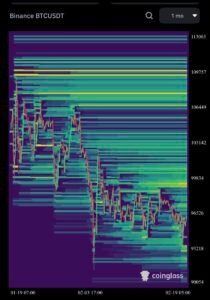

Leading cryptocurrency Bitcoin (BTC) has been relatively stagnant in February, trading below $100,000.

Despite Bitcoin’s stagnant trend, investors’ bullish expectations remain alive.

According to option data, investors continue to place bullish bets. At this point, according to Amberdata, the $110,000 call option was the most preferred option by investors on Deribit this month.

The $110,000 call option expiring on March 28 was the most popular option among investors, with buyers paying over $6 million in premiums for bullish calls, the data showed.

Speaking to Coindesk, Amberdata derivatives director Greg Magadini said that the most active trade was the $110,000 option purchases due at the end of March.

Magadini stated that although there was positive news for Bitcoin during the month, such as the Abu Dhabi investment, renewed macroeconomic negativities such as the above-expectation CPI and PPI data from the US limited BTC’s upward potential.

“There were some bullish news for BTC last week, but it did not translate into a real rise in spot prices.

Combine the Abu Dhabi Bitcoin investment news with the bearish memecoin market drag such as the LIBRA drop, pump-fun craze, and the increasing supply of altcoins, and I see this market as stagnant.

However, investors continue to expect an increase.”

*This is not investment advice.

Read the full article here