Bitcoin (BTC) briefly reached $38,000 on Nov. 24 but faced formidable resistance at the price level. On Nov. 27, Bitcoin price traded below $37,000, which is unchanged from a week ago.

What is eye catching is the unwavering strength of BTC derivatives, which signals that bulls remain steadfast with their intentions.

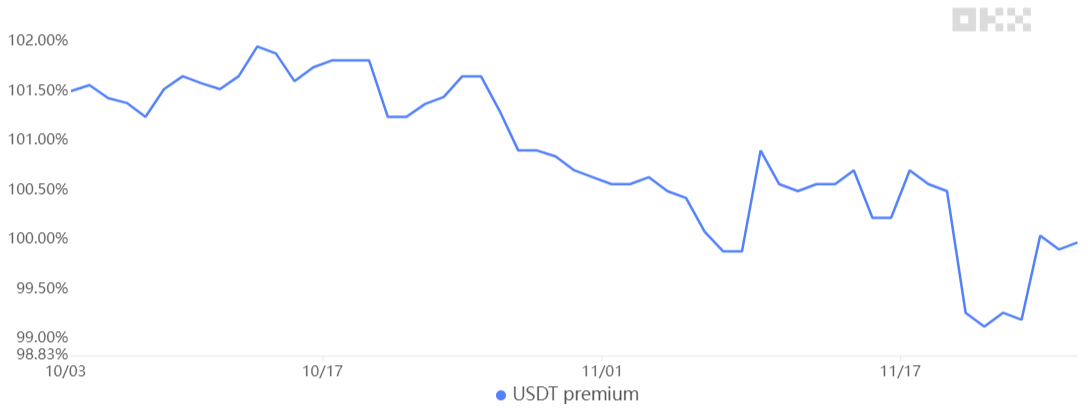

An intriguing development is unfolding in China as Tether (USDT) trades below its fair value in the local currency, the Yuan. This discrepancy often arises due to differing expectations between professional traders engaged in derivatives and retail clients involved in the spot market.

How have regulations impacted Bitcoin derivatives?

To gauge the exposure of whales and arbitrage desks using Bitcoin derivatives, one must assess BTC options volume. By examining the put (sell) and call (buy) options, we can estimate the prevailing bullish or bearish sentiment.

Deribit BTC options put-to-call volume ratio. Source: Laevitas.ch

Since Nov. 22, put options have consistently lagged behind call options in volume, by an average of 40%. This suggests a diminished demand for protective measures—a surprising development given the intensified regulatory scrutiny following Binance’s plewith the U.S. Department of Justice (DoJ) and the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Kraken exchange.

While investors may not foresee disruptions to Binance’s services, the likelihood of further regulatory actions against exchanges serving U.S. clients has surged. Additionally, individuals who previously relied on obscuring their activity might now think twice, as the DoJ gains access to historical transactions.

Furthermore, it’s uncertain whether the arrangement struck by Changpeng “CZ” Zhao with authorities will extend to other unregulated exchanges and payment gateways. In summary, the repercussions of recent regulatory actions remain uncertain, and the prevailing sentiment is pessimistic, with investors fearing additional constraints and potential actions targeting market makers and stablecoin issuers.

To determine if the Bitcoin options market is an anomaly, let’s examine BTC futures contracts, specifically the monthly ones—preferred by professional traders due to their fixed funding rate in neutral markets. Typically, these instruments trade at a 5% to 10% premium to account for the extended settlement period.

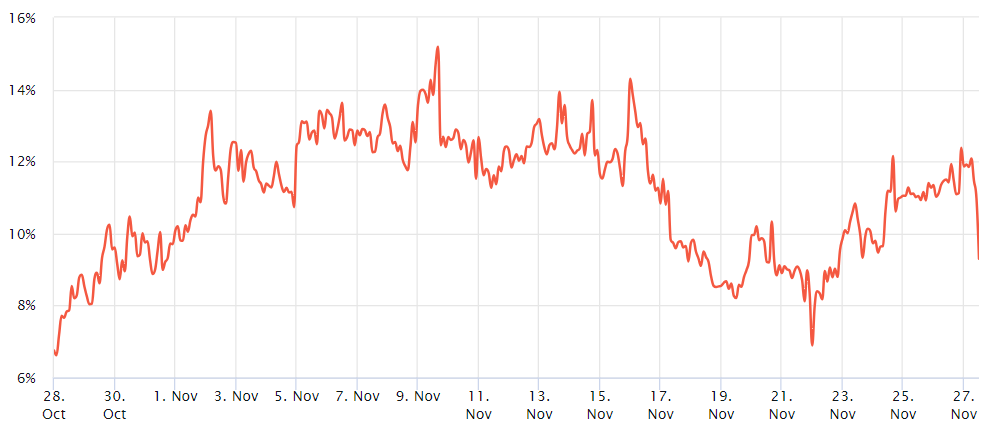

Bitcoin 30-day futures annualized premium. Source: Laevitas.ch

Between Nov. 24 and Nov. 26, the BTC futures premium flirted with excessive optimism, hovering around 12%. However, by Nov. 27, it dipped to 9% as Bitcoin’s price tested the $37,000 support—a neutral level but close to the bullish threshold.

Retail traders are less optimistic after the ETF hopium fades

Moving on to retail interest, there is a growing sense of apathy due to the absence of a short-term positive trigger, such as the potential approval of a spot Bitcoin exchange-traded fund (ETF). The SEC is not expected to make its final decision until January and February 2024.

The USDT premium relative to the Yuan hit its lowest point in over four months at OKX exchange. This premium serves as a gauge of demand among China-based retail crypto traders and measures the gap between peer-to-peer trades and the U.S. dollar.

Tether (USDT) peer-to-peer vs. USD/CNY. Source: OKX

Since Nov. 20, USDT has been trading at a discount, suggesting either a significant desire to liquidate cryptocurrencies or heightened regulatory concerns. In either case, it’s far from a positive indicator. Furthermore, the last instance of a 1% positive premium occurred 30 days ago, indicating that retail traders aren’t particularly enthused about the recent rally toward $38,000.

In essence, professional traders remain unfazed by short-term corrections, regardless of the regulatory landscape. Contrary to doomsday predictions, Binance’s status remains unaffected, and the lower trading volume on unregulated exchanges may boost the chances of a spot Bitcoin ETF approval.

The disparity in time horizons may explain the divide between professional traders and retail investors’ optimism. Additionally, recent regulatory actions could pave the way for increased participation by institutional investors, offering a potential upside in the future.

Read the full article here