On Monday, leading coin Bitcoin surged to an intraday high of $108,952 as renewed buying interest pushed the asset higher. The rally triggered significant activity across BTC-backed ETFs.

Bitcoin ETFs recorded a combined net inflow exceeding $400 million for the day, with BlackRock’s IBIT leading the charge. Today, the king coin has recorded a modest 1% gain, with on-chain showing growing skepticism among leveraged traders.

ETF Inflows Surge on Bitcoin Rally

Bitcoin climbed to an intraday high of $109,952 on Monday as renewed investor interest drove a wave of buying pressure.

This resurgence in momentum helped fuel a spike in inflows into US-listed spot BTC ETFs, which saw a net capital injection of $408.59 million, their largest single-day inflow since June 10.

Total Bitc

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

BlackRock’s iShares Bitcoin Trust (IBIT) led the ETF pack in net inflows, asserting its dominance among institutional-grade crypto investment vehicles. Per SosoValue, the fund’s inflows on Monday amounted to about $267 million, bringing its total historical net inflow to $50.03 billion.

This strong inflow suggests that institutional investors remain largely unmoved by near-term volatility and continue seeing BTC as a valuable portfolio hedge.

BTC Holds Steady, But Traders Hedge for Downside

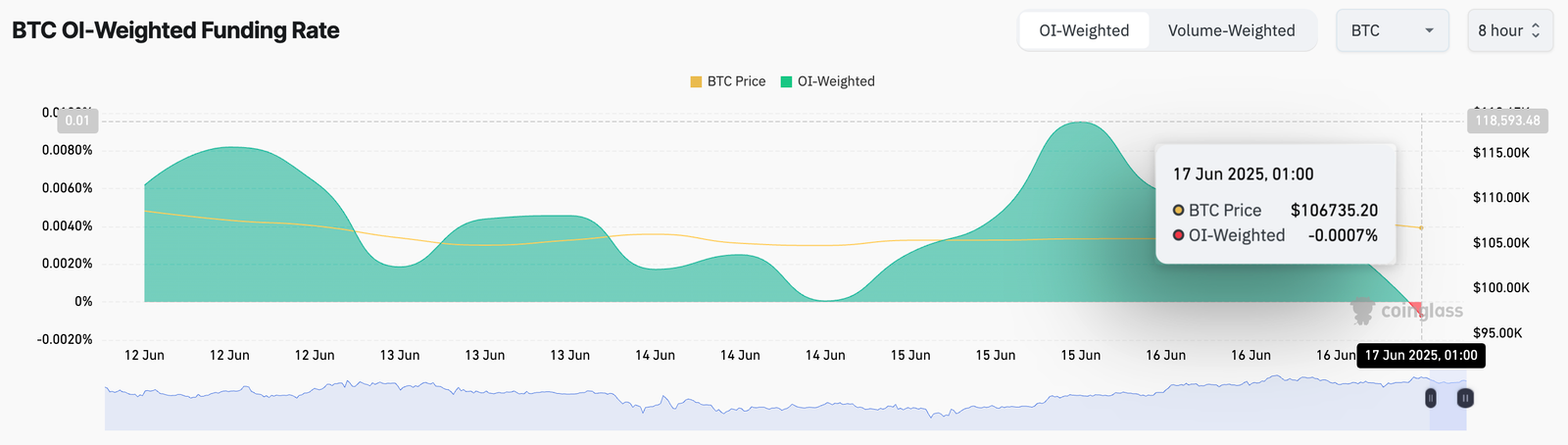

While BTC is up a modest 1% today, the derivatives market is flashing warning signals. Funding rates have flipped negative again, reflecting renewed bearish sentiment among perpetual futures traders. According to Coinglass, this currently stands at 0.0007%.

BTC Funding Rate. Source: Coinglass

The funding rate is a periodic payment exchanged between traders in perpetual futures markets to keep contract prices aligned with the spot market. When the funding rate is negative, short traders are paying long traders, indicating that bearish sentiment dominates the market.

If this lingers, it could exacerbate the downward pressure on the coin’s price.

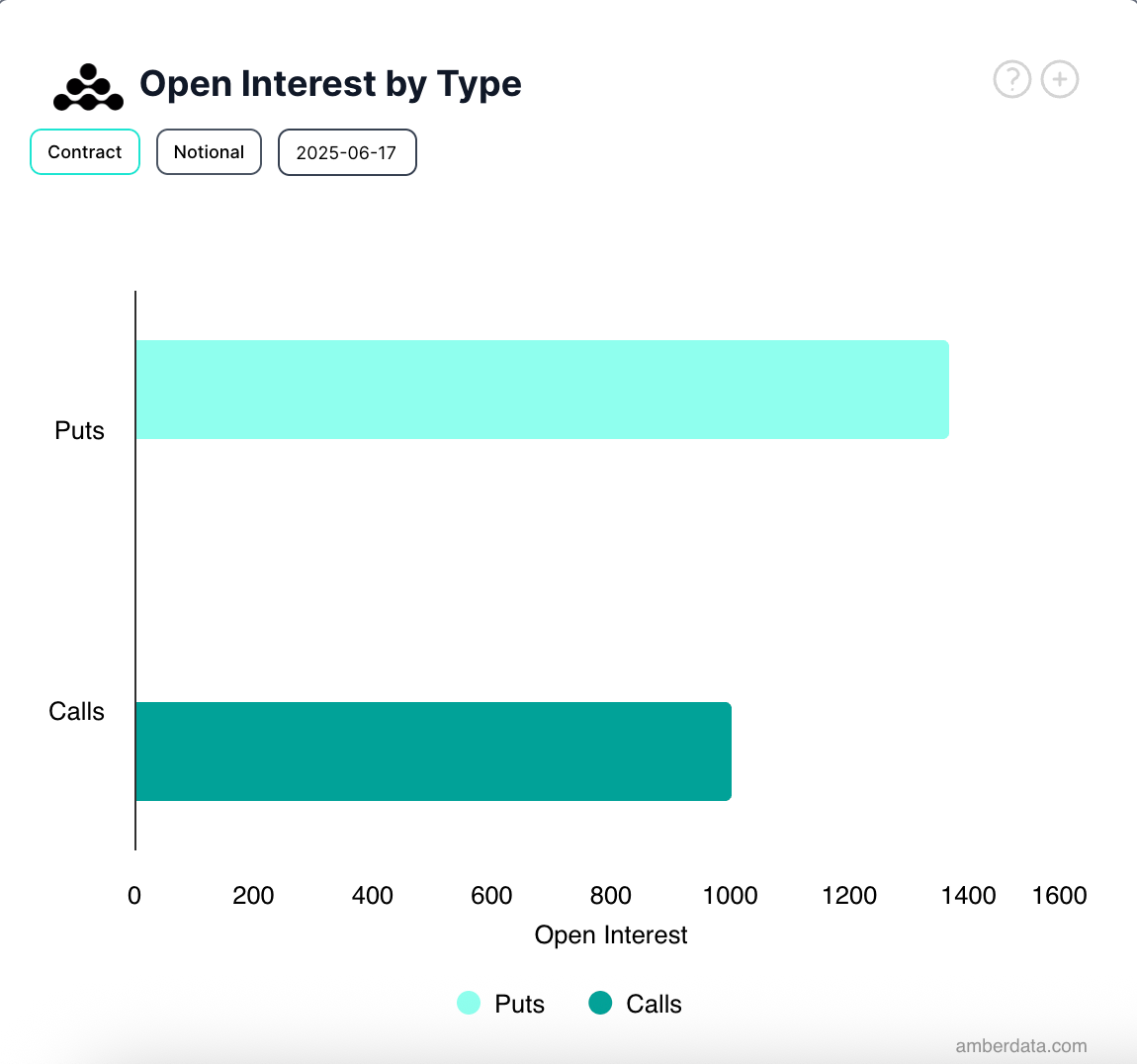

Meanwhile, options traders are also leaning defensive. Data from Deribit shows an increased demand for put contracts over calls today, suggesting investors are seeking downside protection amid growing uncertainty.

BTC Options Open Interest. Source: Deribit

While ETF inflows point to strong institutional demand, the underlying market signals suggest traders are treading carefully. With funding rates turning negative and put options gaining traction, investors may be bracing for short-term volatility despite the bullish inflow narrative.

Read the full article here