Three coins have risen to the top of the leaderboard: The Dogeson, a playful nod to Elon Musk, his son and Dogecoin; Shiro Neko, a cat-themed token tied to gaming and NFTs; and Orbit, a space-inspired coin.

These tokens topped the gainers’ charts on Saturday night. Here’s a closer look at each.

Dogeson

The Dogeson (DOGESON), a Doge-inspired coin named after an edited photo Elon Musk posted of himself and his son, X Æ A-12, is up more than 90% at last check Saturday.

With a market cap reaching $146.6 million, the token is built on the Ethereum blockchain and has garnered attention for its narrative of a “space-bound Doge” — meshing humor with a decentralized finance (DeFi) theme.

Details about The Dogeson’s founding team or developers were not immediately clear.

Shiro Neko

Shiro Neko (SHIRO) is a new cryptocurrency project that blends blockchain technology with play-to-earn (P2E) gaming.

Its ecosystem is built around a native token that can be used for in-game purchases, staking, and governance.

It’s up over 83% at last check, with a market cap of about $441 million.

The project emphasizes a community-driven approach, immersive gaming experiences, and collectible in-game assets, including NFTs. It aims to attract both gamers and crypto enthusiasts through competitive challenges and real-world rewards

Shiro Neko is also building on Shibarium, the Layer 2 blockchain for the Shiba Inu ecosystem, further anchoring itself in a popular crypto community. Additionally, the project is venturing into entertainment by launching an animated series featuring “Shiro” the cat.

The token recently had its Initial Exchange Offering (IEO) on Gate.io, with 88 billion tokens available for sale, representing 0.01% of its total supply of 1 quadrillion tokens.

This reflects a focus on early adoption and community-building in the crypto-gaming landscape.

Orbit

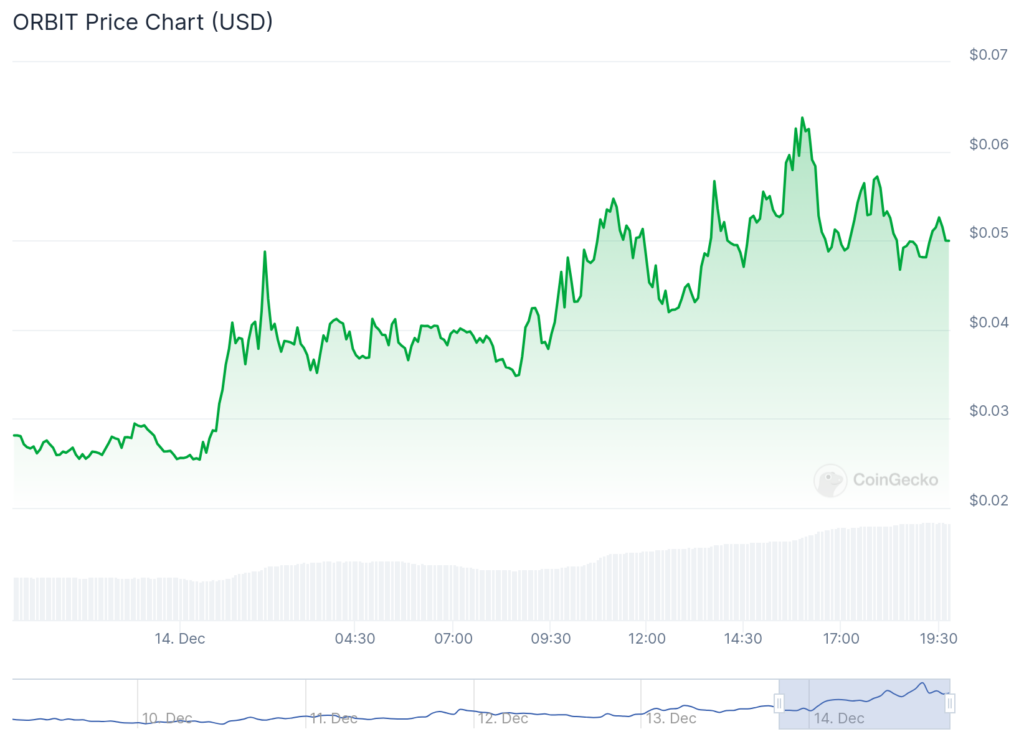

Orbit (ORBIT) was up 77.6% at last check Saturday, with a market cap of roughly $44 million.

Built on the Blast Chain, the native utility token of the Orbit Protocol serves multiple purposes including facilitating governance, incentivizing participants, and enabling staking for rewards.

The protocol also boasts a Total Value Locked (TVL) of over $6.4 million and a fixed total supply of 100 million.

As of now, ORBIT’s market performance shows significant price fluctuations, with a 24-hour range of $0.02543 and $0.06379.

Read the full article here