The price of oil is now lower than it was before the Israel-Iran war and concerns of a global supply disruption have all but vanished.

BTC Recovers While Oil Slides

Bitcoin appeared to have regained its footing Tuesday morning while oil prices continued their decline after U.S. President Donald Trump gave China the greenlight to continue purchasing oil from Iran, following the Islamic Republic’s conflict with Israel.

Iran is one of the world’s top oil producing nations, pumping out roughly 4 million barrels per day. Economists had been bracing for a disruption in oil supply after Israel launched an attack on the country on June 13. Then on Saturday, the U.S. bombarded three key Iranian nuclear sites during what the Pentagon described as “the largest B-2 operational strike in U.S. history.”

Iran subsequently threatened to close off the Strait of Hormuz, a trading route for roughly 20% of global oil-related traffic, but it never followed through with its threat, easing concerns of a potential oil supply shortage. Bitcoin jumped on the news as oil prices retreated.

(Crude oil prices are now lower than they were right before the start of the Israel-Iran war / Trading Economics)

Then today, after Trump gave the nod to China, Iran’s largest oil customer, to continue doing business with the Islamic Republic, oil prices subsided even more, while BTC rose above $105K.

“China can now continue to purchase oil from Iran,” the president wrote on Truth Social. “Hopefully, they will be purchasing plenty from the U.S., also. It was my great honor to make this happen!”

Overview of Market Metrics

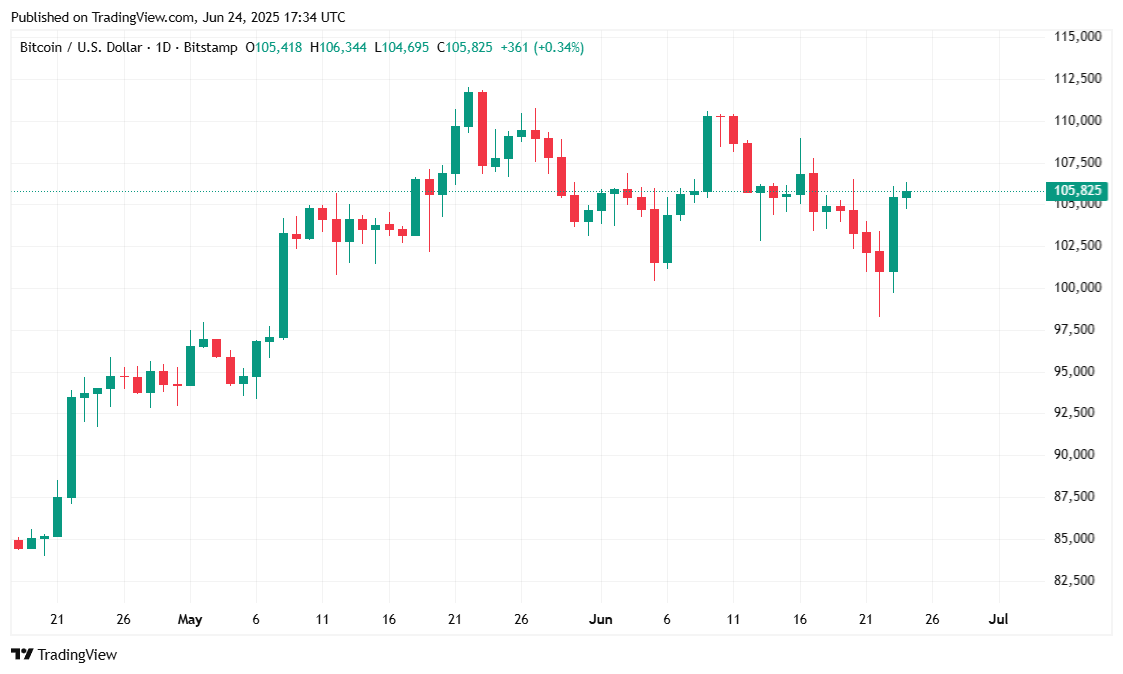

Bitcoin has made somewhat of a comeback over the past 24 hours. The cryptocurrency has climbed 3.24% and was trading at $105,755.74 at the time of reporting. BTC’s daily price range has fluctuated between $102,471.89 and $106,316.83. From a seven-day perspective, bitcoin is also in positive territory, up 1.63% as fears of a spike in oil prices due to the Israel-Iran conflict dissipate.

( BTC price / Trading View)

The uptick in price was accompanied by an increase in activity across the board. Daily trading volume rose 12.92% to $61.40 billion, and total market capitalization reached $2.10 trillion, mirroring the 3.24% daily gain. BTC dominance slid by 0.14% but remains above the 65% threshold at 65.24.

( BTC dominance / Trading View)

Open interest for bitcoin derivatives as up 3.07% to $69.69 billion and liquidations topped $114.62 million. Short sellers bore the brunt of the action, with Coinglass showing $102.82 million liquidated from short positions and a relatively smaller $11.80 million in long liquidations.

Read the full article here