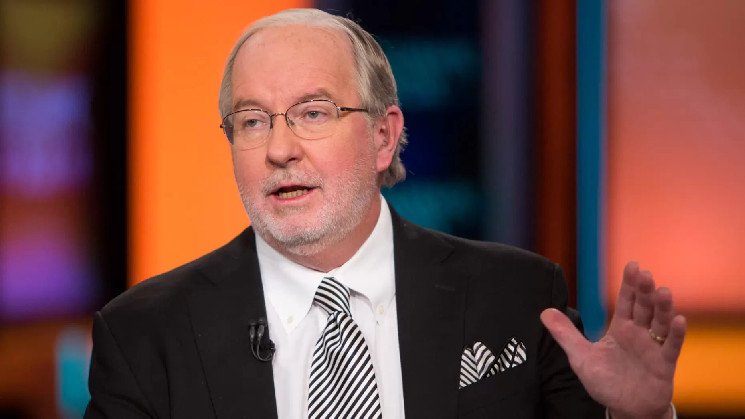

Prominent market analyst and University of Akron Foundation President Dennis Gartman has expressed his skepticism about Bitcoin despite its remarkable rise this year. Speaking to Bloomberg, Gartman expressed surprise at Bitcoin’s performance but continued to favor gold as a more enduring asset.

Bitcoin has gained nearly 140% this year, significantly outpacing gold’s 30% gain. But Gartman remains unconvinced. “It still amazes me how much respect Bitcoin has,” he said. While acknowledging that BTC is a rare asset, Gartman compared the Bitcoin craze to historical bubbles like the Dutch tulip craze of the 17th century and the tech boom of the late 1990s.

“Gold has been valued as an asset for centuries, while Bitcoin has only had a few months,” he said. “I would almost always prefer a century investment to a month investment.”

Despite his skepticism, Gartman avoided predicting an imminent crash, instead warning of eventual volatility, suggesting that Bitcoin’s price could fluctuate dramatically in the future before potentially falling.

When asked to address the argument that Bitcoin is “digital gold” because of its limited supply, Gartman backpedaled. He pointed to the proliferation of other cryptocurrencies, which he believes has undermined Bitcoin’s scarcity appeal. “There’s an infinite number of other cryptocurrencies coming into the market, and that takes away from the one-time scarcity value of Bitcoin,” he said.

In contrast, gold’s history as a store of value and medium of exchange gives it a unique position, the analyst said. “Gold has been money for thousands of years and will likely continue to be so for thousands more,” Gartman said.

*This is not investment advice.

Read the full article here