A new tool from VanEck, a leading asset management firm, models how a Bitcoin reserve could offset U.S. national debt by 2049.

The Crypto Basic used this tool to explore different scenarios based on debt growth, Bitcoin price, and acquisition strategies. Notably, the results show a scenario where the U.S. Treasury’s Bitcoin holdings surpass the projected national debt, eliminating it entirely.

The Bitcoin Acquisition Plan

For context, the BITCOIN Act, introduced by pro-crypto lawmaker Senator Cynthia Lummis, proposes that the U.S. Treasury acquire up to 1 million Bitcoin over five years and store it in a Strategic Bitcoin Reserve for at least 20 years.

While the default assumption is 1 million Bitcoin, other proposals can suggest higher targets. For instance, The Crypto Basic adjusted this parameter to 2.5 million Bitcoin to explore potential outcomes under a more aggressive acquisition strategy.

Further, we set the assumed average acquisition price per Bitcoin at $100,000. This represents the expected cost per Bitcoin in 2025, influencing the starting valuation of the Treasury’s reserve. A higher acquisition price results in a higher initial value.

Projected Bitcoin Growth and Treasury Reserve Value

Meanwhile, for the CAGR, VanEck noted that since Bitcoin’s inception in 2010, its compound annual growth rate (CAGR) has been 136%. However, over the past five years, Bitcoin’s four-year CAGR has dropped, ranging between 34% and 134%.

Citing this pattern, VanEck projects that Bitcoin’s long-term growth will slow, with an expected CAGR of 25% or lower over the next 20 years. Nonetheless, for this analysis, The Crypto Basic set the growth rate at 30%.

Projected Bitcoin Treasury Reserve Value | VanEck

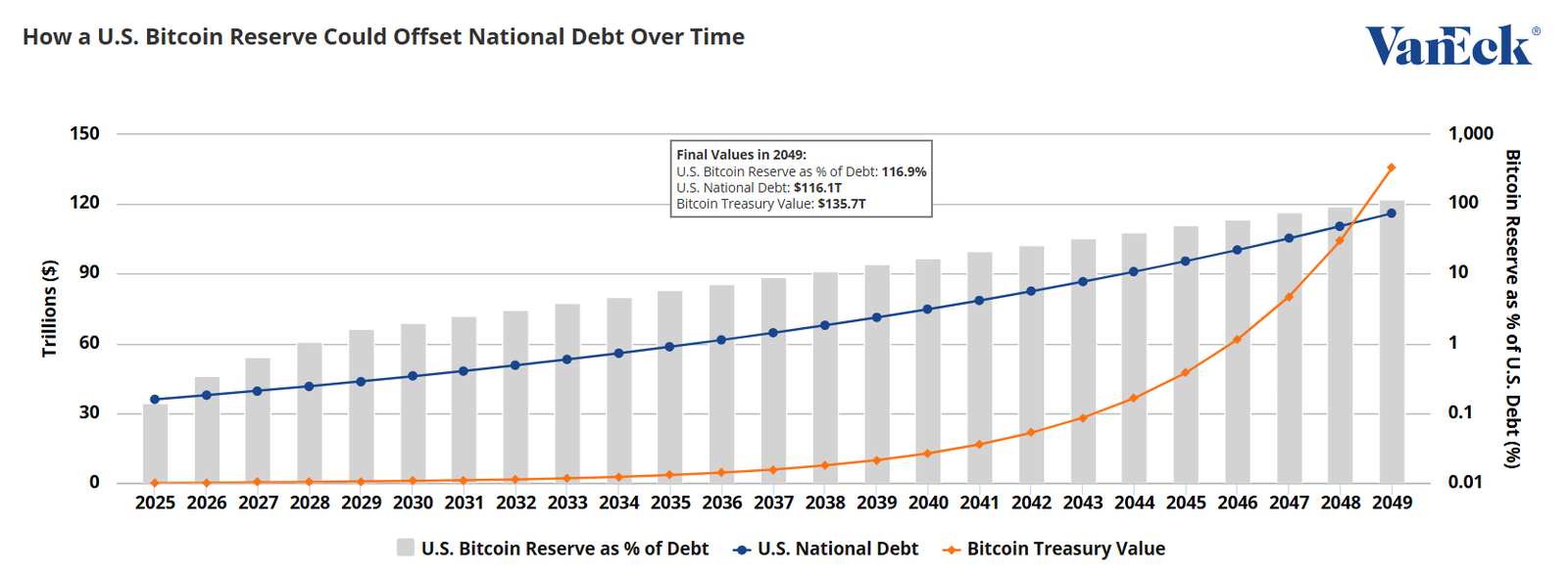

Under these conditions, the Treasury’s Bitcoin holdings would grow massively. By 2049, the Bitcoin reserve would reach a staggering $136 trillion. At this point, Bitcoin would trade at $54 million per token, considering the CAGR of 30%.

US Debt Projections

While analyzing the potential impact of Bitcoin reserves, The Crypto Basic also examined U.S. debt projections. The national debt has grown at an annual rate of about 7% from 2014 to 2024. For this model, we set the debt growth rate at 5%, a more conservative estimate.

Starting at $36 trillion, this growth rate would bring the total U.S. debt to $116 trillion by 2049. If this trajectory holds, the national debt will more than triple in 25 years, making economic stability a major concern.

Comparing Bitcoin Reserves to National Debt

By 2049, the projected value of the Treasury’s Bitcoin reserve would be $136 trillion, exceeding the projected national debt of $116 trillion. This means the Bitcoin reserve could potentially cover 117% of the national debt, effectively wiping it out.

Bitcoin Reserve Against US National Debt | VanEck

Essentially, this analysis confirms that if Bitcoin continues to appreciate at even a fraction of its historical rate, it could become a hedge against rising debt.

While these projections are promising, they depend on multiple factors, including Bitcoin’s long-term adoption and regulatory policies. The Crypto Basic acknowledges that Bitcoin’s volatility can be potentially challenging, but historical trends show that it remains a strong store of value over extended periods.

Read the full article here