As the U.S. prepares for a new wave of tariffs set to go into effect on April 2, financial markets are reacting with uncertainty.

President Donald Trump’s tariff policies targeting Canadian and Mexican goods, Chinese cars and more have caused volatility, but Arthur Hayes, chief investment officer at Maelstrom and co-founder of BitMEX, believes these measures will have little impact on Bitcoin’s trajectory.

During a podcast with Kyle Chasse, Hayes noted that Fed Chairman Jerome Powell’s recent stance on monetary policy outweighs the importance of tariffs. Quoting Powell, Hayes said, “The inflationary aspects of tariffs are temporary,” signaling that the Fed is ready to inject more liquidity into the system.

According to Hayes, this monetary easing could provide a favorable environment for Bitcoin and other risky assets. “Tariffs are no longer important to Powell and they shouldn’t be important to crypto investors,” he said, adding: “Whether Trump imposes 50% tariffs or just 2%, it doesn’t matter because we know Powell will continue to maintain easy monetary conditions to keep assets appreciating.”

Hayes suggested that even if Trump’s tariffs lead to inflationary pressures, Powell would likely ignore the concerns and continue to support accommodative policies, potentially opening the door for further quantitative easing, an outcome that has historically benefited Bitcoin.

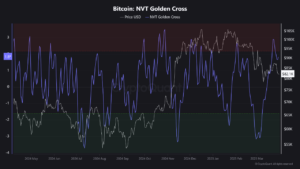

Earlier this week, Hayes revised his Bitcoin price prediction and now predicts a rally to $110,000.

*This is not investment advice.

Read the full article here