This is a segment from the Supply Shock newsletter. To read full editions, subscribe.

On a long enough timeline, all companies will become Bitcoin companies. Some have just been there from the very start.

PayPal, back when it was still owned by eBay, was an unknowing bedrock for the very first Bitcoin exchanges.

And considering how often the two were lumped together — a tech duo flipping the script on online payments — Bitcoin and PayPal were almost adoptive siblings. One radical, one moderate.

On This Day

“Commerce on the internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments,” Satoshi wrote to open the Bitcoin white paper.

“While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.”

PayPal was fundamental in the very first trade between bitcoin and the US dollar, which occurred not on this day, but in October 2009.

Martti Malmi, one of Satoshi’s right-hand men in the early days, famously swapped $5.02 for 5,050 BTC to the operator of New Liberty Standard, with the fiat side of the transaction handled by PayPal.

It was so early that PayPal had no policies dealing with the concept of Bitcoin and cryptocurrency, which of course meant everything was fair game!

New Liberty Standard was a manual operation — the price was initially fixed to the average electricity cost to mine a whole coin, and anyone wanting to buy or sell bitcoin would need to send an email to a Gmail address stating how many they’d like to trade.

Traders were then directed to send cash to a PayPal account and wait for their Bitcoin address to be credited.

New Liberty Standard would later add supply and demand into its pricing model, leaving us with this spectacular post from a non-believer.

New Liberty Standard was more of a currency exchange desk than a trading platform. But within two months, Bitcointalk user dwdollar was working on a way to bring true price discovery to bitcoin.

“I am trying to create a market where Bitcoins are treated as a commodity,” he wrote in January 2010, as bitcoin celebrated its first birthday.

“People will be able to trade Bitcoins for dollars and speculate on the value. In theory, this will establish a real-time exchange rate so we will all have a clue what the current value of a Bitcoin is, compared to a dollar.”

Bitcoin Market debuted shortly after as the first official BTC exchange, as denoted by its ability to price bitcoin based on supply and demand rather than mining cost.

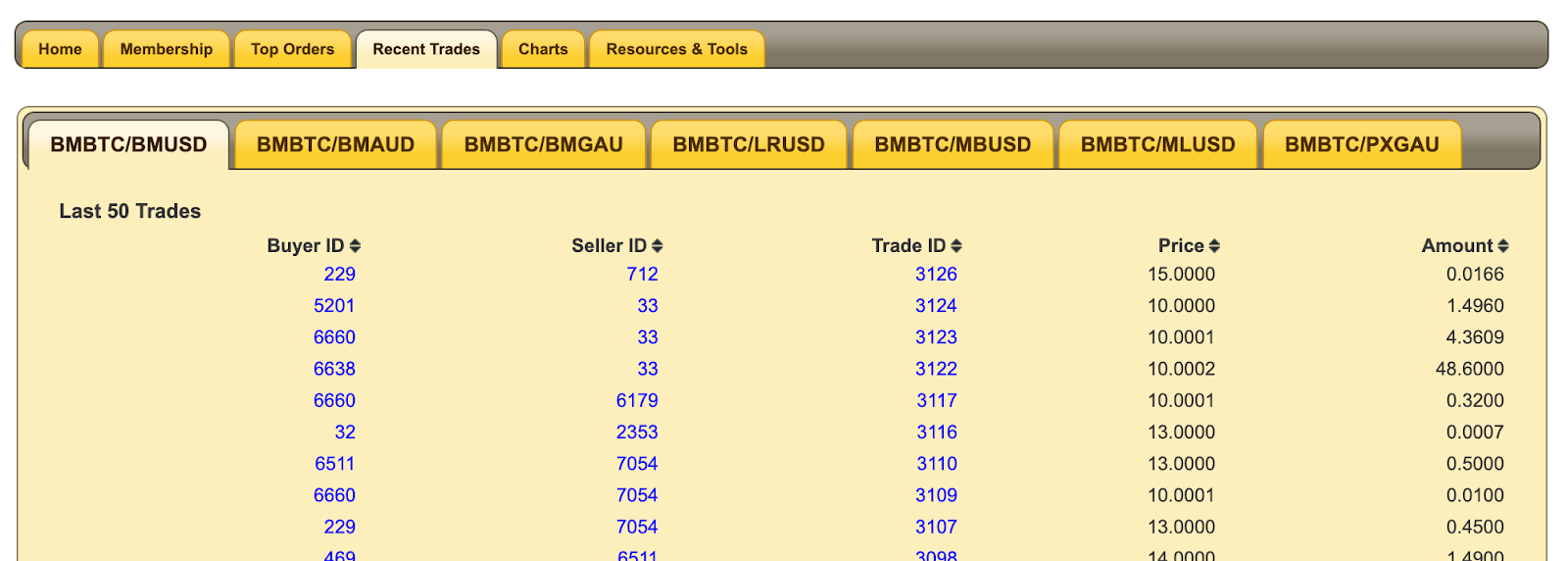

In some ways, Bitcoin Market resembled a modern-day crypto exchange, even if you could only have one order open at a time. There were BTC pairs for fiat currencies (US and Australian dollars) as well as for grams of gold, with all trades handled off-chain by a centralized server.

It took only six months for the price of bitcoin to rise by 1,000% following the launch of Bitcoin Market. By August 2011, bitcoin was trading on the platform for $15 apiece.

Pairs were also broken down by payment processors, which complicated matters. In PayPal’s case, it eventually stopped allowing its users to transact with Bitcoin Market’s PayPal account — so anyone hoping to trade bitcoin with US dollars from their PayPal accounts would need to buy and sell a specialized PayPal USD pair, BMBTC/PPUSD.

The site read: “Bitcoin Market holds the seller’s Bitcoins until the seller has received PayPal funds from the buyer. Then the seller confirms payment and the bitcoins are dispersed to the buyer’s Bitcoin Market account. In short, Bitcoin Market acts like an escrow agent for PayPal payments.”

It was actually on this day, in 2011, thatBitcoin Market was forced to suspend PayPal payments — opposite to how that dynamic usually goes.

After removing the invitation-only restriction on new signups, opening it to the public, Bitcoin Market users were hit by a wave of fraudsters initiating phony PayPal refunds after receiving the coins they paid for. Which is ironically quite similar to a double-spend attack, except it wasn’t the Bitcoin blockchain under siege, but Bitcoin Market’s PayPal hot wallet.

Read the full article here