A Fidelity Digital Assets report indicates that Bitcoin’s primary scaling solution is growing at roughly twice the rate shown by public data because much of its network activity remains private.

The Lightning Network Is Growing and Institutions Are Taking Notice

The total capacity of Bitcoin’s Lightning Network has jumped 384% since 2020 as an increasing number of institutions jump onto the BTC bandwagon, according to a recent research report by Fidelity Digital Assets, the crypto arm of behemoth money manager Fidelity Investments which manages more than $15 trillion.

The report, published on Wednesday by Fidelity Senior Digital Asset Research Analyst Daniel Gray in conjunction with Bitcoin infrastructure firm Voltage, paints a picture of a maturing network that, while functionally stable enough for some institutional use, still requires critical tweaks before it’s ready for prime time.

Back in 2018, the probability of successfully buying a cup of coffee with bitcoin (BTC) using Lightning was like flipping a coin. Lightning capacity was a paltry $1.9 million in December of that year and node count was a dismal 2,329, according to Bitcoin Visuals. But now, Fidelity’s report shows small transactions had a 95% success rate in 2024 and the Lightning Network’s total capacity has soared 384% since 2020 and was roughly $509 million (5,358.50 BTC) across nearly 17,000 nodes in January 2025.

(Historical capacity of the Lightning Network / bitcoinvisuals.com)

“It is worth noting that this capacity does not include private or unannounced channels,” Gray explained. “Which are estimated to be just as substantial,” he added, which means Lightning’s capacity could be double of what the report states.

Other Key Metrics

Private Lightning metrics can be estimated by reviewing data from infrastructure firms such as Voltage which provided Fidelity with access to anonymized user data for that very purpose.

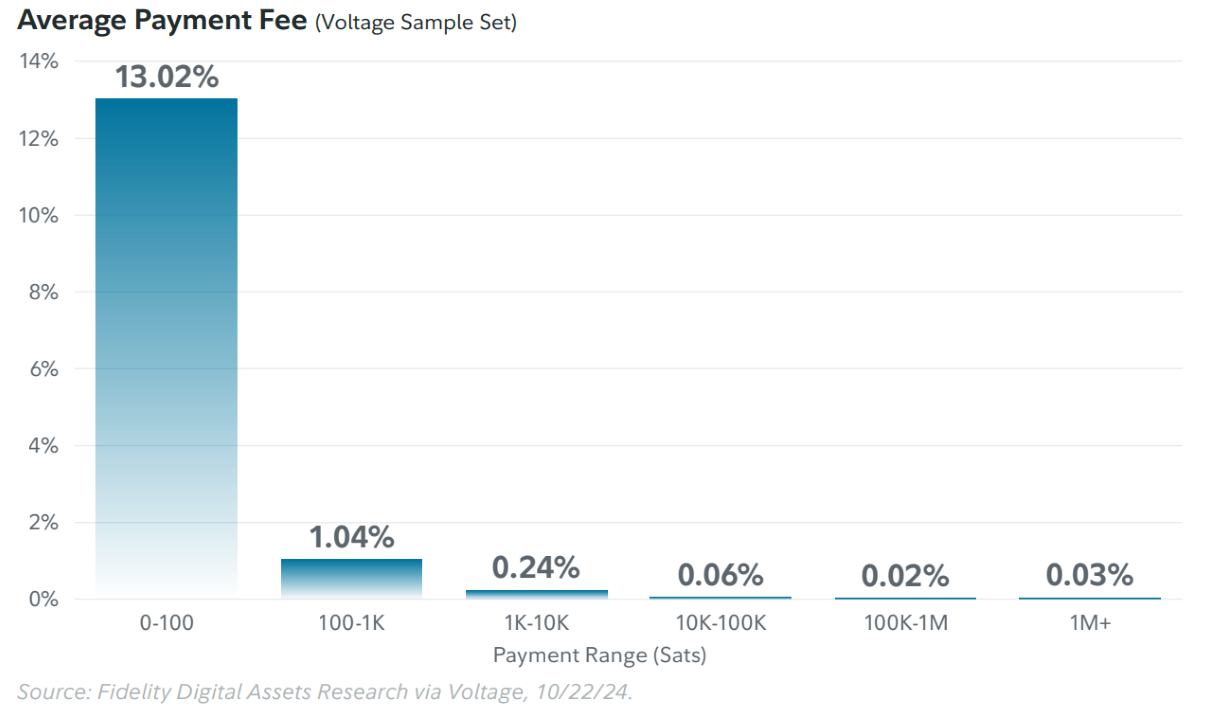

Fees

The report reveals that Lightning fees vary widely, largely depending on the number of nodes a transaction must go through before reaching its destination, referred to as the number of “hops” a transaction takes. Interestingly, payment size doesn’t directly affect transaction cost, but the more the hops, the higher the fees. According to Gray’s report, a $1,000 transaction typically costs anywhere between $0.39 and $1.27, which represents a fraction of one percent.

(Average fees on the Lightning Network / Fidelity Digital Assets and Voltage Inc.)

“Through a well-connected self-hosted node, transactions that required one to three hops paid an average of 0.04%,” Gray said

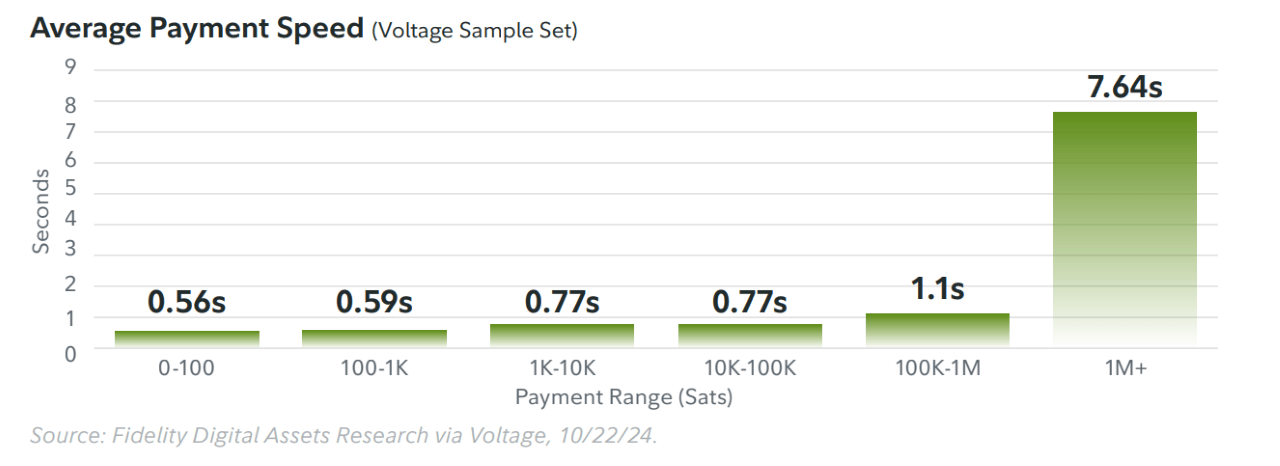

Speed

While transaction size doesn’t directly impact cost, it does slow down execution speed. The most noteworthy criticism of Lightning, certainly from a retail user perspective, is its requirement for channel capacity or liquidity before a transaction can be routed.

Inbound and outbound liquidity describe the ability to receive or send funds on the network. To send funds, one must already have funds, which makes sense, but strangely enough, Lightning also requires users to receive funds to establish inbound liquidity by committing funds and making outbound payments. For example, to receive one bitcoin, you must already have at least one bitcoin.

This makes large payments more difficult to settle since the algorithm must find a node with sufficient inbound liquidity to receive large amounts, reducing the speed of execution and potentially increasing the number of hops, which subsequently increases fees.

(Average payment speed on the Lightning Network / Fidelity Digital Assets and Voltage Inc.)

“Almost all transactions below one million sats finalize in less than one second,” Gray said. One million satoshis or “sats” is equivalent to roughly $1,000 at current prices. Larger amounts take about 7.64 seconds, according to the report.

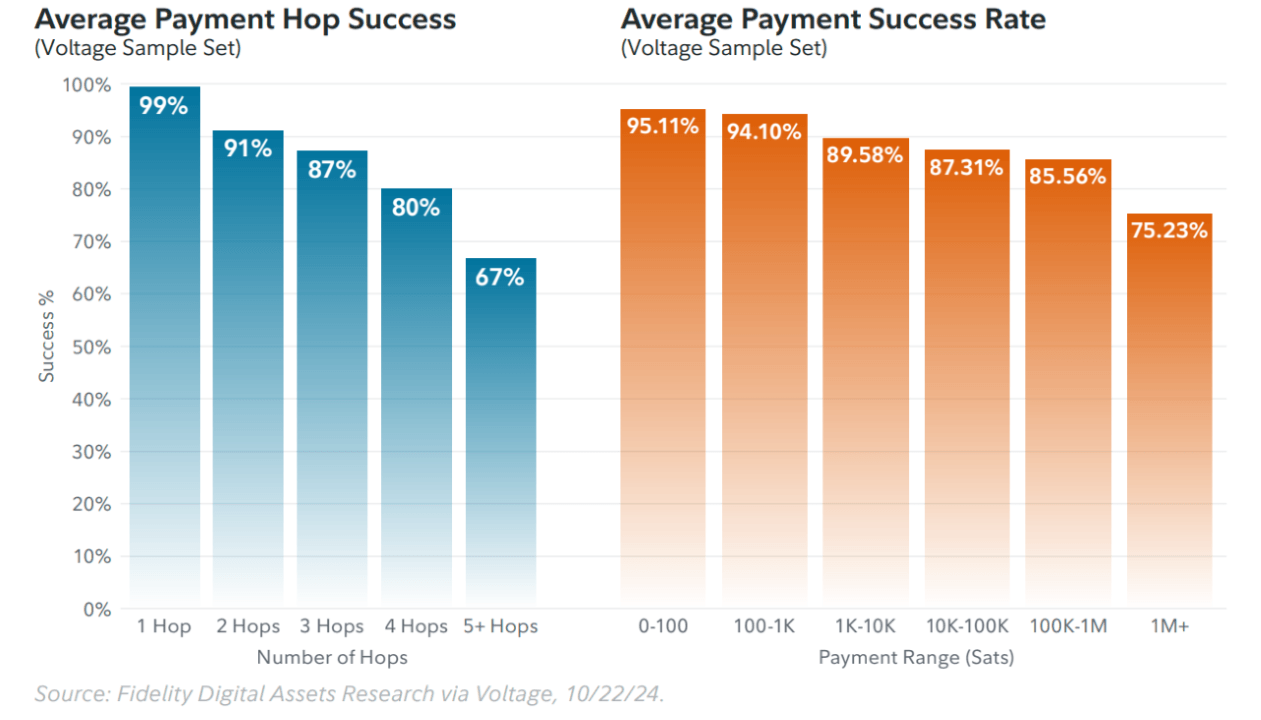

Success Rate

Earlier, a dismal 48% success rate for using Lightning to pay for a cup of coffee was referenced. Fortunately, that metric has vastly improved, and almost all Lightning payments have a success rate that falls within a range of 75-95%.

(Lightning Network success rates / Fidelity Digital Assets and Voltage Inc.)

“The 99%+ success rate is possible with proper configurations,” Gray explained. “A key factor in this rate is engineering solutions such as payment retries,” he added. “With these solutions in place, we anticipate that payments on Lightning will become easier and more reliable.”

Although Gray appears generally enthusiastic about Lightning adoption, it’s clear that the network is still a work-in-progress. It feels like it’s at the stage where the Internet transitioned from dial-up to cable. And just as the Internet continued to progress and went from cable to DSL (digital subscriber line) then to fiber optic, many hope Lightning advances to its next stage, which is where the real magic will happen.

“By adopting this technology, banks, exchanges, and payment processors may be able to position themselves at the forefront of financial innovation,” Gray said. “For Lightning to be truly effective, users need Lightning payments to work 100% of the time.”

Read the full article here