In the last 20 days, Bitcoin (BTC) has lost four percentage points of its cryptocurrency market dominance, fueling an altseason. A dominance loss means key cryptocurrencies are outperforming the leader, absorbing capital.

Notably, these events are also known as altcoins’ rallies, or ‘altseasons’, if they overextend for a larger time frame. Cryptocurrency traders usually migrate part of their gains to these altcoins, expecting to profit from their higher volatility, fuelling an altseason.

In particular, the Bitcoin Dominance Index (BTC.D) is one of the most used indicators to signal this season. The index is calculated by dividing Bitcoin’s market cap by the total capitalization. Therefore, the decrease in BTC.D means investors are deploying more capital to other cryptocurrencies than BTC.

As of writing, the index has aggressively plummeted to 51.43% after breaking down from November’s low at 51.82%. Bitcoin’s dominance has not been this low since October 16, which marks a pivot after peaking at 55.35% on December 7.

Altseason is fueled and ready to start

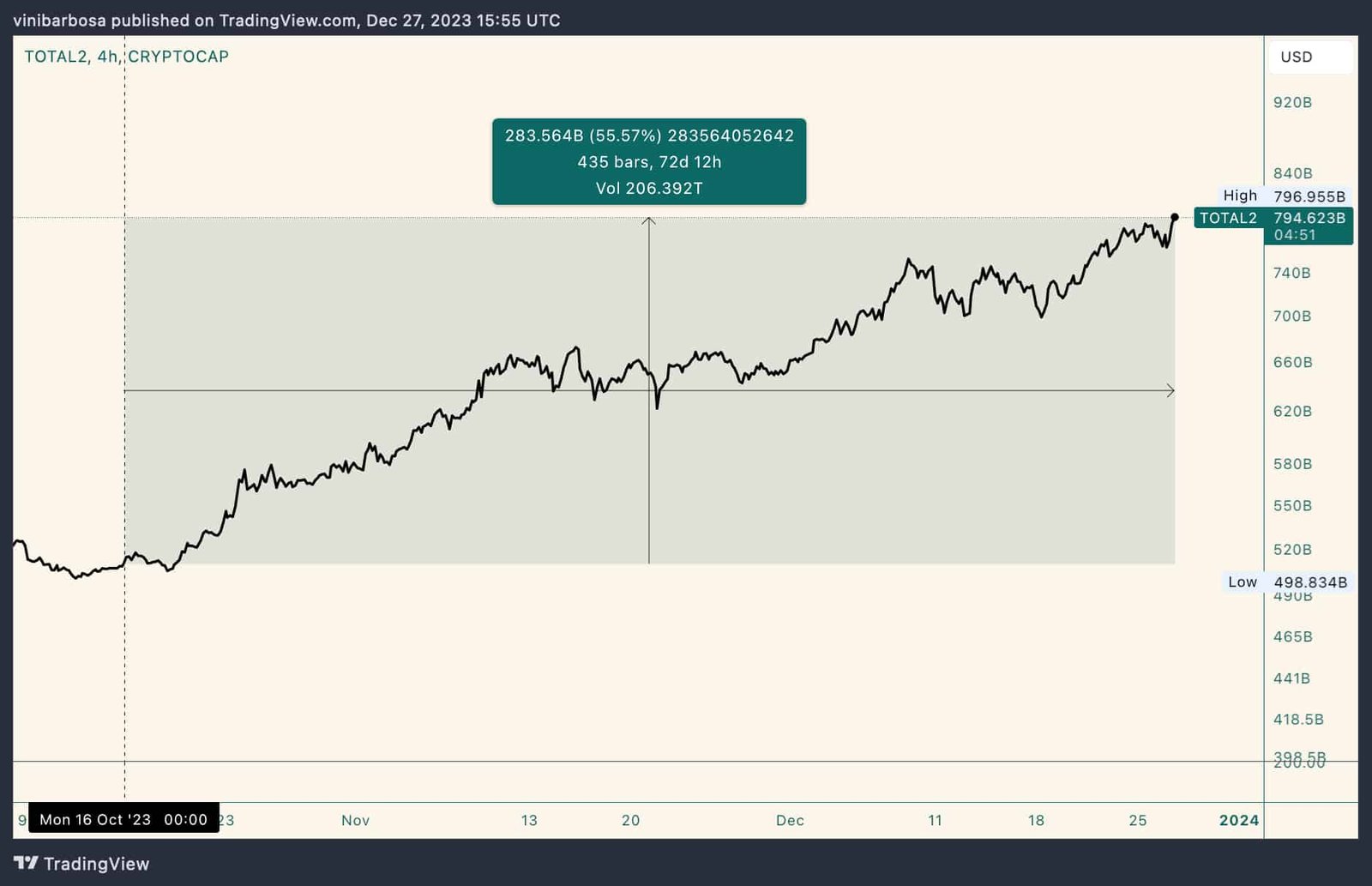

In the meantime, the Total Crypto Market Cap 2 Index reached multi-yearly highs at $796.955 billion. This particular index measures the cryptocurrency market capitalization, excluding Bitcoin.

Interestingly, the index is up 55.57% since October 16, for a $283.564 billion increase in the period. At the beginning of 2023, all cryptocurrencies except BTC had a $468 billion market cap, marking a 70% surge.

Recently, Solana (SOL) took the altseason leadership with an impressive 1,072% year-to-date (YTD) price increase. Conquering the 4th position among the most valuable cryptocurrencies after dethroning BNB Chain (BNB) and other DeFi competitors.

For now, Bitcoin Cash (BCH) seemed to be the ignite for the aforementioned dominance drop of its core competitor. Other alternatives also join the spotlight, such as the low-cap mentioned by Elon Musk’s AI, Grok — for a viable payment tool on X.

However, it is important to understand that altcoins have lower liquidity and higher volatility. These properties expose investors to even higher risks, so they must remain cautious when investing in altcoins. Making their due diligence is crucial to understand what projects they are deploying capital in.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here