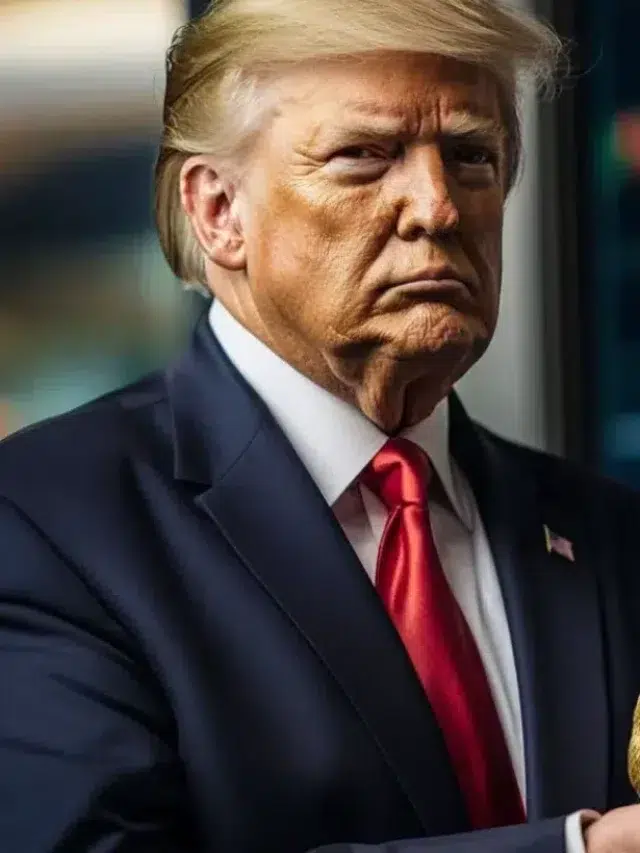

World Liberty Financial (WLFI), the Donald Trump-backed DeFi firm, has picked up another batch of ETH, extending its buying spree as prices push higher.

Summary

- Trump-linked DeFi firm WLFI just bought another 256 ETH for $1 million.

- The company’s total ETH stash is now worth nearly $300 million.

- Critics are warning of conflicts of interest as Trump-linked firms ramp up crypto exposure.

According to data shared by Lookonchain on July 29, WLFI has purchased an additional 256.75 Ethereum (ETH) at $3,895. Acquired for approximately $1 million USDC (USDC), the buy is the latest in a string of steady purchases over the past month, and follows WLFI’s $30 million buy just days ago.

World Liberty Financial’s total ETH stash now sits at 77,226, worth around $296 million at current prices. The average price of the tokens is roughly $3,294, putting the firm up nearly $42 million in profits.

Ethereum, meanwhile, has been on an upward trend. Trading slightly over 3824 at press time, ETH has climbed out of its months-long downward trend, reigniting investor interest. Despite posting a modest 1.6% decline in the past 24 hours, the second largest crypto asset is up more than 55% in the last 30 days.

WLFI’s ETH buying spree aligns with a broader pattern of crypto exposure by Trump-linked entities. Just days ago, Trump Media and Technology Group invested approximately $300 million in Bitcoin options. The deepening exposure also comes as regulatory tides in the United States shift, with the President championing the introduction of pro-industry legislation.

The timing of the moves is now drawing criticism.

Analysts warn of conflict of interest in Trump’s crypto ventures

Per a recent Bloomberg report, experts are raising red flags over the ties between Trump’s political influence and his crypto-linked business dealings. With WLFI actively acquiring ETH and Trump Media placing sizable bets on Bitcoin, critics argue there’s a growing risk of policy being shaped to serve personal interests.

The White House has pushed back on the criticism. Spokesperson Seth Fields told Bloomberg in an email that the president “has never been involved in conflicts of interest and will never be involved.”

Trump and his entities are estimated to hold roughly $900 million in liquid assets, about half of which come from crypto ventures, according to Forbes.

Read the full article here