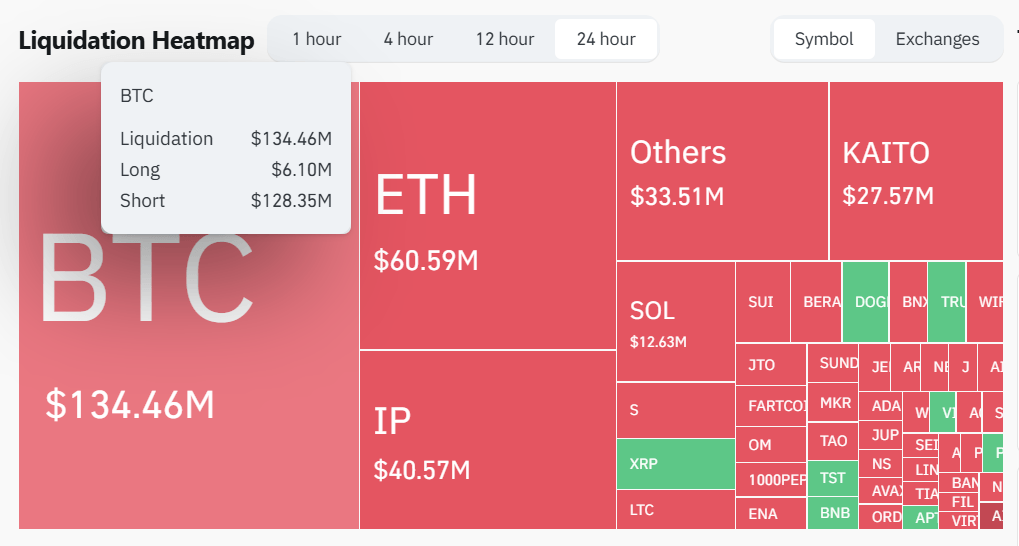

BTC traded as high as $99,497.97 before retreating, but the dominant digital asset has been gradually edging towards the $100,000 barrier, with bears getting squeezed on shorts to the tune of $128.35 million.

Bitcoin Nears $100K But Meets Resistance

Bitcoin (BTC) is edging closer to the highly anticipated $100,000 milestone, trading at $99,207.54 at the time of reporting. The world’s leading cryptocurrency has gained 1.51% over the past 24 hours and is up 2.39% over the past week. With a 24-hour trading range of $96,874.82 to $99,497.97, BTC is showing signs of strong bullish momentum as investors continue to push the price higher.

(BTC price / Trading View)

Trading Volume and Market Capitalization on the Rise

Bitcoin’s 24-hour trading volume has surged 27.08% to $34.42 billion, reflecting increased market participation and heightened investor activity. Alongside this uptick in volume, Bitcoin’s total market capitalization has risen to $1.96 trillion, marking a 1.47% increase since yesterday. These metrics suggest growing confidence in BTC, with traders positioning themselves for potential further gains.

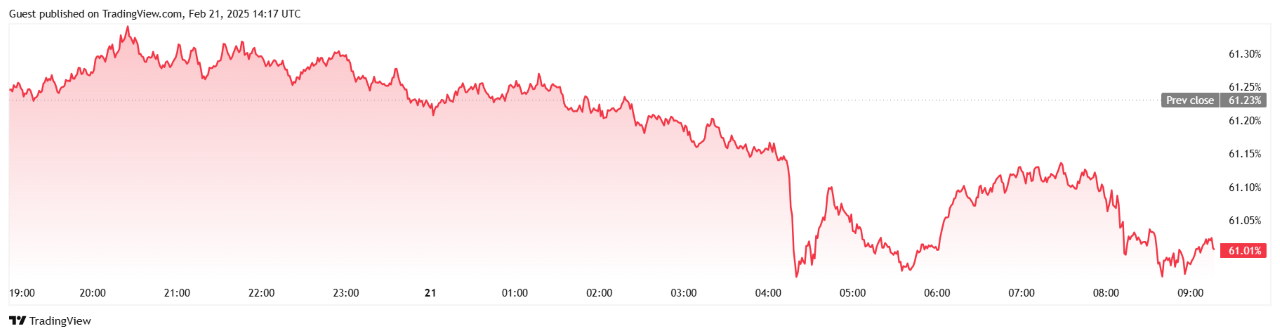

BTC Dominance Sees Slight Dip Amid ETH Rally

Despite bitcoin’s strength, its dominance in the crypto market has dipped slightly by 0.34% over the past 24 hours, currently standing at 61.02%, according to Trading View. This decline can be partially attributed to ether’s (ETH) recent performance. ETH is trading at $2,824.63, having rallied 2.31% over the past 24 hours and expanded its market capitalization by 2.32%. Consequently, BTC’s overall market share has seen a minor reduction as investors allocate capital to ether and potentially other altcoins.

(BTC dominance / Trading View)

Futures Market Sees Increased Speculation, Shorts Squeezed

In the derivatives market, bitcoin futures open interest has jumped 3.33% over the past 24 hours to $65.83 billion, according to Coinglass. This increase indicates a growing number of leveraged positions betting on BTC’s next move.

Liquidation data highlights an aggressive short squeeze, with total liquidations reaching $134.46 million over the past 24 hours. Short traders bore the brunt of the losses, accounting for $128.35 million of the total, while long liquidations remained relatively modest at $6.10 million. The imbalance suggests that traders betting against BTC’s price increase were forced to cover their positions, contributing to the recent upward momentum.

(Crypto liquidations / Coinglass)

Bitcoin Market Outlook

With bitcoin hovering just below $100,000, market sentiment remains bullish. The rise in trading volume and futures open interest, combined with a significant short squeeze, suggests continued upward pressure on BTC’s price. However, the slight dip in BTC dominance indicates that capital is also flowing into altcoins, particularly Ethereum, which could affect Bitcoin’s immediate trajectory.

Looking ahead, BTC needs to break past the psychological resistance of $100,000 to solidify its next leg up. If buying pressure sustains, a decisive move beyond this level could open the door for new all-time highs. On the downside, support remains around $97,000, where buyers may look to step in if the price faces a temporary pullback.

Read the full article here