Bitcoin has rebounded slightly after dropping below the $100,000 mark, a decline attributed to escalating geopolitical tensions. The digital asset reached lows of approximately $98,974 following reports of US military strikes on Iran.

At the time of writing, Bitcoin has regained some ground and is trading at $102,1010, representing a 2.4% increase over the past 24 hours and a 5.82% decrease over the last week. Amid this price performance, recent on-chain analysis points to a phase of consolidation rather than a structural breakdown.

CryptoQuant analyst Darkfost shared in a QuickTake post that long-term Bitcoin holders appear to be maintaining their positions rather than exiting, indicating continued conviction despite short-term volatility.

Bitcoin On-Chain Indicators Signal Consolidation, Not Capitulation

According to Darkfost, the current market behavior is reflective of a quiet consolidation period, with long-term holders showing little inclination to sell.

Based on the 30-day moving average of Binary Coin Days Destroyed (CDD), his analysis shows that the metric has stayed below the 0.8 threshold typically associated with major corrections. The value recently peaked at 0.6 before trending downward, suggesting limited market overheating at present levels.

Darkfost emphasized that this moderation could precede a continuation of the broader bull cycle, mirroring past market structures where consolidation phases led to further price advances.

He noted that past bull runs have often been characterized by a “staircase” trajectory, periods of sideways or modest downward movement followed by renewed upward momentum. In this context, subdued sentiment may indicate that the market is preparing for a potential next leg higher. The analyst wrote:

Importantly, this does not signal the end of the bull cycle. Instead, similar to the past two phases, we may once again see a staircase-like movement where consolidation is followed by another leg up. Historically, Bitcoin’s explosive rallies tend to occur when market attention fades and sentiment is quiet, making the current silence potentially a precursor to the next big move.

Whale Behavior Remains Steady Amid Market Tensions

Complementing this outlook, another CryptoQuant contributor, Mignolet, provided insight into whale activity during the current consolidation phase.

He noted that while the market setup resembles the double-top formation seen in 2021, key on-chain signals from whales have not aligned with those seen during that previous peak.

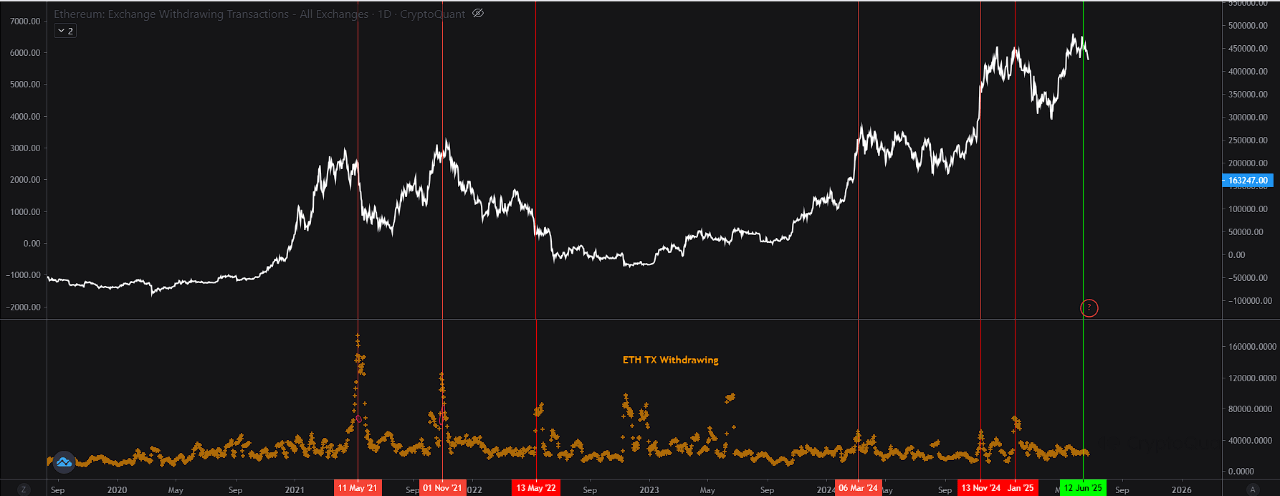

Specifically, Ethereum transaction outflows, often used as a proxy for large investor exits, have not shown the kind of spikes observed during the 2021 market top.

Mignolet pointed out that although Ethereum has seen a gradual decline in market share relative to other layer-1 and layer-2 chains since 2020, its transactional data still maintains a strong correlation with Bitcoin price movements.

The absence of aggressive exit activity among large holders suggests that major market participants are not rushing for the exits, despite heightened geopolitical uncertainty and short-term price volatility.

Featured image created with DALL-E, Chart from TradingView

Read the full article here