Bitcoin

In a detailed post, Dom described current market conditions as “vital,” noting that Bitcoin and the broader crypto space are at a moment where “it needs to save itself or we’re going south.” The recent weekly chart, he said, reflects a bearish “liquidity grab”—a move where BTC pushed above the previous weekly high only to sharply reverse, a pattern often marking local tops.

That reversal has been accompanied by a three-touch declining strength formation, signaling fading bullish momentum. “I think time is ticking for bulls to save this chart, as it needs to happen soon IMO,” Dom added, underscoring the urgency of a bullish reclaim to invalidate the setup.

Related Reading

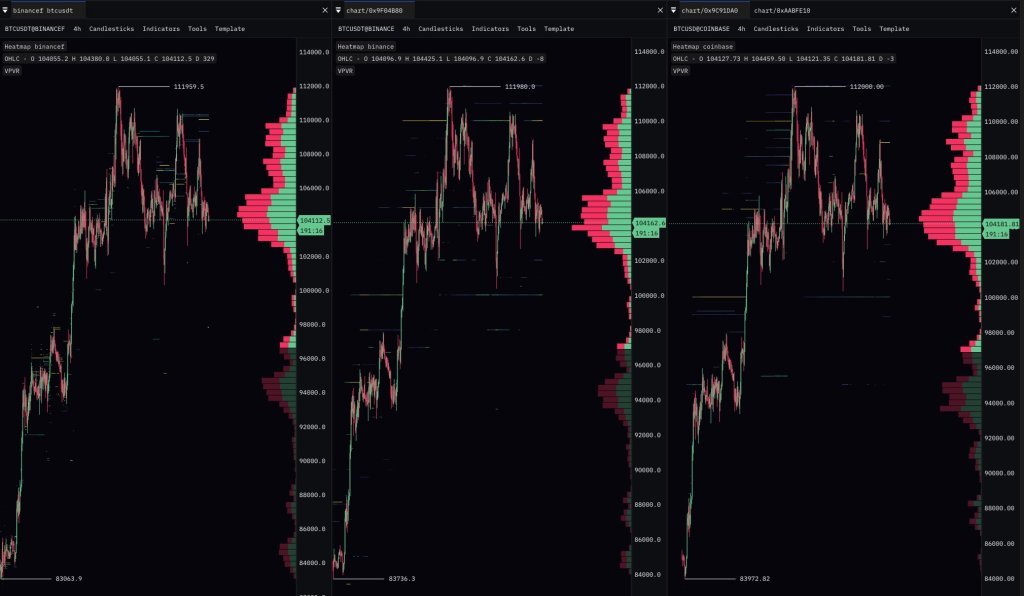

Beneath price action, the structural foundation appears increasingly fragile. Dom pointed to alarmingly thin order books across key spot markets—Binance, Bybit, Coinbase, OKX, and Kraken. Over the past three weeks, roughly 38,000 BTC has been sold into the market, absorbed by passive bids.

While buyers have held so far, the analyst warned that visible liquidity beneath current price levels is virtually nonexistent. “There is virtually no support down to 80ks (at least as of now), not even advertisement of support,” he said.

The same bearish pattern is playing out in perpetual futures markets. Platforms like Binance, Bybit, OKX, and Hyperliquid have seen consistent taker-side selling, forming what Dom described as a “relentless downtrend of market selling.” With perp books also thin, the pressure may be unsustainable unless conditions change quickly.

Drawing a parallel to Bitcoin’s February breakdown from the 90k level, Dom noted, “We saw the same dynamic pre-90k breakdown.” The implication is clear: without a shift in market behavior, BTC may be headed toward a similar fate.

Related Reading

Seasonal trends are adding weight to the bearish outlook. Dom highlighted that summer months historically bring weaker market participation and lower liquidity—an environment that exacerbates downside moves and limits the impact of bullish efforts to regain control.

Despite the grim analysis, Dom remains clear on what would invalidate his bearish stance: a recovery of the 108.5k level. “If that level regains, great. I think we can void these signals,” he said. “But for now, bearish outlook for me is the better R/R on a risk-first basis.”

In a separate reply, Dom acknowledged that a dip to the $96,000–$98,000 region, even with a wick into the $80,000’s, would not necessarily break structure. “It surely would not be abnormal and I think structure would still be ok,” he wrote, adding that he would reassess the setup if such a move occurs.

With order books thinning, taker flow intensifying, and no solid support beneath, Dom’s message is blunt: time is running out.

At press time, BTC traded at $104,694.

Featured image created with DALL.E, chart from TradingView.com

Read the full article here