The Bitcoin (BTC) price hovers below the $107,000 threshold, and a supply overhang limits further upside.

Meanwhile, traders’ attention is on the US Federal Open Market Committee (FOMC) interest rate decision in the June 17/18 meeting.

Bitcoin Stalls Below $107,000 as Fed Decision Looms

The FOMC’s interest rate decision tomorrow is critical after last week’s CPI (Consumer Price Index) report. BeInCrypto reported that inflation increased in May for the first time since February.

Data on the CME FedWatch Tool shows markets pricing in a near certainty of no interest rate cut.

FOMC Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Against this backdrop, speculation has shifted to subtler sources of liquidity, especially changes to the Supplementary Leverage Ratio (SLR), as a hidden trigger for the next crypto bull run.

“Bitcoin attempted another break at the range high but has failed to push higher yet again. This ~$108K resistance remains an important area to watch and without a clean break above, it’s not the time to get excited just yet. Still in this larger range,” said analyst Daan Crypto Trades.

While the Fed is widely expected to hold rates steady, with Polymarket odds giving a 98% chance of no change in June and 84% in July, several crypto analysts are more focused on what’s not being said.

“No rate cuts this week. Everyone’s watching rate cuts. But the real liquidity comes from SLR,” analyst Quinten wrote.

The SLR, or Supplementary Leverage Ratio, is a regulatory capital requirement that restricts how much exposure banks can have to certain assets, particularly Treasuries.

SLR, Not Rate Cuts, Could Trigger the Next Crypto Liquidity Wave

Loosening this rule effectively gives banks the green light to absorb more debt, increasing market liquidity without directly resorting to quantitative easing (QE).

Meanwhile, investor sentiment around interest rate policy remains deeply divided, with Fed chair Jerome Powell still resisting political pressure from President Trump.

“The US will be too late with cutting interest rates again. But once they start cutting rates… Crypto will explode,” stated analyst Mister Crypto.

Chamath Palihapitiya’s recent commentary on The All-In Podcast adds to the speculation. The Canadian-American venture capitalist (VC) argued that the Fed’s hesitation is ultimately political.

“If the numerical justification is there to lower rates and it has all of these other positive externalities for the United States economy, why don’t (you) do it? The only answer is political,” he said.

Citing the VC, the All-In Podcast indicated that the Fed cutting rates by 100 basis points (bps), which Trump advocates for, would reduce the interest on national debt by $300 billion and stimulate economic growth through increased borrowing and GDP expansion, despite potential inflation risks.

However, while the Fed’s decision may be predictable, the real action could follow in Jerome Powell’s press conference. Even subtle shifts in tone could move markets.

“There’s something else which will be even more important than the rate cut decision. The ‘Powell Press Conference’… If negotiations [in the Iran-Israel conflict] happen before FOMC, the Fed could hint towards ending QE and possible rate cuts. In this case, the markets could rally, and alts could pump. Otherwise, it’ll be a dump-only event,” wrote Cipher X.

Elsewhere, analyst Marty Party speculated that the GENIUS Act, alongside the FOMC interest rate decision, is another bullish fundamental for Bitcoin’s price.

“Bitcoin Wyckoff Accumulation Feb/June 16th – entering final Phase. IMO: GENIUS Act or FOMC will be used as the markup narrative,” wrote Marty Party.

Based on the Wyckoff market cycle, an asset’s price transitions into the markup phase after the accumulation phase, with sustained upward movement and increased buying pressure.

This signifies the beginning of a potential uptrend, where the price rises to new highs.

Bitcoin Price Outlook Ahead of FOMC Interest Rate Decision

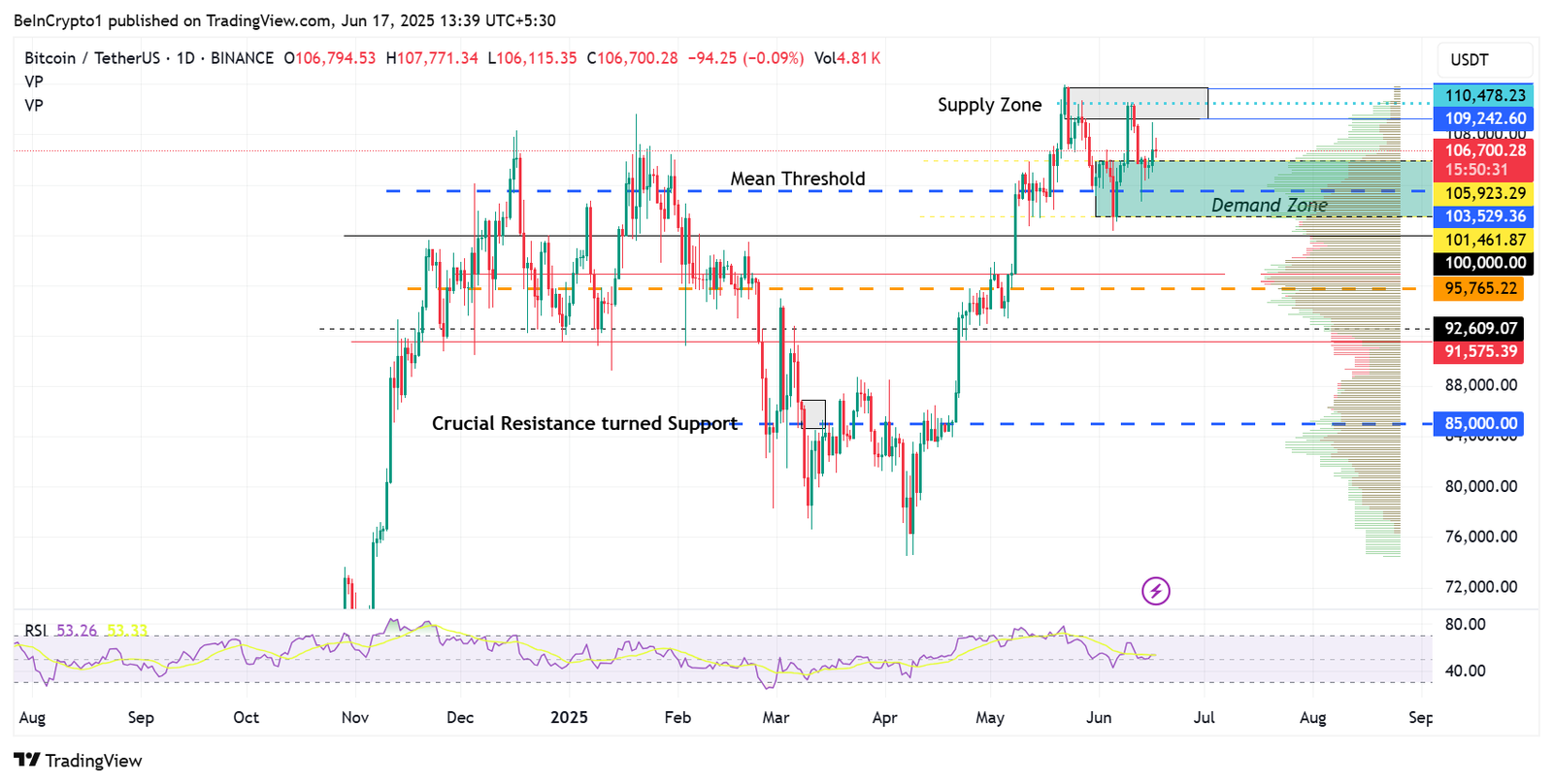

Data on TradingView shows Bitcoin was trading for $106,700 as of this writing, with a low-hanging demand zone between $101,461 and $105,923.

Buyer momentum is expected within this range, with the bullish volume profiles (green nodes) showing investors waiting to interact with BTC once it drops to this zone.

Increased buying pressure could see Bitcoin price retest the supply zone between $109,242 and $111,634. A break and close above the $110,478 midline on the one-day timeframe could set the pace for a new all-time high for Bitcoin.

Bitcoin (BTC) Price Performance. Source: TradingView

Conversely, if selling pressure increases and Bitcoin price drops below the mean threshold of $103,529, a close below this support could exacerbate the losses. Likewise, bearish volume profiles (red bars or nodes) show bears waiting to interact with the BTC price around this price area.

With both macro risks and technical pressure mounting, traders are watching not just the Fed’s rate stance.

Read the full article here